Instant reaction on a highly volatile digital asset market often determines the success of traders. To get this kind of speed, many people use crypto bots—automatic programs that watch market trends and make trades for them. If these bots are set up right, they can improve strategies, lower risks, make things more efficient, and increase profits.

In this guide, we present a ranking of the top crypto trading bots 2025 that traders can confidently use to enhance their strategies.

What Are Crypto Trading Bots?

A crypto trading bot is a digital tool designed to monitor market activity and automatically execute buy and sell orders according to predefined parameters. In essence, it’s an ideal assistant: it never sleeps, makes instant decisions, doesn’t panic, and is immune to FOMO (fear of missing out).

These crypto currency trading bots integrate with exchanges through API keys. That integration allows the program to perform real-time operations: placing limit, market, or stop orders, as well as implementing advanced risk and capital management strategies.

How Do Crypto Bots Work?

Using a trade bot crypto usually follows these steps:

- The user creates an account on the bot’s website or app.

- The program receives access to the user’s exchange account via API (without withdrawal permissions).

- The trader selects a strategy and sets trading parameters.

- Risk tolerance, maximum losses, entry thresholds, and position sizes are defined.

- The program is launched to trade automatically.

Trading bots for crypto are especially useful for:

- Arbitrage — buying assets on one exchange and selling them on another at a higher price. Crypto bots trading can instantly detect these opportunities and execute transactions in milliseconds.

- Scalping — rapid, high-frequency trades within minutes. Ai trading bots crypto react faster than humans and can handle dozens of trading pairs simultaneously.

- Day trading involves opening and closing all positions in a single day. Automated crypto bots can help traders avoid letting emotions influence their decisions and make the process more streamlined.

Best Crypto Trading Bots 2025: Top 12 Platforms

Below is our ranking of the best crypto trading bots 2025, chosen based on reputation, user reviews, and features.

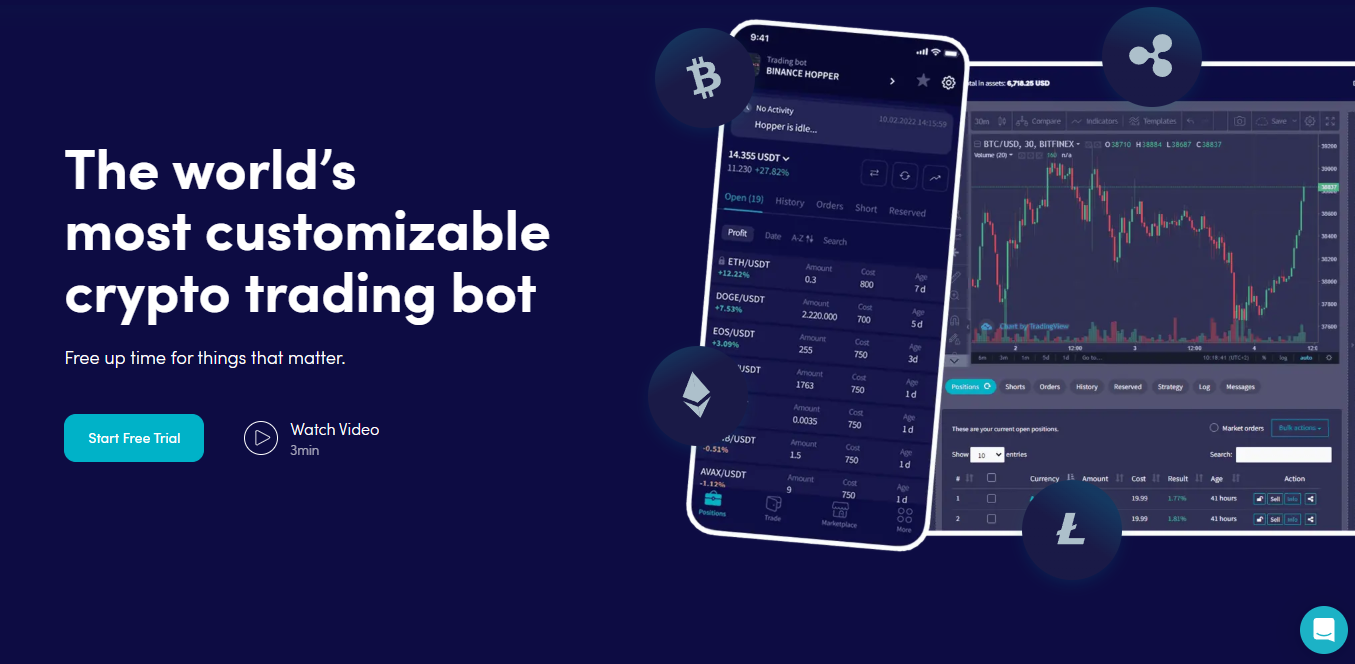

Cryptohopper

Cryptohopper supports arbitrage, DCA, copy trading, and automatic trade execution on signals. It also offers a marketplace for ready-made strategies.

Exchanges: Binance, KuCoin, Coinbase Pro, Kraken, Bitfinex, Huobi, Poloniex, HitBTC, Bittrex, OKX, Gate.io.

Pricing: From $29/month to $129/month; free limited plan.

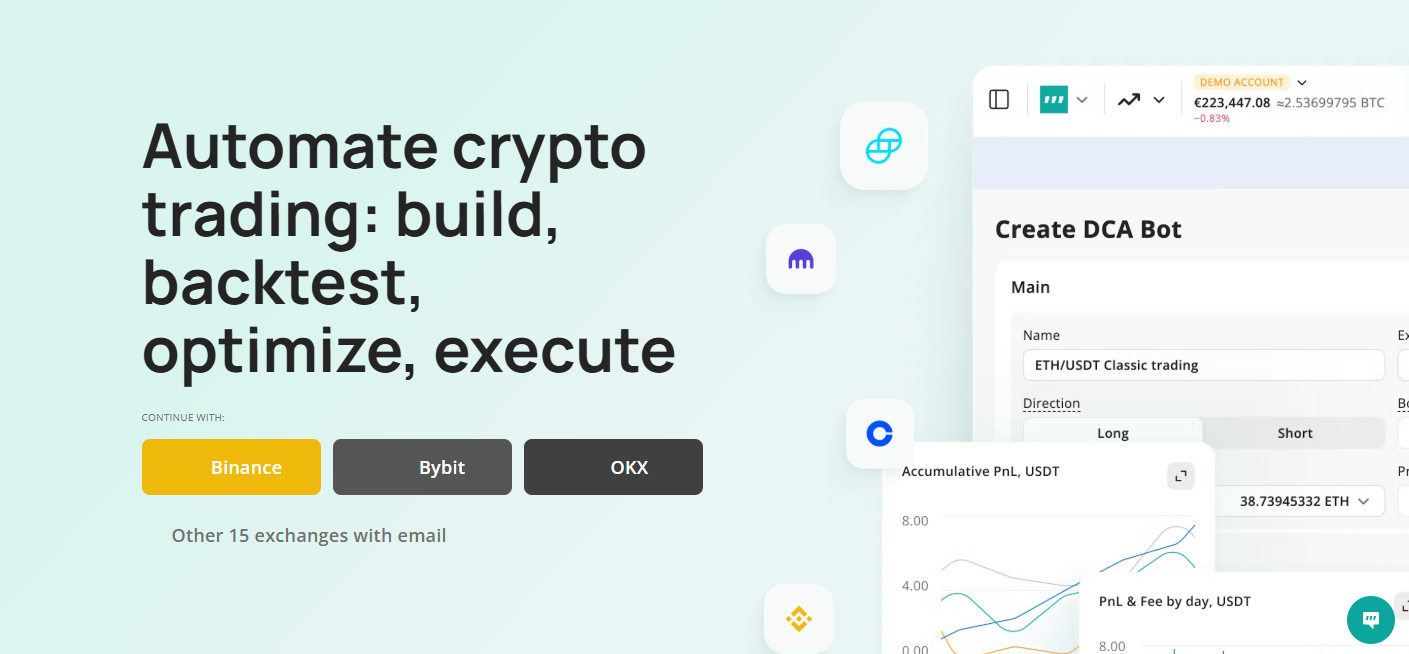

3Commas

3Commas is considered one of the leading crypto trading bots, offering tools like DCA, GRID, Smart Trade, copy trading, and seamless TradingView integration. For advanced users, it also allows full control over stop-loss and take-profit settings.

Exchanges: Binance, Bybit, OKX, KuCoin, Coinbase, Bitfinex, Kraken, and more.

Pricing: Free limited plan, Pro $49/month, Expert $79/month, Asset Manager $499/month.

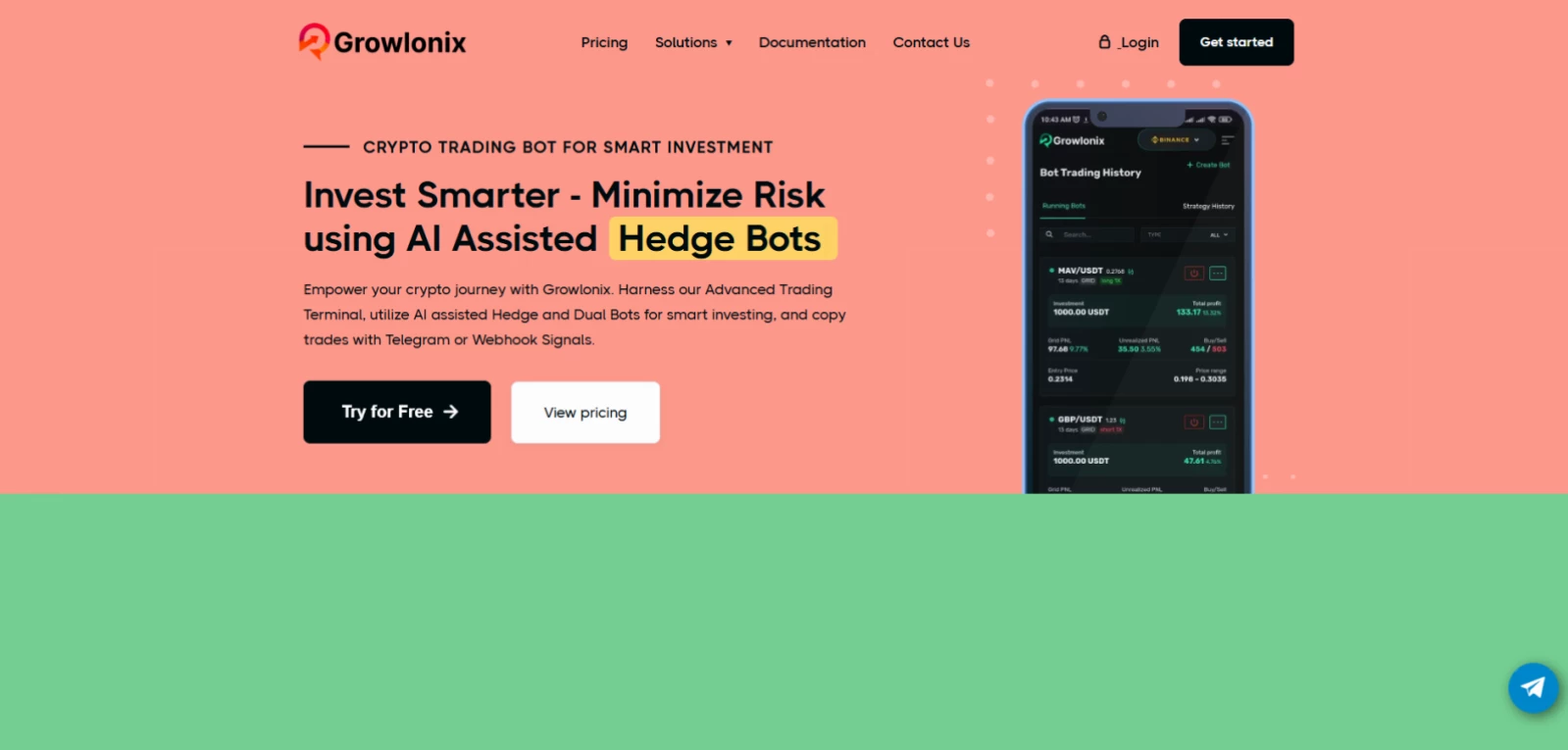

Growlonix

This bot is built for traders who know their way around tech. It lets you set up automated trading, make your own plans, and trade super fast.

Exchanges: Binance, KuCoin, Kraken, Coinbase Pro, Huobi, Bitfinex, OKX.

Pricing: From $17/month; free trial available.

Bitsgap

Bitsgap allows users to manage multiple exchanges from one interface. It supports arbitrage, manual trading, and automated strategies. This makes it a top crypto trading bot for both spot and futures.

Exchanges: Binance, KuCoin, OKX, Kraken, Bitfinex, Bybit, Coinbase Pro, and more.

Pricing: From $28/month; 7-day free trial.

Veles Finance

Perfect for beginners, Veles Finance offers quick setup and easy DCA or scalping strategies. The platform takes a 20% commission from profits instead of a fixed fee.

Exchanges: Binance, KuCoin, OKX, Bybit, Bitget.

Pricing: No monthly fee, 20% profit share.

RevenueBot

A cloud bot that only takes a cut from profitable trades, which is great for beginners who don't want to risk much.

Exchanges: Binance, KuCoin, OKX, Gate.io, Poloniex, Kraken, and others.

Pricing: No subscription, 20% profit share.

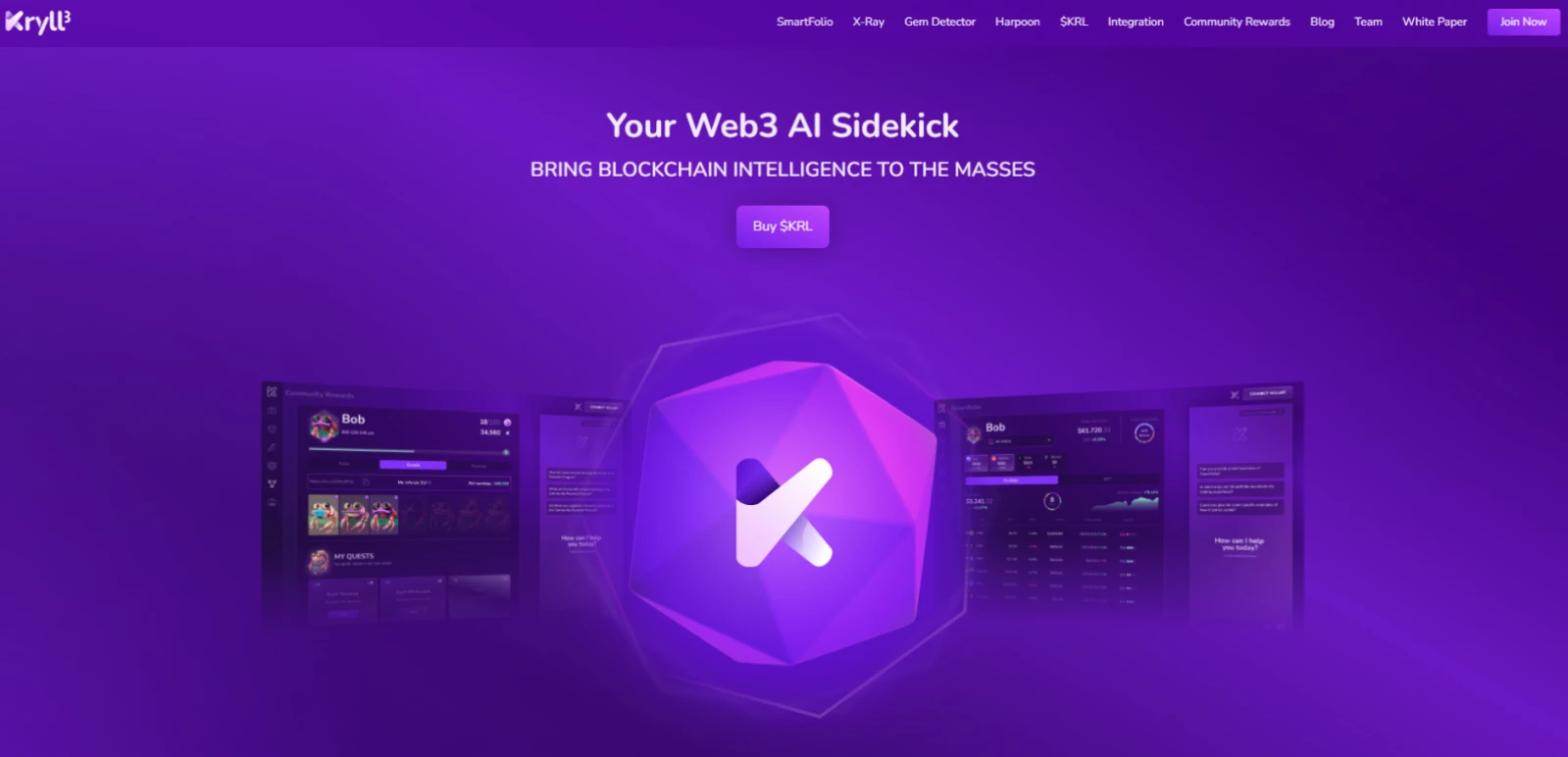

Kryll

Kryll features a visual strategy builder — no coding skills required. Strategies are built with drag-and-drop logic blocks. It also offers a marketplace for renting trading templates.

Exchanges: Binance, KuCoin, Bittrex, Kraken, HitBTC.

Pricing: From $4.99/month or token-based payments.

WunderTrading

This crypto auto trading platform integrates with TradingView and supports DCA, trailing stop, multi-account trading, and strategy copying.

Exchanges: Binance, Kraken, Bybit, KuCoin, Bitfinex, Deribit.

Pricing: From $17.99/month; free 7-day trial.

Pionex

Well-known crypto auto trading bot that provides 16 ready-made strategies and very low trading fees.

Exchanges: Native CEX infrastructure (Pionex).

Pricing: Free.

Altrady

A multi-account management platform with smart order placement, portfolio tracking, and strategic automation. Its “Smart Trading Terminal” provides advanced visualization and analytics.

Exchanges: Binance, KuCoin, Coinbase Pro, Kraken, and others.

Pricing: From $20/month.

Gunbot

This trading bot comes with more than 100 ready-to-use strategies, with well-known options like Bollinger Bands and Gain among them.

Exchanges: Binance, Coinbase Pro, Kraken, KuCoin, OKX, and more.

Pricing: From $29/month.

Coinigy

Coinigy is more of a trading and analytics platform than just a regular bot. However, it allows automated orders, API integrations, and signals.

Exchanges: Binance, Kraken, Bitfinex, OKX, and over 45 others.

Pricing: Free 7-day trial, Pro Trader from $18.66/month.

How to choose the best automated cryptotrading platform

When picking an automated crypto trading platform, remember these points:

- Trading Options: note that Some bots focus on spot trading, while others handle both spot and futures.

- Risk Management: Does the platform have tools such as stop-loss and take-profit orders?

- Strategy: Can you use pre-made templates, or do you need to build your own trading strategies?

- Dependability: The top bots should be reliable and function smoothly.

- Exchange Compatibility: Having more integrations is generally an advantage.

- Pricing: You might encounter subscriptions, profit-sharing models, or a single payment.

AI crypto bots: upsides and downsides

Conclusion

If you're looking to level up your crypto trading and maintain steady performance, crypto trading bots can be a huge asset. In 2025, the most effective bots are automated, secure, and simple to customize. To choose the right one, it’s worth comparing different platforms, checking their features, and reading reviews from other traders. A careful choice here can noticeably improve your trading performance.