3commas is an online platform designed to automate cryptocurrency trading. It supports over 20 major exchanges and provides a convenient interface via both web and mobile applications (iOS and Android). Since its launch in 2017, the platform has attracted more than $40 million in investments from funds such as Alameda Research and Target Global. At its peak market activity, the monthly trading volume exceeded $400 billion.

In this 3commas review, we will analyze the platform’s features, trading bots, advantages, disadvantages, and evaluate how it compares to other alternatives. This detailed 3commas trading bot review 2025 is based on the current functionality, usability, and user experience.

What is 3Commas?

3 commas is a platform for automating cryptocurrency trading without requiring programming knowledge. It connects to supported exchanges and executes trades based on predefined parameters. Users can manage all operations through a single interface while controlling multiple exchanges at once.

The system allows you to run several trading bots across different exchanges simultaneously, provided that API keys are correctly connected and subscription requirements are met.

To make trading more flexible, 3Commas provides tools like Smart Trade and Terminal. Smart Trade enables users to set orders with Take Profit, Stop Loss, and Trailing Stop. The Terminal, in turn, gives access to more advanced features, such as leverage and hedging.

Security is ensured through SSL encryption and two-factor authentication (2FA). For those who want to test the functionality without risk, there is a demo account known as Paper Trading.

Capabilities of 3Commas Trading Bots

The platform provides several trading strategies, including DCA (Dollar Cost Averaging), Grid, and Signal bots. Each is optimized for different market conditions. Previously, a HODL bot was available, but now long-term strategies are implemented through the more advanced DCA bot.

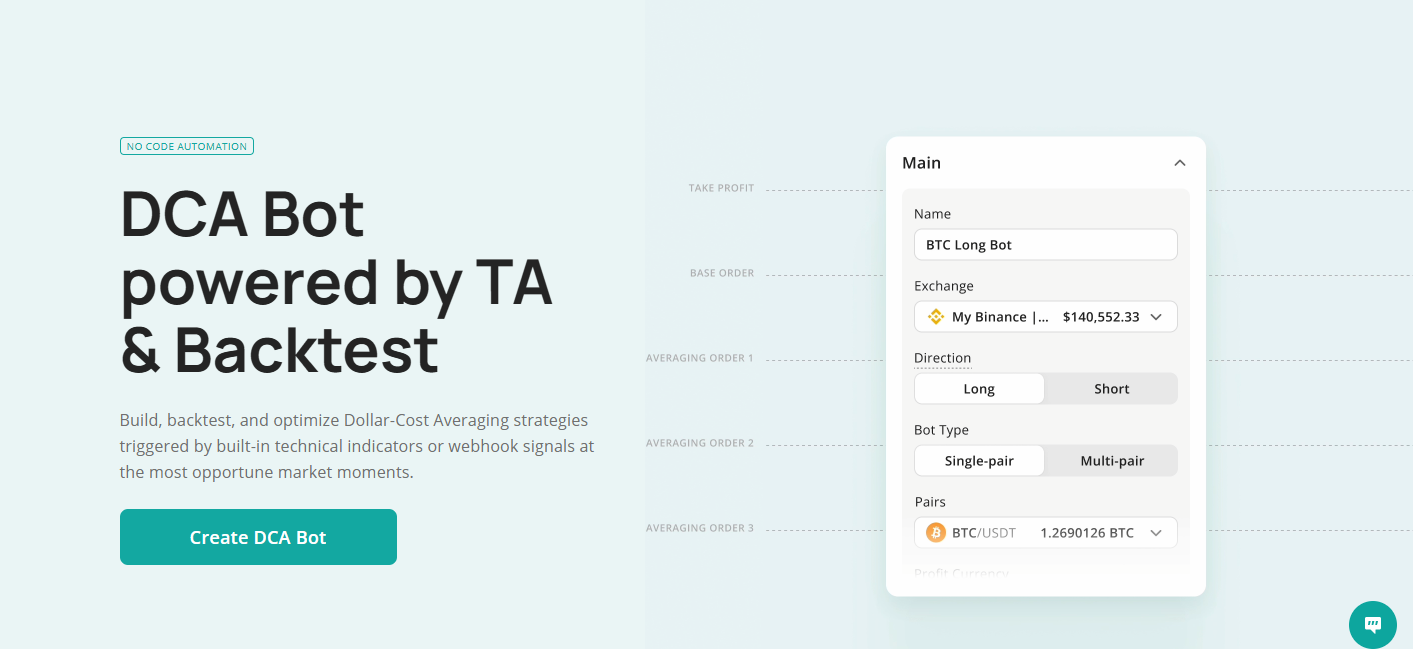

The DCA Bot

Dollar Cost Averaging (DCA) starts with an initial buy and then adds more buys as the price goes down. This helps bring down your average cost.

For example, if Bitcoin drops from $60,000 to $50,000, a DCA bot will place several buy orders as it falls, which lowers your average entry price. When the market goes back up, you can sell for a profit. So, a 3Commas bot check is useful for traders wanting to build positions with less risk when things are up and down.

The Grid Bot

The Grid bot sets up buy and sell orders at different price points, making a “grid.” It makes money from every price change within a certain range.

For example, if an asset trades between $50,000 and $55,000, the grid bot will buy at $50,000 and sell at $55,000, earning profits with each rise and fall. Because lots of people like it, many users look for a 3Commas grid bot check to see how it does when the market isn't trending.

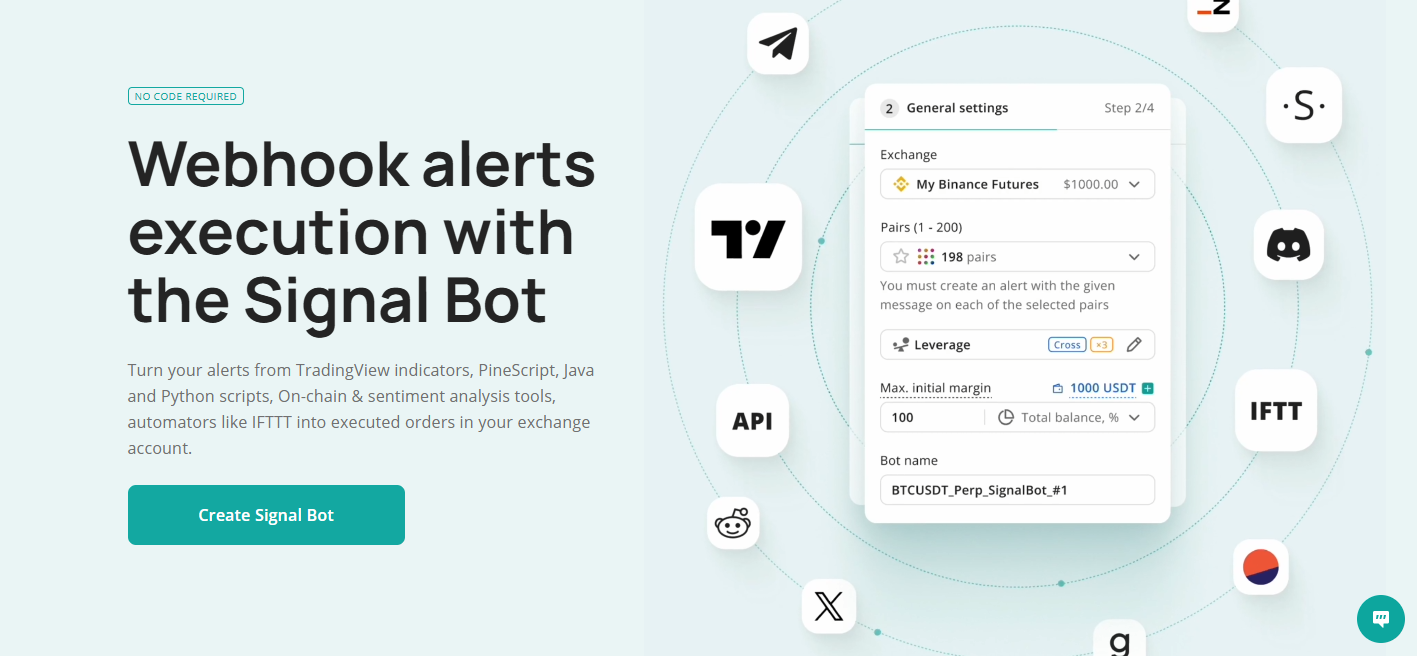

The Signal Bot

The Signal bot trades based on signals from other sources, mainly TradingView. Users can subscribe to signals or create their own.

For example, if TradingView signals a buy when a token reaches a certain level, the bot will automatically place an order using the settings you've chosen. This makes 3Commas more flexible than other trading bot platforms.

Comparing Bot Strategies

| Name | Strategy | Market Conditions | Key Feature |

|---|---|---|---|

| DCA | Averaging cost | Falling markets | Lowers average entry price |

| Grid | Grid trading | Sideways markets | Profits from price fluctuations |

| Signal | Signal-based automation | Any market | Executes trades from TradingView signals |

This clear comparison demonstrates why a 3commas crypto trading bot review must include all strategies: they each address different trader needs.

Getting Started with 3Commas

Step 1. Registration

On the official 3Commas website, users enter their email, country, and password. Quick sign-in options via Google, Apple, Facebook, or Binance are also available. If registering by email, a 6-digit code is sent for confirmation.

Step 2. Connecting to Exchanges

After registration, you can connect to one of 20+ supported exchanges. This is done either by redirecting to the exchange’s website or manually entering API keys. Once connected, the full range of features becomes available.

How to Launch a 3Commas Trading Bot

Launching a bot is straightforward:

- Select the type of bot (DCA, Grid, or Signal).

- Set parameters such as trading pair, trade size, Take Profit, and Stop Loss.

- Adjust advanced settings like price steps, number of orders, trailing options, etc.

- Click “Launch” and the bot will begin trading according to your parameters.

- Monitor progress, pause or edit at any time via the dashboard.

This functionality is the backbone of any 3commas trading bot review. It demonstrates how easy it is to automate trades without deep technical skills.

Paper Trading Demo Mode

For beginners, 3Commas offers Paper Trading with a simulated account balance of 10,000 USDT.

- It mirrors the real interface.

- Allows you to practice with Smart Trade and bots.

- Helps users test strategies without risking funds.

This feature is often highlighted in a 3commas trading bot review 2025, as it significantly lowers the entry barrier for new traders.

Smart Trade and Terminal

Beyond bots, Smart Trade and Terminal allow for manual yet enhanced trading:

- Smart Trade: lets you set complex orders quickly (Take Profit, Stop Loss, Trailing Stop/Buy) through an interactive TradingView chart.

- Terminal: offers professional-grade tools, including leverage, long/short positions, and hedging.

These tools make 3Commas suitable not only for beginners but also for experienced traders.

Portfolio Management on 3Commas

The Portfolio section helps monitor and manage assets across exchanges.

- Displays connected exchanges, balances, and portfolio dynamics.

- Shows performance in USD and BTC.

- Provides pie charts for diversification overview.

- Allows deposits, transfers, and account filtering.

Users can also create virtual portfolios to track performance of assets not stored on exchanges.

Automatic Rebalancing

This feature automatically restores the set ratio of assets in your portfolio, particularly useful in volatile markets. It currently supports Binance Spot and HTX, but not demo accounts.

Conclusion

This 3commas review-2025 shows that the platform is one of the most comprehensive crypto trading automation tools.

Key benefits include:

- Multi-exchange integration.

- Multiple strategies (DCA, Grid, Signal).

- Smart Trade and Terminal tools.

- Paper Trading demo account.

3Commas is a good choice because it works well and is secure. No matter your trading skill, 3Commas can automate your trades, lower risks, and make things more efficient.