The Best Cryptocurrency Staking Platforms

Staking became a popular way to earn passive income in the world of cryptocurrencies. According to OnStaking, the Proof-of-Stake (PoS) market could grow 200% in 2025 compared to last year. Investors are looking at the best crypto staking platforms, with more favorable and reliable conditions. In 2025, there are many crypto staking platforms with different conditions: from centralized exchanges (CEX) to decentralized protocols (DEX) and liquid staking services. When choosing a platform, consider specific parameters: reliability, asset control, lockup periods, and realistic rates of return. In this article, we'll explore the key differences between staking platforms and the pros and cons of various solutions, helping you identify the best staking platform for your needs.

What is staking and how to choose the best platform?

Staking is holding cryptocurrencies on a platform or wallet to support the blockchain. In the Proof-of-Stake system, users temporarily lock up their tokens to participate in transaction confirmations and support the network. For this, they are rewarded with new coins.

Key points when choosing a platform:

- Security. Reliable platforms protect your funds, guarantee transparency of token issuance, and minimize the risk of loss.

- Profitability and holding periods. It's important to consider the platform's lockup periods, flexible withdrawal options, or liquid staking options (when, instead of locked coins, they give a representative token that can be used without waiting for unlocking).

- Supported tokens. Consider the cryptocurrency's market capitalization, popularity, and prospects.

- Ease of control. It should be easy to track accruals, reinvest rewards, and control your holding.

It's also important that the platform be accessible without restrictions in your country. For example, Bybit and wallets like TR.ENERGY Wallet provide the ability to manage tokens without problems, reducing counterparty risks. This is especially relevant when selecting the best crypto staking platform or comparing the best staking platforms for long-term use.

Top Staking Platforms – 2025 Platform Rankings

Below are platforms offering staking in 2025 with varying conditions and returns — a list that includes several top crypto staking platforms 2025 gaining popularity among users.

KuCoin

A centralized exchange founded in 2017. It offers staking for over 40 popular PoS coins, including ETH, SOL, and ADA. Flexible, fixed, and liquid staking options are available, making it one of the top crypto staking platforms for diverse user needs.

OKX

Founded in 2017, this centralized exchange (CEX) supports staking for 80 PoS cryptocurrencies, including ETH, SOL, and DOT. Users can choose their holding periods and enjoy flexible redemption options.

Bybit

One of the most popular centralized exchanges, launched in 2018. It offers liquid and flexible staking for a limited number of coins, such as SOL and USDT, with the option to reinvest rewards.

MEXC

Launched in 2018, this centralized platform supports staking of 20–25 tokens, including ETH, AVAX, and ATOM. Fixed and flexible plans with varying terms are available, positioning it among the best crypto staking platforms 2025 for users who want both liquidity and increased returns.

Kraken

A veteran exchange founded in 2011, it supports staking for over 15 PoS coins, including ATOM, DOT, and ETH 2.0. Flexible and fixed staking options are available, with transparent profitability information.

Bitget

A centralized exchange founded in 2018. Offers staking for over 20 PoS coins, including SOL, ATOM, and DOT. Flexible and fixed plans with varying holding periods and periodic rewards are available.

Gate.io

Operating since 2013, it is one of the oldest centralized platforms. It supports staking for over 600 PoS cryptocurrencies, including ALGO, NEAR, and ADA. It offers flexible, fixed, and liquid staking options, depending on the token, making it a frequent mention among top staking platforms for users seeking a wide range of assets.

BingX

Founded in 2018, this centralized exchange offers staking for 35 PoS coins, including DOT, SOL, and ATOM. Users can choose flexible products or fixed lockup periods with increased returns.

HTX

A large centralized platform operating since 2013. It supports staking for approximately 18 PoS assets, including TRX, EOS, and SOL. Flexible and fixed plans are available, as well as promotional products with increased returns.

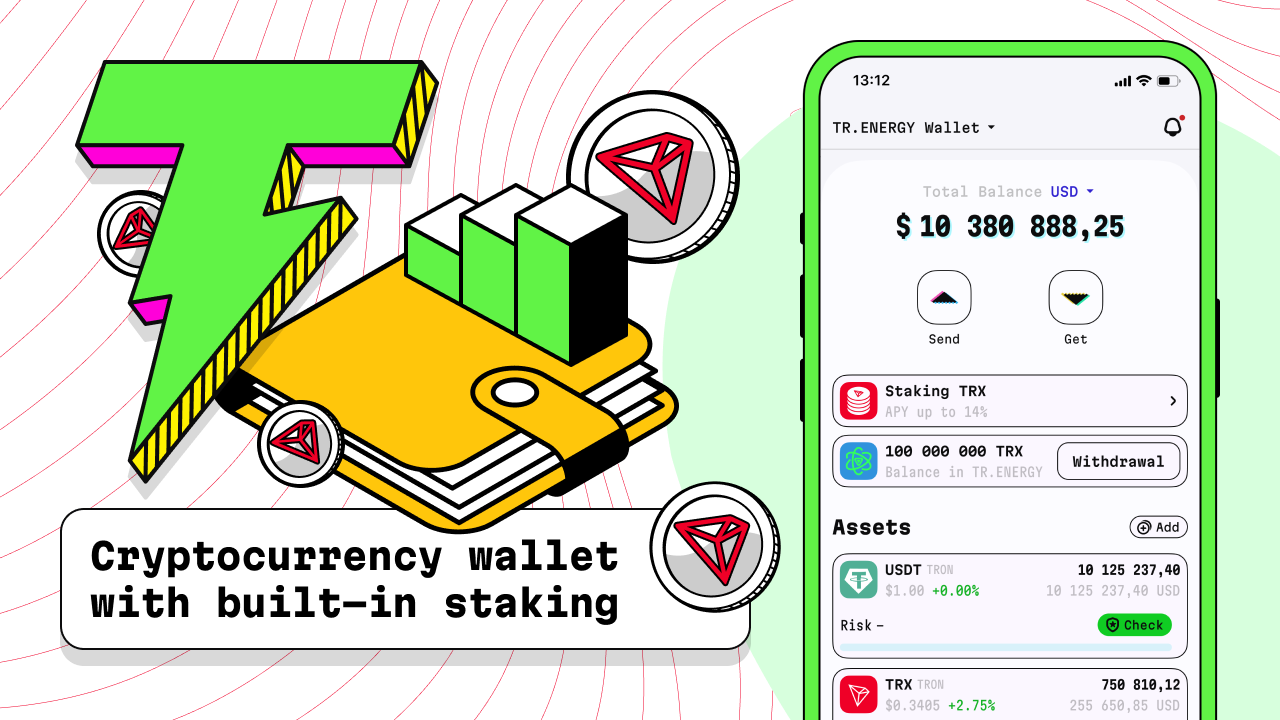

Cryptocurrency wallets with built-in staking

Besides centralized exchanges, there are crypto wallets that provide an opportunity to participate in staking without intermediaries. For example, TR.ENERGY allows you to manage TRON energy without transferring coins to a third-party service, track the accrual of remuneration, and use functions of liquid staking. This approach reduces the risk of loss and ensures complete control over your assets, which is valuable when comparing top staking platforms 2025 and independent staking options.

Comparison of the best platforms

In 2025, several major exchanges and services stand out among cryptocurrency staking platforms. They differ in the number of coins they support, staking types (flexible, fixed, or liquid), and yield conditions. Below are the key ones.

In 2025, the most popular staking platforms offer different conditions and yield formats, so the choice largely depends on the investor’s goals. For example, Bybit focuses on liquid and flexible staking — a convenient option for those who want to earn rewards while keeping their tokens available for withdrawal at any time. The yields here are usually moderate, typically within a few percent per year.

MEXC, on the other hand, combines both flexible and fixed-term products. Flexible rates provide slightly lower yields, while fixed periods allow users to earn higher returns if they are willing to lock their assets for a set duration. This makes the platform appealing to investors who want to balance liquidity with enhanced earning potential.

TR.Energy deserves a separate mention, as it operates not as an exchange but as a specialized service for staking within the TRON ecosystem. It does not offer flexible or fixed staking in the traditional sense. Instead, users delegate their TRX tokens to network validators and earn rewards according to the blockchain’s native mechanisms. This is a suitable choice for those already working with TRON and looking to maximize returns within this specific ecosystem.

How to Start Staking: A Quick Guide for Beginners

To stake cryptocurrency, you only need to follow a few steps:

Choosing a platform. Determine your goals – passive income, liquidity, or long-term holding. Consider user restrictions. Whether you're considering top staking platforms or niche services, choose the option that best matches your assets and risk tolerance.

Registration and verification. Create an account, complete KYC, and connect your wallet.

Balance replenishment. Transfer tokens to the platform or wallet. The minimum amount depends on the coin.

Delegation. Select cryptocurrency and the staking type (fixed, flexible, liquid). Specify the term and confirm the transaction.

Income monitoring. Keep track of interest accrual, interest rate changes, and retention terms.

Profitability Comparison

Below is an overview of popular and reliable platforms offering staking in 2025. Terms vary among services: some only support flexible or liquid staking, while others also offer fixed plans with increased returns. This comparison helps identify the top staking platforms 2025 depending on yield expectations and token availability.

Staking Yield Comparison – Best Staking Options in 2025

Below is an overview of popular and reliable platforms offering staking services in 2025. Conditions vary widely: some support only flexible or liquid staking, while others additionally provide fixed-term plans with increased APY.

| Platform | Link | Number of PoS Coins | Average Yield |

| KuCoin | kucoin.com | 40+ PoS coins (NEAR, KAVA, XRD, EGLD) | flexible: 1–8%, fixed: up to 12% |

| OKX | okx.com | ~80 PoS coins (ETH, SOL, DOT) | flexible: 1.5–5.4% |

| Bybit | bybit.com | ~30 PoS coins | liquid / flexible: 2–8% |

| MEXC | mexc.com | ~17 PoS coins (SOL, AVAX, ATOM, etc.) | flexible / fixed: 3–10% |

| Kraken | kraken.com | 15+ PoS coins (ATOM, DOT, ETH 2.0) | flexible: 4–8%, fixed: 16–22% |

| TR.ENERGY | tr.energy | TRON staking | flexible: 10–14% |

Risks and safety precautions when staking

There are certain risks involved in staking crypto that you need to consider. Even the best crypto staking platforms and seemingly top crypto staking platforms include potential downsides that every investor must evaluate.

Slashing. The loss of a portion of coins due to validator errors or violation of consensus rules.

Locks. With fixed staking, funds are inaccessible until the end of the period, reducing liquidity.

Counterparty risk. Centralized exchanges may face technical or regulatory issues.

Technical risks in DeFi. Smart contract vulnerabilities can lead to loss of funds.

Profitability changes. The reward percentage may vary depending on token issuance and network capitalization.

Safety precautions:

- use official wallets or trusted services with direct staking support (for example, Tron wallets compatible with TR.ENERGY);

- diversify assets;

- check minimum amounts and blocking periods;

- track platform updates.

If you take the necessary precautions, you can avoid problems with possible loss of funds. This applies to both newcomers choosing the best crypto staking platforms 2025 and experienced users operating across several best staking platforms.

Conclusion

Choosing the best platforms for cryptocurrency staking depends on the investor’s goals, his readiness for possible risks, as well as from the choice of the crypto itself. Centralized exchanges are suitable for beginners due to their convenience, while liquid and DeFi platforms are suitable for experienced users who want flexible token management. Using reliable wallets, such as TR.ENERGY Wallet, increases control and reduces risks. Ultimately, effective diversification across several top crypto staking platforms can increase long-term returns and protect your assets.