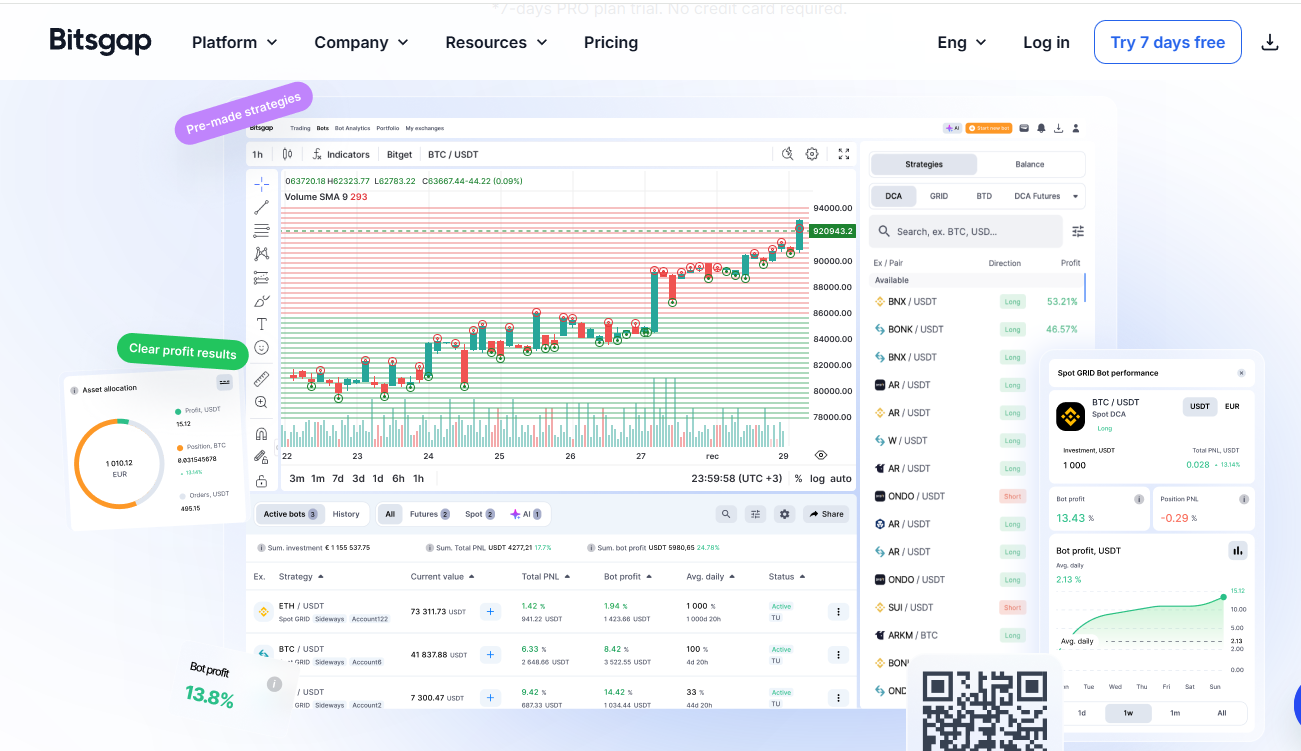

Bitsgap is a platform for automated cryptocurrency trading, developed in Estonia and launched in 2018. It provides traders with a unified ecosystem for portfolio management and algorithmic trading. By 2025, users had already launched around 5 million Bitsgap bots on the platform.

What makes this platform stand out compared to other crypto trading automation services? Which algorithms are supported? Let’s explore in detail in this Bitsgap review 2025.

What Is the Bitsgap Trading Bot?

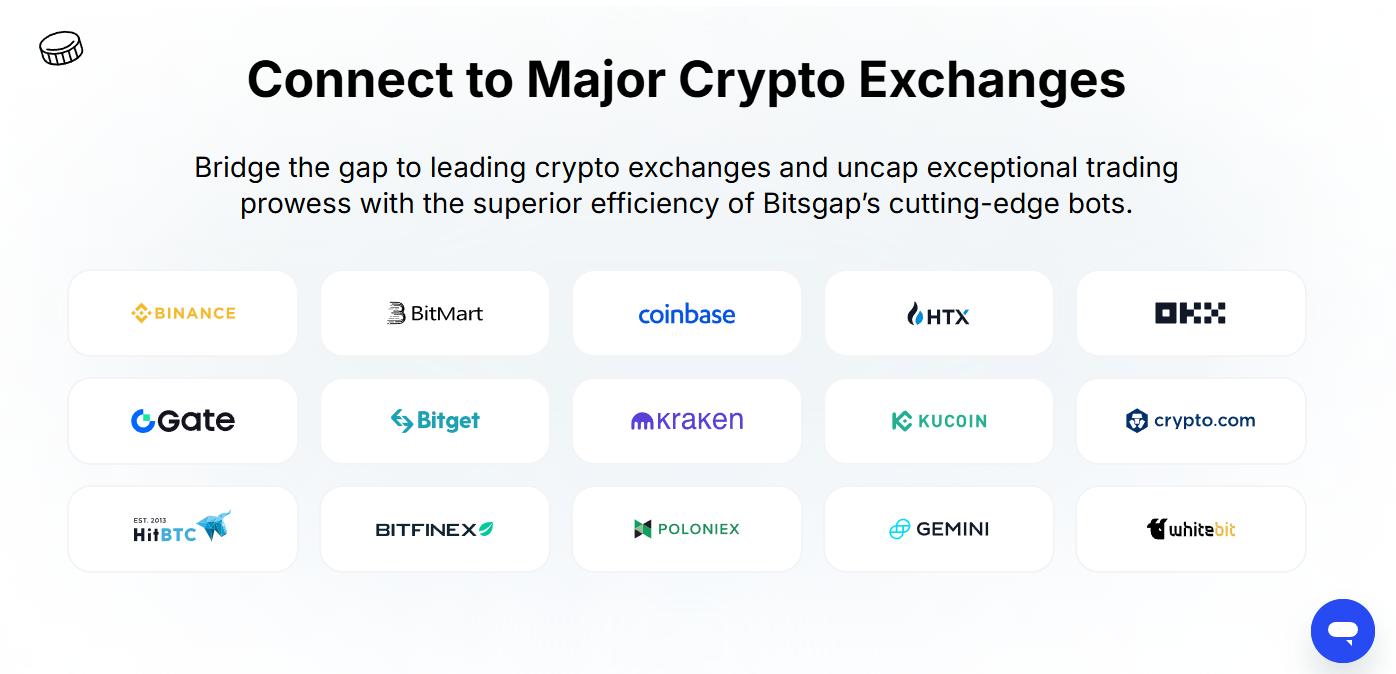

Bitsgap is a cloud-based solution for automated crypto trading. The service offers access to a variety of trading algorithms and strategies. With a single interface, traders can manage trades across exchanges like Binance, OKX, Kraken, Bybit, and more.

Key Features:

- Automated trading bots: Grid, DCA, Futures.

- Arbitrage strategies.

- Technical analysis with TradingView indicators.

- Risk management with customizable stop-losses.

- Demo mode for testing strategies.

Unique Aspects of Bitsgap

One of the core advantages highlighted in any Bitsgap trading bot review is that the platform integrates over 15 cryptocurrency exchanges into a single interface. Here are some of its distinctive features:

- Multi-exchange integration – Connections via API allow instant execution of orders. Traders can diversify risks and benefit from arbitrage opportunities.

- Algorithmic trading – The platform provides pre-set strategies for various market conditions:

- Grid bot for sideways markets.

- DCA bot for dollar-cost averaging.

- COMBO bot for futures trading (a combination of DCA and GRID).

- Buy-the-dip (BTD) bot for falling markets.

- Loop bot for reinvesting profits automatically.

- Portfolio management – The platform allows traders to monitor and analyze their investments with tools for:

- Asset rebalancing.

- Profitability analysis.

- Tax reporting optimization.

Types of Bitsgap Bots

Users can employ six main trading algorithms on Bitsgap bots:

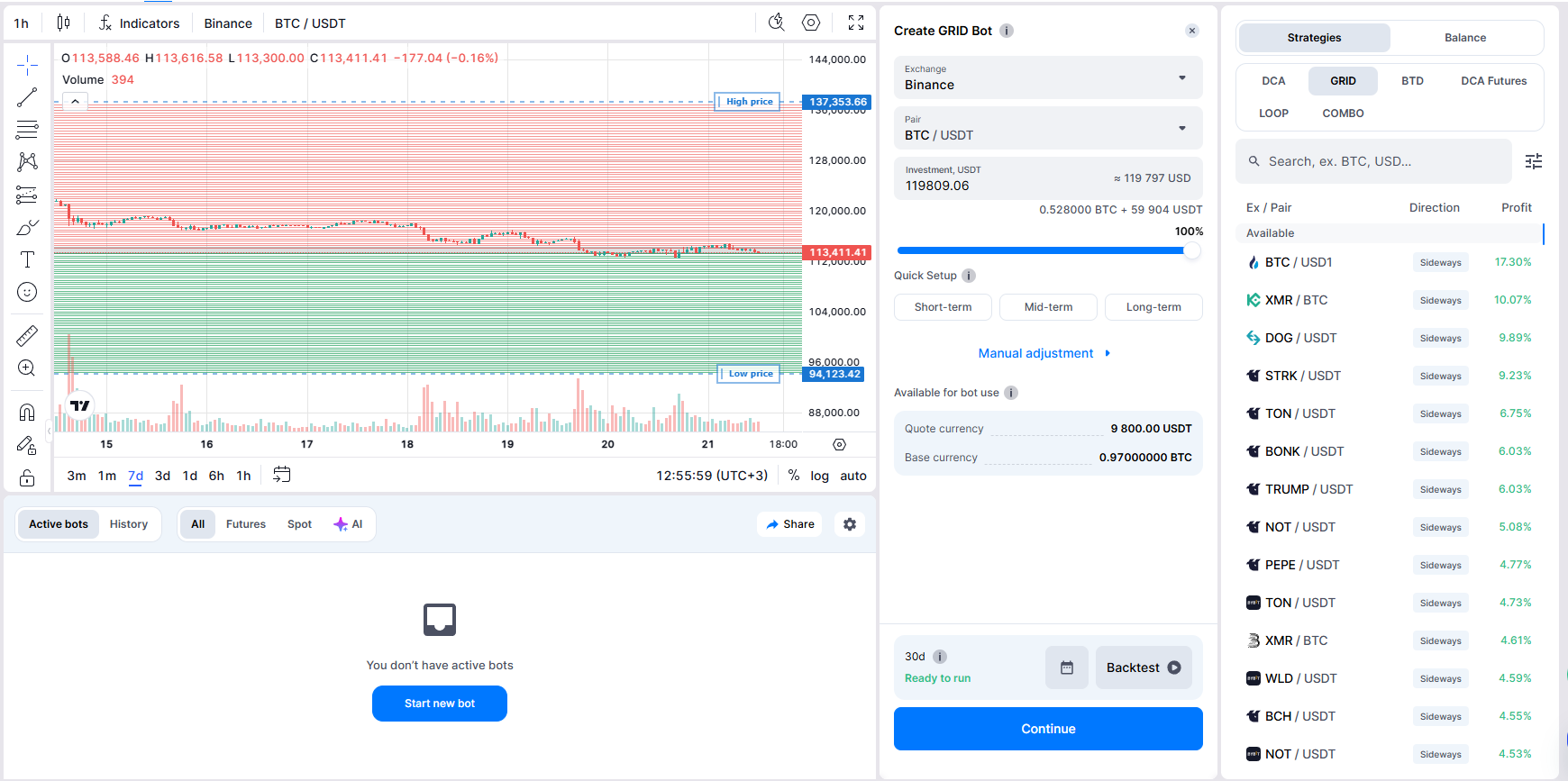

Grid Bot

Ideal for high-frequency trading within a set price range. It automatically buys at lows and sells at highs. Features include arithmetic/geometric grids and AI optimization.

DCA Bot

A long-term investment tool that helps average entry prices using safety orders. Supports both long and short strategies.

COMBO Bot

Combines DCA and Grid strategies for leveraged futures trading. Includes stop-loss, take-profit, margin auto-rebalancing, and liquidation level management.

DCA Futures Bot

Designed for futures with leverage up to 10x. Automatically adds orders against market movement to lower entry price. Protects positions with margin rebalancing and trailing tools.

Loop Bot

Continuously opens and closes positions based on chosen parameters, automatically reinvesting profits. Particularly effective with volatile altcoins.

BTD Bot

The “Buy the Dip” tool opens positions during significant price drops, sets automatic take-profits, and reduces average entry with DCA.

Each of these tools shows why many traders in their Bitsgap trading bot review emphasize its versatility.

Registration on Bitsgap

Getting started with Bitsgap is simple:

- Go to the official website.

- Click “Log In” and then “Sign Up.”

- Enter email and password.

- Confirm registration via email.

- Enable 2FA and set up security codes.

Connecting a Bitsgap Bot to an Exchange

To link a Bitsgap bot with an exchange:

- Create an account on a supported exchange.

- Complete KYC verification.

- Enable 2FA security.

- Generate API keys in exchange settings.

- Assign trading permissions.

- Add the keys into your Bitsgap account.

Once completed, your trading bot can begin executing strategies automatically.

Bitsgap Pricing Plans

The platform offers a 7-day free trial without requiring a credit card. After that, three subscription tiers are available:

- Basic – $28/month.

- Advanced – $66/month.

- Pro – $144/month.

Demo Mode on Bitsgap

Demo mode is one of the most mentioned advantages in any Bitsgap review. It allows users to test bots and strategies without financial risk:

- Full bot functionality.

- Access to all algorithms.

- Realistic parameters and trading environment.

- Trading terminal access with TradingView charts.

Portfolio Management in Bitsgap

The Portfolio tool offers traders a comprehensive way to manage and analyze assets:

- Track balances across all connected exchanges.

- Analyze allocation and profitability.

- Rebalance assets.

- Compare ROI performance over time.

The cross-exchange monitoring and analytics make this feature highly valuable for both beginners and professionals.

Trading Terminal

Bitsgap includes a built-in trading terminal available in all subscription tiers, including the free trial.

Features:

- Market and limit orders.

- Stop-loss and take-profit orders.

- TWAP algorithmic orders.

- Scaled orders for gradual execution.

- Access to TradingView indicators (200+ technical tools).

This terminal ensures that even manual traders can enhance their performance within Bits gap’s ecosystem.

Supported Exchanges

Bitsgap supports leading exchanges such as Binance, Bybit, KuCoin, Bitget, HTX, and Crypto.com. Depending on your trading style:

- Binance and Bybit are strong choices for futures and spot markets.

- KuCoin and Bitget are better suited for altcoin trading.

However, regional restrictions apply. For instance, Binance does not allow Russian residents to trade without KYC verification.

Overall, most Bitsgap reviews highlight more strengths than weaknesses.

Conclusion

This Bitsgap review shows that the platform is a universal solution for automated crypto trading. With multiple strategies (Grid, DCA, LOOP, COMBO) and advanced analytics, Bitsgap bots are valuable for both beginners and professionals. The demo mode provides an opportunity to experiment risk-free before committing to paid plans.

For anyone looking to optimize crypto trading with automation, Bitsgap trading bots are a competitive and reliable choice.