The Wundertrading platform is a specialized service for automated cryptocurrency trading. It offers three key modules: signal bots, copy trading, and a professional terminal with TradingView integration, based on the Pine Script programming language.

In this article we will take a detailed look at the Wundertrading platform and its advantages, main functions and possibilities.

What is Wundertrading?

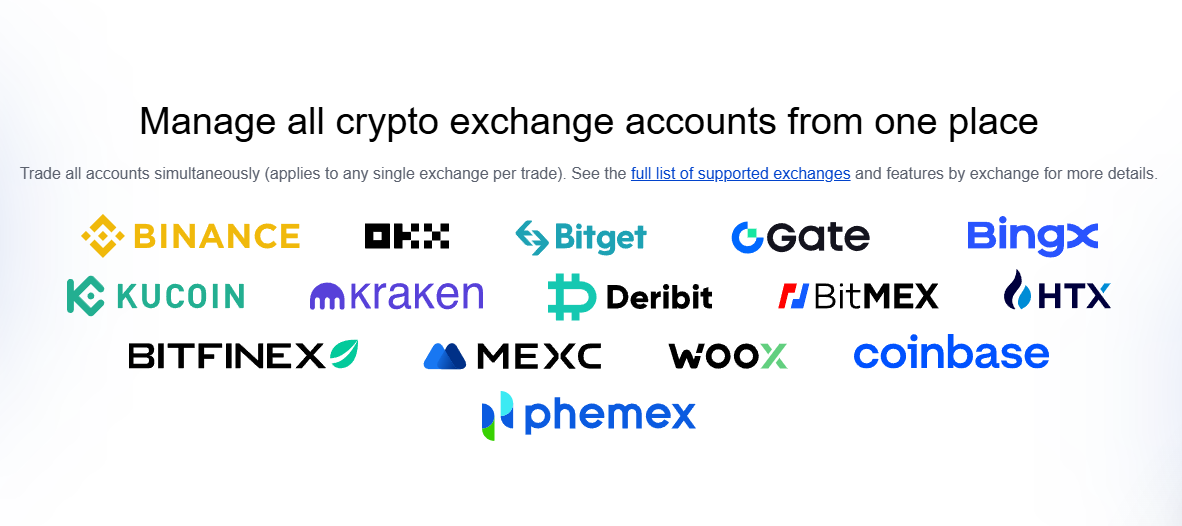

Wundertrading is a cloud platform that allows users to create and launch trading bots without programming skills, thanks to direct integration with TradingView via Pine Script. The service supports over 12 crypto exchanges, including Binance, Bybit, and OKX, and offers unique features: arbitrage trading, DCA-strategies and a marketplace of signals for copying trades of other traders on the market.

Features of trading bots

The platform was founded in 2018 and stands out from its competitors: it allows users to convert any TradingView alerts into functional trading bots with customizable risk parameters. Wundertrading provides a single interface for manual trading, automatic strategies and copy trading with detailed statistics on traders and algorithms available on the marketplace.

Features and functionality Wundertrading

The main functions it provides platform Wundertrading includes:

Wundertrading trading terminal

Wundertrading offers users a multifunctional terminal that combines all the tools for effective trading crypto.

The entire toolkit from TradingView, allowing traders to monitor charts and apply technical indicators from the analytical platform.

The terminal offers arbitration and advanced order management – from setting stop loss, take profit and trailing stop to working with an order grid.

Trading signals - Pump Screener Wundertrading

Pump Screener is a tool for identifying sharp price movements and open interest in futures markets in real time, with a flexible system of filters.

The Pump Screener algorithm analyzes two key parameters: price changes and open interest (OI) in the futures markets.

Feautures for traders

- Possibility of early detection of pump situations;

- Comprehensive analysis of liquidity and market interest;

- Fast execution of trades without switching between platforms;

- Flexible filter system to filter out false signals.

The tool is available in the Wundertrading interface and requires minimal settings parameters for a specific trading strategy. The algorithm can be used in conjunction with others strategies platforms, increasing trading efficiency.

Cryptocurrency bots Wundertrading

In the Wundertrading interface, traders have the opportunity to use the service's key solutions, trading bots cryptocurrency. They are divided into several types, each of them is designed for specific market conditions:

- Signal Bot – for trading based on signals received from technical indicators from TradingView;

- AI Bot is an adaptive bot that uses artificial intelligence technologies to adjust strategies to current market conditions with analysis of historical data;

- GRID Bot – bot, strategy which is based on grid trading with the placement of several orders and profit taking on each of them;

- DCA (Dollar Cost Averaging) Bot is a classic bot for automated trading with averaging of trader positions.

Each type of bot has flexible settings risk management, including automatic stop losses, take profits and trailing stops.

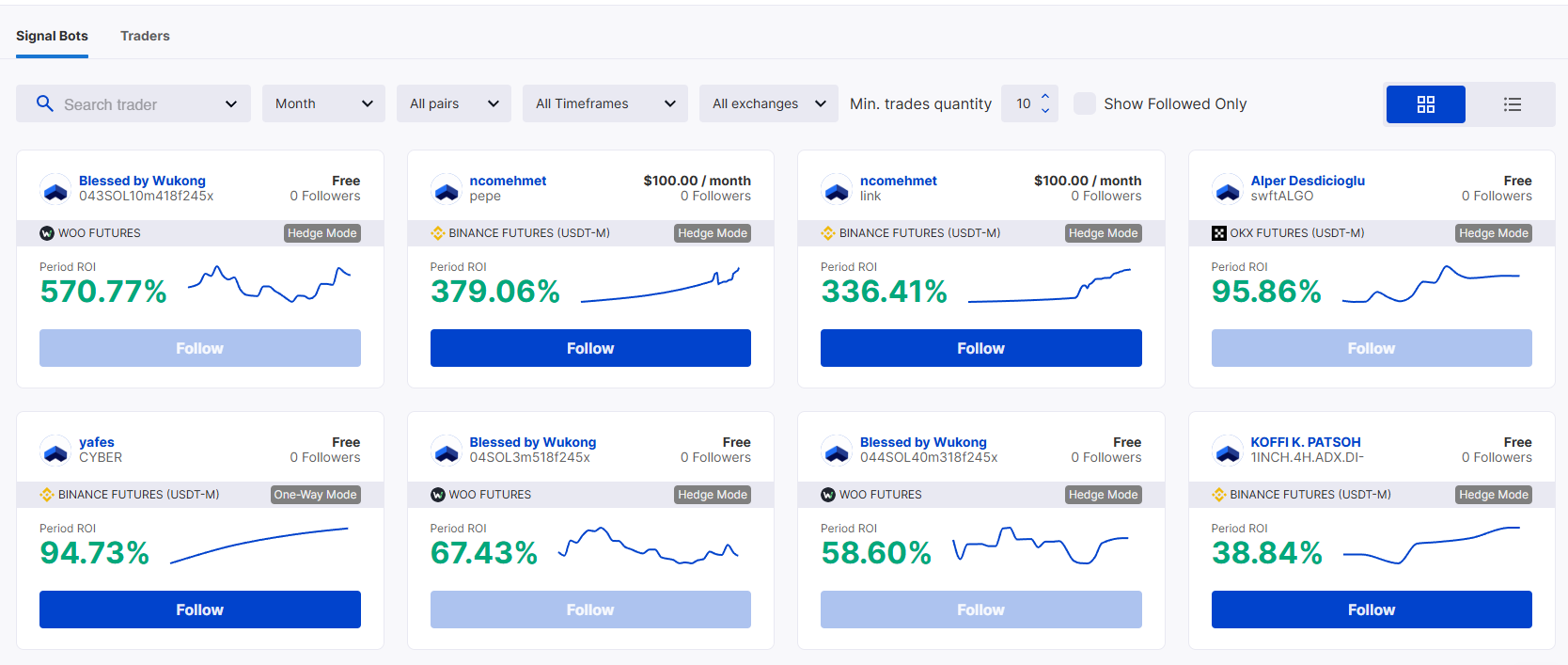

Marketplace - copy trading Wundertrading

Social trading is an opportunity for beginning investors to learn from professionals and replicate their successes strategies Wundertrading has implemented this concept through its own marketplace.

The marketplace interface presents verified traders with detailed statistics of their trading activity: profitability, drawdown, activity and number of subscribers. Users have the opportunity to get detailed data on each of them. The system allows flexible adjustment of copying parameters: from the size of the position relative to the deposit to the level of acceptable risk.

Wundertrading's special feature is its transparent rating system and the ability to test strategies on historical data before connecting.

Multi-accounts in Wundertrading

For professional traders and investors working with multiple exchanges. At the same time, it is important to have a single interface for managing accounts. Wundertrading solves this problem through a multi-account system. Thus, platform allows you to connect multiple exchange accounts via API. This may be useful for arbitrage strategies, when it is necessary to quickly respond to price discrepancies between trading assets platforms.

In addition, the portfolio function for cryptocurrency trader gives the opportunity to track the status of all assets on the connected exchanges, including details for each open and closed position.

The user can obtain full statistics on assets in the portfolio in the personal account in the “Assets” section.

How to start working with Wundertrading – review

To start using the platform, you need to create an account by following these steps:

- Go to official website Wundertrading оr app;

- In the upper right corner of the page, click “Registration”;

- Enter your e-mail and create a strong password;

- Receive a code by email to confirm your registration;

Enter the confirmation code on the website.

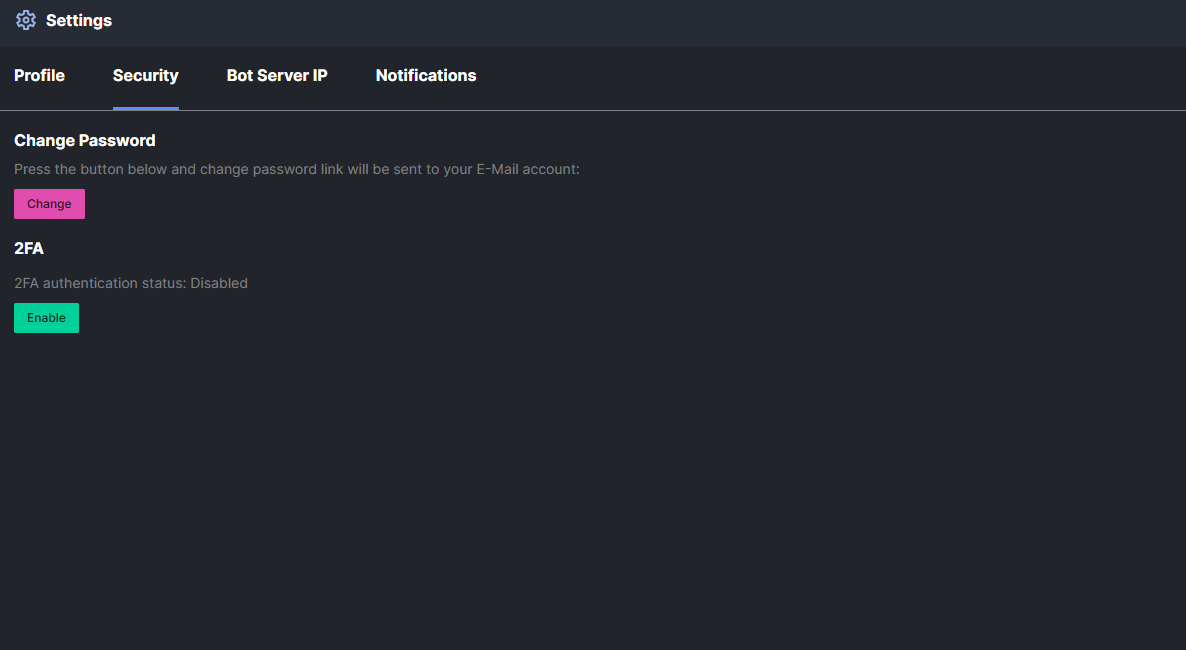

Security Configuration

After registration, you need to complete the basic setup security account.

To do this:

- Go to settings personal account;

- Select section “Safety”;

- Find the “2FA” tab;

- Click “Enable” and confirm the connection of two-factor authentication via Google Authenticator.

To receive notifications from trading bots, Wunder trading allows you to link your user profile via official bot service.

Types of trading bots

Functional Wundertrading allows you to connect different types of bots:

Signal Bot (TradingView+DCA)

Allows automate trading, creating trading parameters based on signals received from TradingView, combining the connection of the DCA model. After settings alerts in TradingView, the bot will automatically execute trades on the connected exchange.

DCA trading bot

Dollar Cost Averaging – strategy gradual averaging of the position. The bot automatically buys the asset as its price decreases, averaging the entry cost.

GRID bot

The algorithm creates a grid of orders above and below the current price. It is effective in a sideways trend, automatically buying at the minimums and selling at the maximums of a given range.

Wundertrading AI bot

Uses artificial intelligence technology to adapt trading strategies to current market conditions. Capable of analyzing huge amounts of data to find optimal entry and exit points, as well as effectively managing traders' orders, taking into account risk management.

Each type of bot has detailed settings:

- Long\Short strategies;

- Deposit size in position;

- Setting bot activation conditions based on technical indicators;

- Detailed settings orders (take-profit, trailing-stop, stop-loss, etc.);

- Number of orders in the grid;

- Enabling protection against sharp price fluctuations (Pump Protection);

- Enabling the mode using webhooks.

For beginners platform offers ready-made parameters for each type of bot, which can be adapted to your needs. Experienced traders can create completely custom configurations.

Important. After setting up the bot, we recommend testing its operation on historical data through the built-in backtester before launching it with real funds. Wundertrading also provides detailed statistics on all bot transactions, which allows you to continuously optimize trading strategies.

How to connect Wundertrading to the stock exchange

To connect the service account to the user's exchange account, you must first create API keys crypto exchange. To do this:

- Go to your personal account on the exchange;

- Find settings “API” keys;

- Click “Create New ”API key”;

- Select “Connect a third-party service”;

- Find “Wundertrading” in the list;

- Confirm creation API keys and copy them.

Next you need to:

- Go to your Wundertrading personal account;

- On the left side of the screen, click “My Exchanges”;

- Click “Add exchange”;

- Select an exchange from the list, for example, OKX;

- Enter the connection name;

- Paste the previously copied keys (public, secret) into the empty lines;

- Be sure to insert in the “Password” line the password that was entered to create API keys on the exchange itself;

- Click “Connect exchange”.

After that stock exchange will appear in the list of connected ones in your Wundertrading personal account.

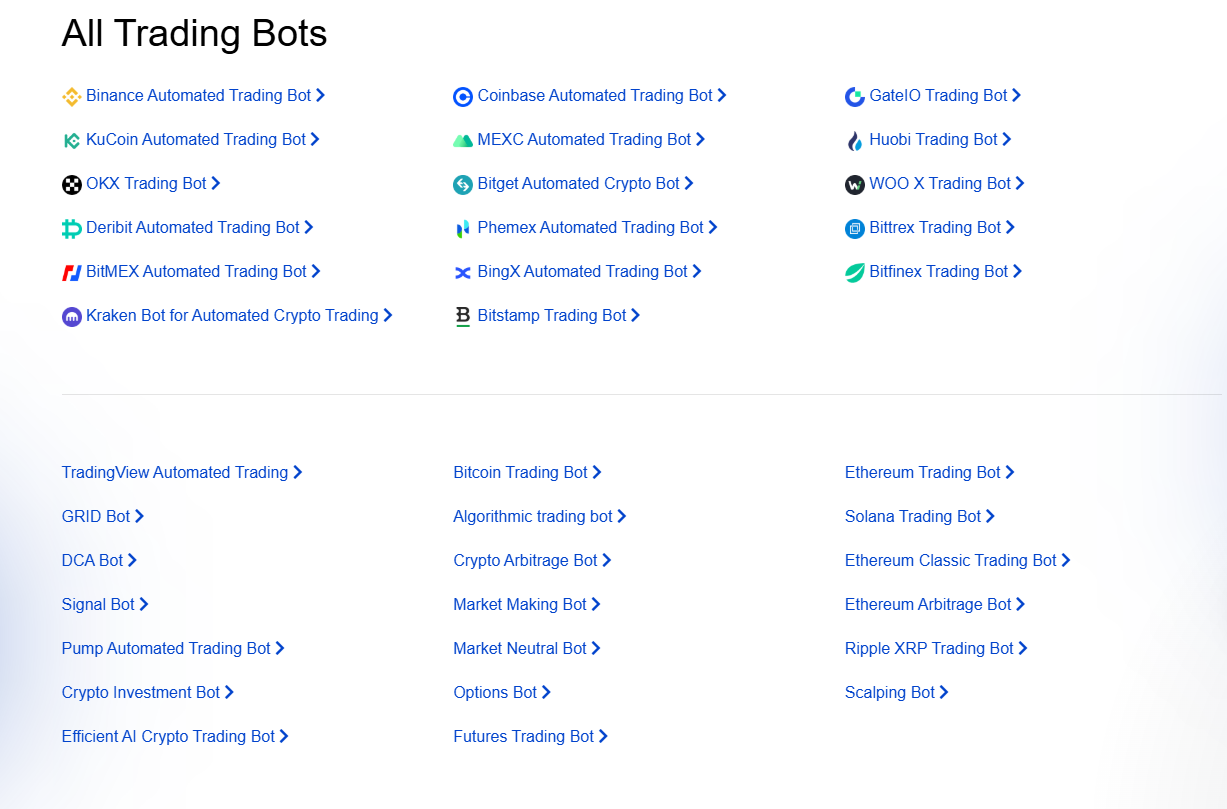

Which exchanges does Wundertrading support?

Platform Wundertrading provides integration with most leading cryptocurrency exchanges. Among the supported trading platforms:

- Binance

- Bybit

- OKX

- Bitget

- Gate io

- BingX

- Woo X

- BitMEX

- Deribit

- Kraken

- KuCoin

- MEXC

- Huobi (HTX)

- Bitfinex

- Coinbase

- Phemex

How to create and run trading bot

To launch a ready-made bot in Wundertraing you need:

- Go to the main page of the official website;

- Select the bot type, for example DCA Bot;

- Click “Open”;

- On the right side of the screen, click “Settings”;

- Select from the list connected via API cryptocurrency stock exchange;

- Select a trading pair, for example TRX\USDT;

- Install strategy LONG or SHORT;

- Enter volume in USDT;

- Set up appropriate parameters for the bot (Auto or Custom);

- When selecting “Custom”, set the required parameters for orders;

- Set take profits and stop losses;

- Click “Create bot”.

Before launching Wunder trading bots, be sure to back test the installed parameters.

Cost of using bots Wundertrading

The service offers several subscription plans:

- Free rate with limited functionality

- Basic: $19.95 per month.

- Pro: $39.95 per month.

- Premium: $89.95 per month.

A 7-day trial period is available for new users functionality tariff Pro.

Payment for a Wundertrading subscription is possible with Visa/Mastercard and via the Paypal payment system. In addition, you can pay tariff plan cryptocurrency, including BTC, ETH and over 50 more tokens.

Demo account in Wundertrading

Platform provides testing capabilities functionality bots without the risk of losing traders' capital. A trial period with the ability to tariff Pro.

Among the key features of the trial period, we can highlight the possibility of simultaneous activation of:

- 50 signal bots;

- 100 DCA bots;

- 10 GRID bots.

Also, the Wundertrading demo mode allows you to:

- Connect five cryptocurrency exchanges;

- Use the built-in backtesting tool to test bots on historical data;

- See profitability analytics, bot statistics, trader transactions;

- Adjust parameters before launching with real funds;

- Use the marketplace to copy trading.

Conclusion

Wundertrading is considered one of the most balanced platforms for automation trading crypto. The service combines professional settings and easy to use strategies. Wundertrading also stands out for its deep integration with the analytical service TradingView, opening up more opportunities for traders who focus on technical analysis. At the same time, copy trading with transparent statistics makes the platform attractive to investors with different levels of experience. But to achieve the best results, we recommend starting with testing strategies as part of the free tariff or a trial period, which allows you to evaluate possibilities systems without significant financial risks.