KuCoin is a worldwide crypto exchange operating since 2017. Its users can trade, sell, and buy lots of various digital assets. In addition to that, it has its own mobile app, compatible with both Android and iOS operating systems, that lets you trade cryptocurrency almost anywhere.

KuCoin gives traders a safe, reliable environment. It supports a wide range of currencies, from well-known ones such as Bitcoin and Ethereum to various less popular coins. Thanks to this, KuCoin can satisfy the necessities of many investors and traders.

However, KuCoin has one major downside — it doesn’t have a US license. Of course, traders from the USA can use it, but KuCoin US has some limitations and risks. In addition to that, this platform has problems with regulation in Canada and The Netherlands.

KuCoin Exchange: Products & Specs

KuCoin provides a large assortment of features to its users, which makes it a truly versatile exchange.

Below, we’ll give you a brief review of its most prominent features:

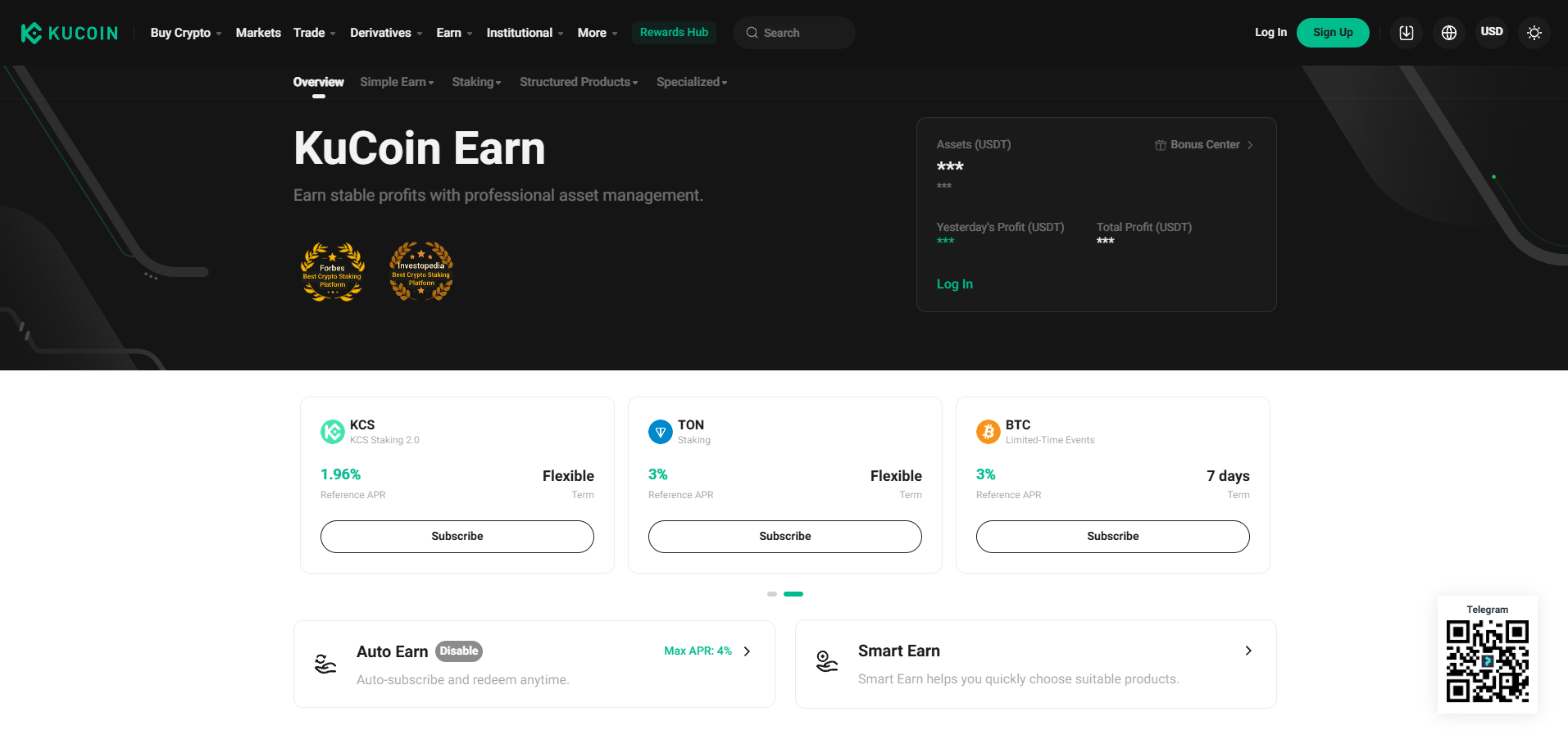

- Staking. KuCoin has a special feature for staking called Pool-X. With it, you’ll be able to get passive income by holding and staking your cryptocurrencies. It’s a great possibility for long-term investors who want to increase their crypto income;

- Lending. It’s another method of earning passive income on the KuCoin crypto exchange. If you lend your crypto assets to other traders, you can get more interest on your own assets. The terms are flexible, and the interest rates are competitive, which makes lending an excellent variant for those who want to generate extra returns and get cryptocurrency without any trading;

- Mobile App. KuCoin’s mobile app is an efficient and user-friendly instrument that lets you engage in trading regardless of where you are. Moreover, the app will send you notifications about market news and your asset performance. It’s a perfect variant for traders who prefer to watch over their investments constantly.

Derivatives Trading Explained

Now, let’s talk about derivatives trading on KuCoin. This process is very simple and profitable. We’ll review such KuCoin options as order types and leveraged tokens.

KuCoin’s Order Types

KuCoin Exchange has a wide assortment of order types that fit various trading strategies.

The main ones are limit orders and market orders.

- Limit orders allow you to establish a special price for the trade. If the market reaches this price, they execute, which increases the level of your control;

- Market orders execute instantly at the current price. They’re perfect for fast purchases or selling if you don’t want to care about the exact costs.

Also, there are order types for advanced trading strategies, such as stop limit, trailing stop, and stop market.

Placing an order on KuCoin is very simple. For it, you’ll need to:

- Choose a trading pair;

- Pick the order type;

- In case it’s applicable, enter the price and amount;

- Review and click the confirmation button.

KuCoin’s Leveraged Tokens

Leveraged Tokens on KuCoin are assets that go short or long on the underlying asset and leverage profits this way. Also, they’re available for trading. Holding such tokens doesn’t require any margin or collateral maintenance, and there’s no risk of their liquidation. However, their prices can be highly volatile, so you should be careful when making investments in them.

Leveraged tokens are a great option for one-sided market moves. But if the market is fluctuating, we don’t recommend you use them. Otherwise, your intraday losses may be rather significant.

Instant Coin-to-Coin Convert

On KuCoin, there’s a subplatform named KuCoin Convert. It lets traders instantaneously swap currencies with no trading fees and the necessity for classic spot trading. Its base includes more than 150 coins and is regularly expanding. Examples of the newest additions are IMX, CGPT, XLM, and FLR. Thanks to its numerous benefits, KuCoin Convert is popular both among newbies and experienced traders.

What is KuCoin Earn

KuCoin Earn is a subplatform for professional asset management meant to help traders manage their assets and make more profit. You can access it via the navigation menu at the top of the website or go to www.kucoin.com/earn. If you’re using the app, choose Earn in its grid menu.

There are two types of products in Kucoin Earn: low-risk (Staking, ETH Staking, Savings, Promotions) and high-return (mostly various futures products). Each one of these categories needs its own subscription.

KuCoin Trading Bot Review

KuCoin has its own trading bot named Spot Grid. It carries out transactions inside a certain price range, benefitting from market fluctuations. For a human being, it’s physically hard to monitor the cryptocurrency market the whole day and night. That’s why this bot is so useful. It helps traders get passive income while living their ordinary daily lives. It automatically sells and buys orders within a so-called grid — a predefined range of prices. It purchases assets when their price is lower and sells them when it becomes higher. It’s very user-friendly, even for complete beginners.

There are several methods of operating the bot, such as:

- AI integration — artificial intelligence chooses all the parameters;

- Copy trading — following users who make significant profits and copying their strategies;

- Customized trading — you manually select the parameters that you prefer.

KCS (KuCoin Shares)

KCS is KuCoin’s own token that appeared in 2017. It fulfills several tasks on the exchange. KCS functions on the ETH blockchain. Its holders can benefit from various everyday bonuses. Also, if you pay trading fees in KCS, you can get very attractive discounts. Staking these coins on KuCoin Earn can bring you a share of the exchange’s profits.

With KCS, you can take part in different KuCoin events, such as token sales. You also may use it to buy different goods and services. It’s important to note that the platform regularly purchases these coins and deletes them, which helps it to decrease their supply and thus make them more valuable.

Cryptocurrency Exchange KuCoin: Available Pairs

KuCoin supports plenty of crypto coins and pairs. The overall number of coins is more than 700, pairs — over 1200.

Let’s name some examples:

- Bitcoin;

- Bitcoin Cash;

- Ethereum;

- Notcoin;

- Toncoin;

- Polkadot;

- Hamster Kombat Coin;

- Dogecoin;

- Shiba Inu Coin;

- Solana;

- XRP;

- KuCoin Token;

- And many others.

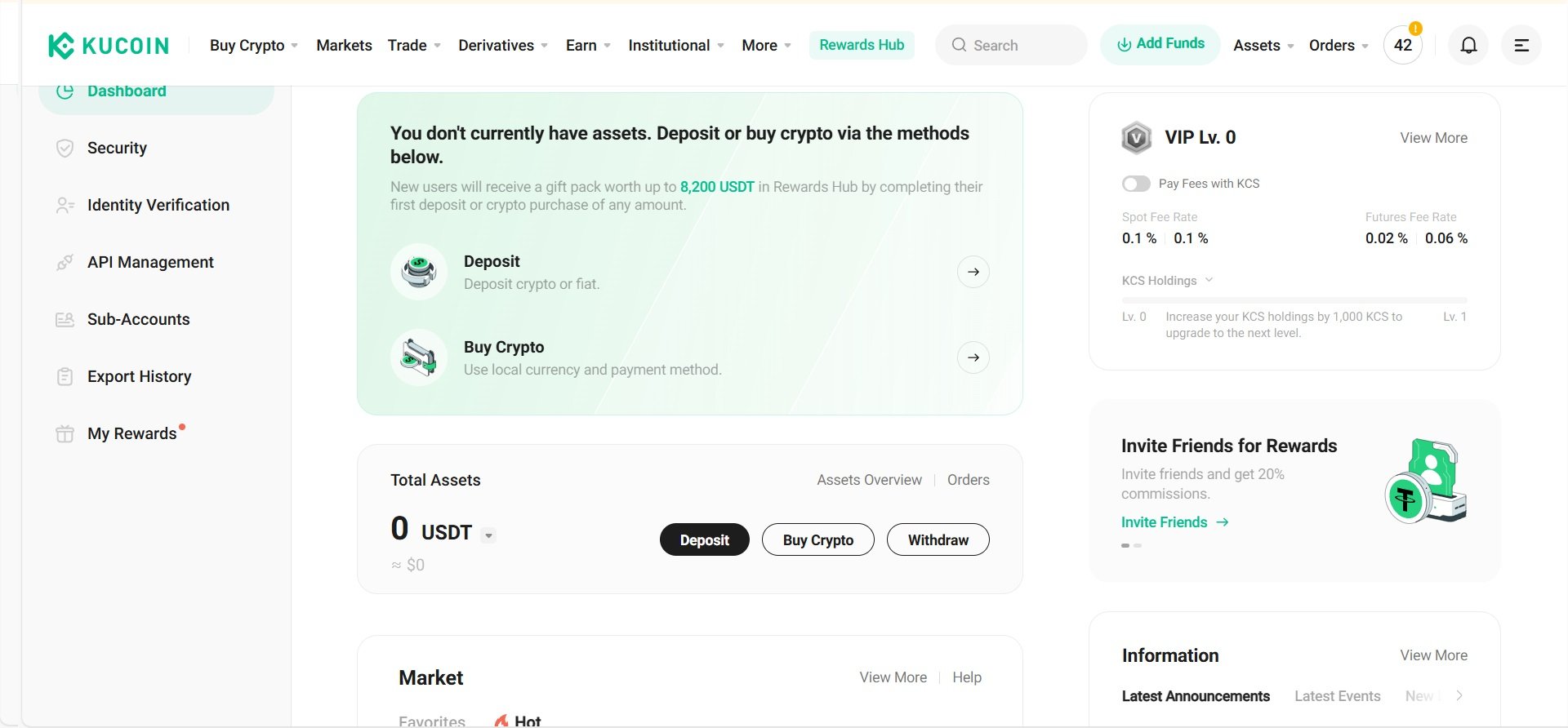

KuCoin Exchange: Starting the Work

It’s very easy to start working with KuCoin. First of all, you’ll need to create an account. If you want advanced possibilities, you’ll need to go through KYC verification. After that, you’ll be able to make a deposit and start trading.

Creating an Account

The procedure for opening an account at KuCoin is very simple.

It consists of the following steps:

- Open the website or download the app of KuCoin;

- Create your own account by pushing the Sign Up button. You can find it in the top-right corner of the screen. Then, enter your phone number or email address;

- You’ll get a verification code. To verify your account, you’ll need to enter it in a special field;

- Create a strong, secure password.

KYC Verification Process

If you want to get higher withdrawal limits and a wider range of features, completing the KYC verification procedure is necessary. You’ll need to submit your personal data, such as your real name, address, and ID, with photos. Also, you’ll have to verify your face.

Since August 31, 2023, all new customers have to complete this process — otherwise, they won’t be able to use the platform. If you’ve registered before this time but haven’t verified your account, you can have access only to a very limited number of services.

Let’s compare withdrawal limits with completed KYC and without it:

| Verification status | Daily withdrawal limit | P2P |

| Completed | 999,999 USDT | 500,000 USDT |

| Not completed | 0-30,000 USDT (depending on how much information about yourself you’ve disclosed) | - |

Why does KuCoin have such strict verification? It’s a measure against money laundering, fraud, scams, financing terrorists, and other criminal organizations.

Crypto Deposit on KuCoin

On KuCoin, you can make deposits either from outer sources or from another KuCoin account (so-called internal transfer).

Making deposits on KuCoin is rather simple. For it, you’ll have to:

- Verify your identity;

- Open the Deposits page (on the website, click Assets in the top-right menu and select Deposits. In the app, choose the Deposits button on the main page). There, you’ll find all the necessary info;

- In the menu that will appear, pick the asset you want to deposit. Alternatively, search for the asset’s name. After that, choose the account that you want to transfer these assets to;

- Enter your deposit address into the withdrawing menu. After that, you’ll be able to make deposits into your account;

- In some cases, KuCoin can pre-credit assets that you deposit. When this happens, you can instantly start using them for buying, investing, trading, and other operations;

- KuCoin notifies users about the outcomes of their deposits through notifications, email letters, and other means. Also, you can watch your yearly deposit history in your account.

Crypto Trading on KuCoin

There’s nothing difficult in trading cryptocurrency on KuCoin.

To do it, you’ll need to:

- Open the KuCoin Spot Trading menu;

- Choose a cryptocurrency pair;

- Enter your password for trading;

- Select an order type;

- Create an order and place it.

KuCoin Exchange Commission

KuCoin crypto exchange has different fees, such as futures, trading, withdrawal, and transfer fees. Let’s discuss them more profoundly.

KuCoin’s fee structure is a competitive maker/taker one. It depends on your order type. A maker order creates crypto liquidity, while a taker one reduces it.

There are three classes of cryptocurrencies on this platform: A, B, and C. The first class includes top-level currencies like Bitcoin and Ethereum. In the second one, there are less popular coins, such as LoveCoin. Class C has rather few currencies, usually the least-known ones with the lowest market caps.

| Coin class | Taker fee | Maker fee |

| Class A | 0.1% | 0.1% |

| Class B | 0.2% | 0.2% |

| Class C | 0.3% | 0.3% |

Regarding futures trading, the platform has a multi-leveled fee structure. Your level depends on your KCS holdings and cryptocurrency trading volume. Fees can differ significantly, so you’ll need to check them before trading.

Sending currency to another KuCoin account is usually free. But when you transfer it to another platform or an external wallet, you’ll have to pay a fee. Its size depends on the coin you use and other factors.

As on many other crypto exchange platforms, there are withdrawal fees on KuCoin. They differ depending on the currency. For example, Bitcoin's withdrawal fee is 0.0005 BTC. Don’t forget to check this fee for every currency before buying it if you want to transfer it outside KuCoin.

Security of KuCoin Exchange: Review

Safety is crucial for cryptocurrency trading. KuCoin is one of the safest exchanges, and it applies many measures to keep users’ assets secure.

The main of them include:

- Routine security audits (internal and external);

- 2-Factor authentication. It provides an additional level of protection to traders’ accounts;

- System security. It includes protocols that are standard for the industry — for instance, SSL and HTTPS;

- Multiple-layered encryption of wallets. To increase the safety of asset storage, the exchange utilizes both cold and hot wallets;

- Measures to prevent phishing, such as a customizable safety phrase feature.

So, as you can see, this crypto exchange really cares about the safety of its users. However, you also should take all the necessary measures to keep your account secure.

KuCoin Support Service

KuCoin has several types of customer support, such as support tickets, live chat, various social media, and a Help Center. The platform guarantees that its users can get all the necessary help as quickly as possible.

Let’s talk about them in more detail:

- Live chat. You can find it on Ku Coin’s website or in its app. In this chat, you can contact the platform’s consultants at any time. It’s most suitable if you’re in a hurry or have an urgent question;

- Support ticket. You can submit it via the exchange’s website. The consultants will answer you through an email letter. It takes more time than in live chat, so it's better to use it if your problem is not so urgent. Also, it’s suitable for complicated questions;

- Social media. The exchange has active channels on Facebook, X, Reddit, Telegram, and other platforms. There, the KuCoin team posts various news and announcements, reads customers’ feedback, and interacts with them;

- Help Center. It’s a web resource that consists of many guides, articles, and frequently asked questions that cover all the main topics about using KuCoin. It’s a must-read for everyone who’s new to this exchange.

KuCoin and Other Crypto Exchanges: Comparison

Compared to its competitors, KuCoin has small fees and a great selection of coins. Moreover, it supports such options as margin, staking, P2P trading, and futures. It makes KuCoin a great variant for traders with big experience. However, this platform also has several disadvantages, especially the lack of a US license.

Let’s compare KuCoin to one of its main competitors, Coinbase:

- Unlike KuCoin, Coinbase does have a US license;

- Coinbase supports much fewer currencies than KuCoin — only 240+, while KuCoin has more than 850;

- Coin base's trading fees are way higher than kucoin's;

- KuCoin's support options don’t include phone support. On Coinbase, it’s available.

So, if you’re from the United States, Coinbase probably will be more suitable for you. If you live in another country, KuCoin might be a better option for you. It has smaller fees and much more coin options.

KuCoin Exchange Review: Takeaway

Although not perfect, KuCoin is a great cryptocurrency exchange that is suitable for traders with any level of experience. Its advantages are numerous — a large assortment of features, a simple interface, moderately transparent fees, an attractive fee structure, and so on. It offers such possibilities as trading with a bot’s help, lending, and staking. It can be a great variant for those who want to optimize the costs of their trading and increase their profit.