How to make money on cryptocurrency – top popular methods

In July 2025 the price of bitcoin updated its historical maximum: the main digital asset cost more than $123,000. Cryptocurrency market capitalization while reaching $3.8 trillion. The market is at its peak again: new traders are coming, interest in decentralized services is growing. The main incentive is the desire to get a large profit. Cryptocurrency holders can earn money on spot trading, staking, participation in airdrop campaigns, automatic trading using bots. We will analyze each instrument in detail and learn how to make money on crypto trading.

What is cryptocurrency and how does it work

Cryptocurrency is a digital asset that exists in a decentralized network. Transfers are made without the participation of banks and intermediaries. The technological basis is blockchain. It is a distributed database in which each transaction is recorded in a separate block. The blocks are connected to each other and protected by cryptographic algorithms. It is impossible to forge or delete the information.

First on blockchain started working, bitcoin (BTC). The token appeared in 2009 as an alternative to traditional financial systems. At the start, the coin cost less than one cent, and in 2025 the rate exceeded $120,000. Bitcoin used for calculations, accumulation, transfer of funds.

Based on the same principles, alternative cryptocurrencies Ethereum (ETH), Solana (SOL), Ripple (XRP), Toncoin (TON) and others emerged. Altcoins needed to run smart contracts, staking, processing transactions, participation in voting, payment for services.

Due to their practical application and market capitalization, these assets form the basis of the industry. In 2025, more than 60% of market transactions are in BTC, ETH, SOL, XRP. These cryptocurrencies provide liquidity, support key segments of market infrastructure.

Ways to make money on cryptocurrency

The cryptocurrency market offers several options for earning money. Active and passive formats. Each method has different terms and requirements for the trader's experience.

Spot trading

Stock trading is a method how to make money in crypto on daily. Buying and selling tokens at the current price - this is spot trading. They earn here on exchange rate difference – buy cheap, sell expensive. For example, buying coins for $30,000 and selling at $35,000 will give a 16.6% profit.

A clear mechanism and the possibility of quick income attract beginners. Usually, users make their first transactions on the cryptocurrency market on the spot.

Investing in cryptocurrency

Digital assets can be owned long-term. The main task is to choose a project with stable technical and economic indicators' briefcase often include Bitcoin, Ethereum, Solana. Some funds are placed in stablecoins – such tokens are tied to fiat currency rates and are less subject to volatility.

The market is characterized by sharp fluctuations. To reduce risks, use the strategy of averaging (DCA) and diversification. The approaches help distribute capital between different assets and price levels.

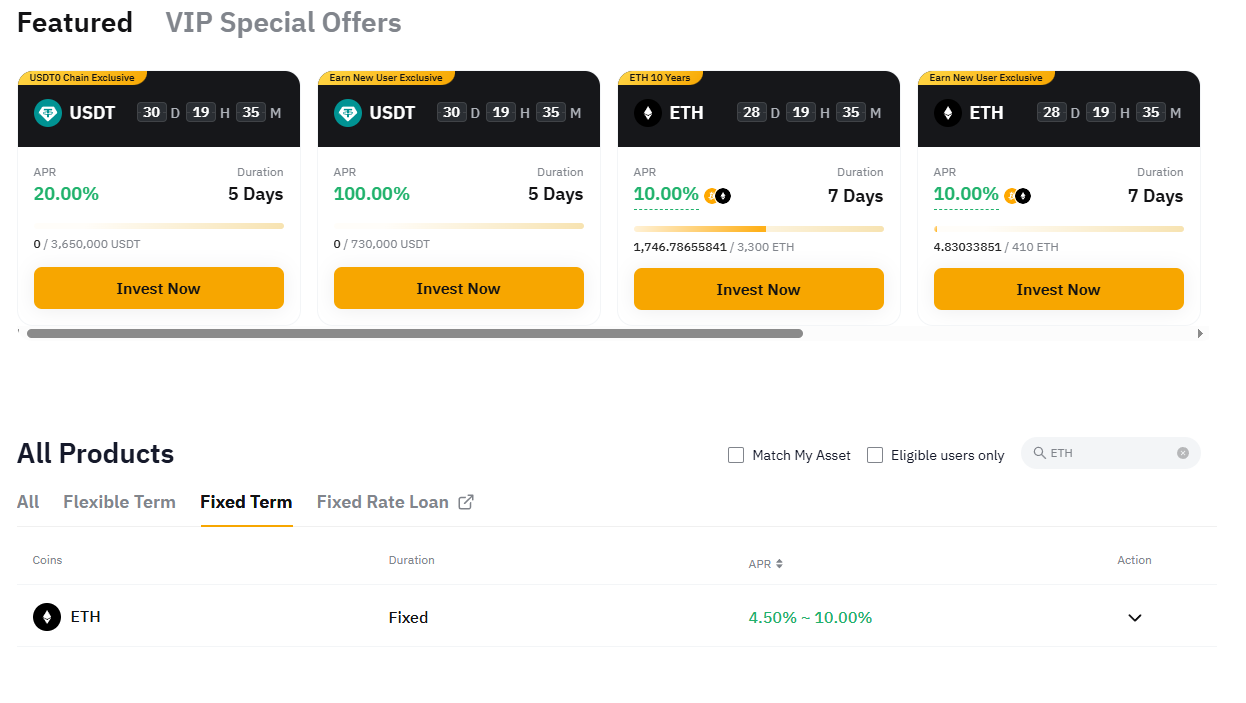

Staking and passive income

You can get a stable passive income for participation in confirmation transactions. The essence of staking is to buy and place tokens on the net. Profitability determines the bet size and the lock period. Competitive conditions are offered by ETH, ATOM, AVAX, SOL.

Exchanges can offer automatic staking. The format eliminates manual wallet settings or node launches. Terms frosts and the number of accruals depends on the chosen platform.

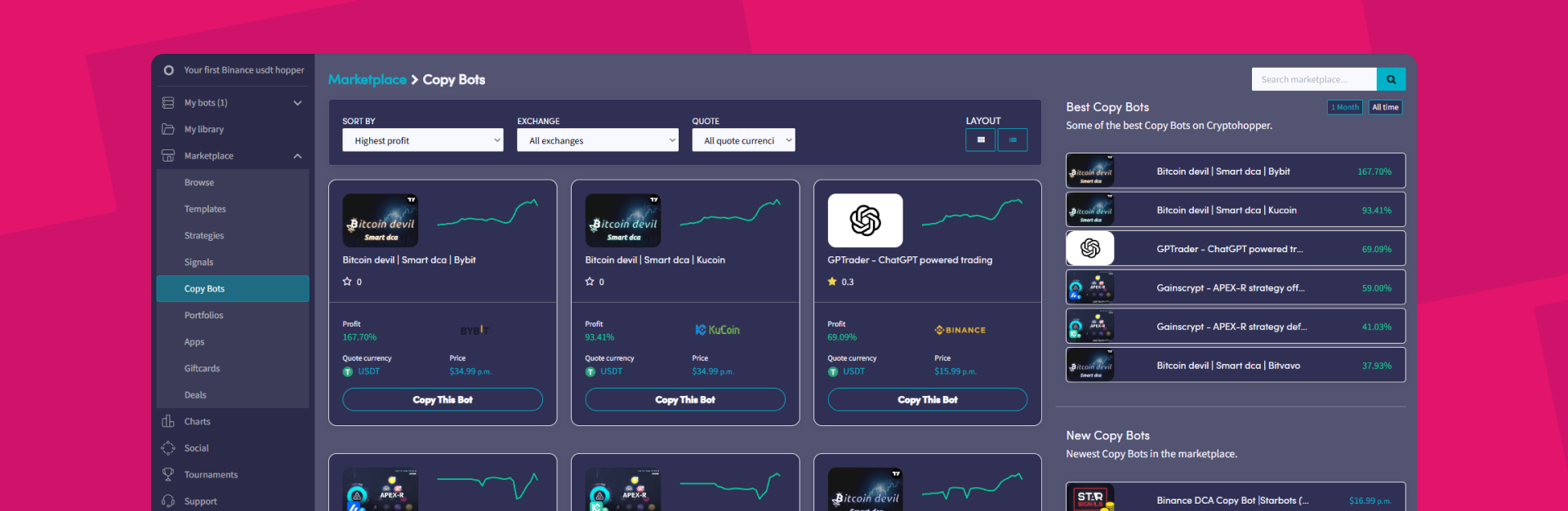

Cryptobots and automated trading

You can delegate operations on the crypto exchange to algorithms – trading bots. They sell and buy assets at specified strategies. Averaging, scalping, and arbitrage schemes are used. Bots operate around the clock. Popular platforms for automatic trading are 3Commas, Cryptohopper, Revenue Bot.

The user configures trading pairs, price step, transaction volume, limits. Some services provide ready-made templates, built-in signals, technical analysis tools.

How to Make Money on Crypto for a Beginner in 2025

Beginner traders quickly get used to the cryptocurrency market. The exchanges themselves help – they simplify the interfaces of sites and applications, add training sections and tips. The minimum entry amount is $10. Options for earning with minimal user participation appear: staking, automatic trading, lending.

How to start making money on cryptocurrency from scratch

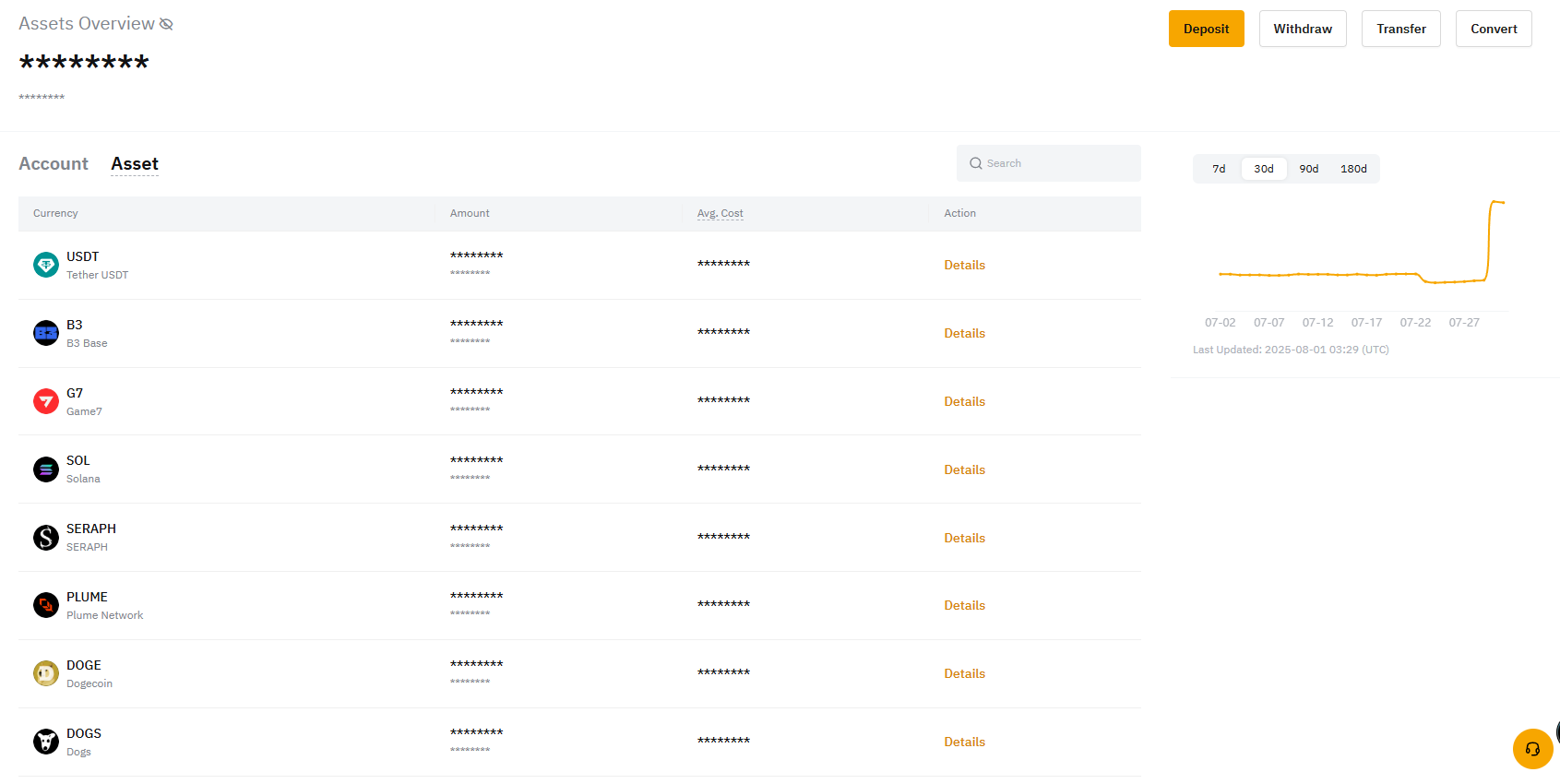

The first step is to choose a platform. Bybit, OKX, HTX, MEXC, KuCoin are suitable. Exchanges support P2P exchange.

The second and third steps are registration and identity verification. You need to specify your email, upload a photo of your passport, take a selfie with the document. After passing verification, access to trading, staking, P2P and other functions of the exchange open.

Step-by-step instructions

The start-up process at the largest centralized ones is usually similar. The sequence of actions is as follows.

- Registration. You need to fill out a short form - the user specifies an email address and password.

- Setting up your personal account. In the profile menu, you can set up two-factor authentication (2FA) for enhanced account protection, add a bank card for quick deposits and withdrawals.

- Verification. The exchange will ask you to confirm your identity with a scanned ID, a selfie, or utility bills. The minimum level of identity verification is enough to start trading and withdraw your earnings.

- Buying cryptocurrency. BTC, ETH, SOL can be purchased for fiat on the exchange or from users across P2P. The most common operation is the purchase of USDT. Stablecoin is the main means of payment on the market, it can be exchanged for almost any cryptocurrency on the exchange.

The next steps are related to the chosen method of earning: either the user actively trades on the spot or futures market, analyzes trends, follows the news; or freezes assets in staking; or connects a bot or copy trading.

Tips to Minimize Risks

The key principle is not to invest borrowed or last money. It is also a bad idea to invest all your capital in one cryptocurrency. The portfolio should be different assets: Bitcoin, altcoins, memecoins and stablecoins. Diversification will reduce the negative impact of volatility.

If we are talking about long-term investments in cryptocurrencies, it is better to store tokens in cold wallets. They are disconnected from the network - hackers will not gain access to other people's funds.

Before buying, you need to study the characteristics token and reliability of the project. When working with platforms – check the website address and log into your personal account only from the official page of the exchange.

Ways to Safely Store Cryptocurrency

Wallets for storing digital assets are divided into hot and cold. Hot ones are connected to the Internet and are suitable for regular transactions. These can be mobile applications, browser extensions, exchange accounts. Examples are Trust Wallet, Metamask, wallets on centralized platforms.

Cold wallets work offline and are used for long-term storage. These include, for example, Ledger and Trezor, which isolate access to private keys. They do not connect directly to the network and reduce the risk of hacking.

To prevent funds from disappearing from hot wallets, you need to set a complex password, enable two-factor authentication, and store the backup recovery phrase in a safe place.

The best ways with and without investments

You can earn money on cryptocurrency both with and without starting capital. The first method requires a deposit, the second - activity and time. Entry conditions depend on the instrument, the chosen platform, and the user's goals.

Airdrop

Free giveaway tokens for completed tasks: registration, subscription, testing services, participation in trading on decentralized platforms. An example is the ZKsync airdrop in January 2025.

To participate, you will need an account and a crypto wallet. Received tokens can be sold after listing. It is important to follow announcements and news.

Staking

Users post tokens in the network to keep it running. For this, they are awarded a reward. Profitability depends on the project, blocking period, provider. In 2025, the average values are:

- SOL – about 7.5%;

- ATOM – 14–20%;

- ETH – 3–5%.

Place asset scan be done through centralized exchanges Binance, OKX, Kraken or using DeFi wallets. Rewards are accrued daily or weekly. They offer to block funds for a fixed period, flexible - you can withdraw funds at any time, Launchpool - placing assets (for example, USDT or BNB) to receive new tokens.

Common mistakes of beginners

Inexperienced users lose money due to technical errors, lack of knowledge, and violations of rules. Most situations can be avoided - you need to follow simple rules.

Wrong choice of exchange and wallet

There are cases of blocking accounts without prior notice. Using unknown wallets increases the risk of phishing. Attackers can gain access to the seed phrase and withdraw funds. It is recommended to use proven ones for storage non-custodial solutions: MetaMask, Trust Wallet, Mycelium.

Ignoring security

One of the most common reasons for losing funds is a violation of account security rules. Risks are related to the lack of two-factor authentication (2FA), the use of simple or identical passwords on different sites, and storing data in the browser. Another critical error is the lack of a backup copy of the wallet recovery phrase.

Clicking on links from emails, messengers, and chats can lead to phishing attacks. Reliable platforms do not ask to transfer funds or provide codes - all operations are performed within the personal account.

How to choose a reliable crypto exchange

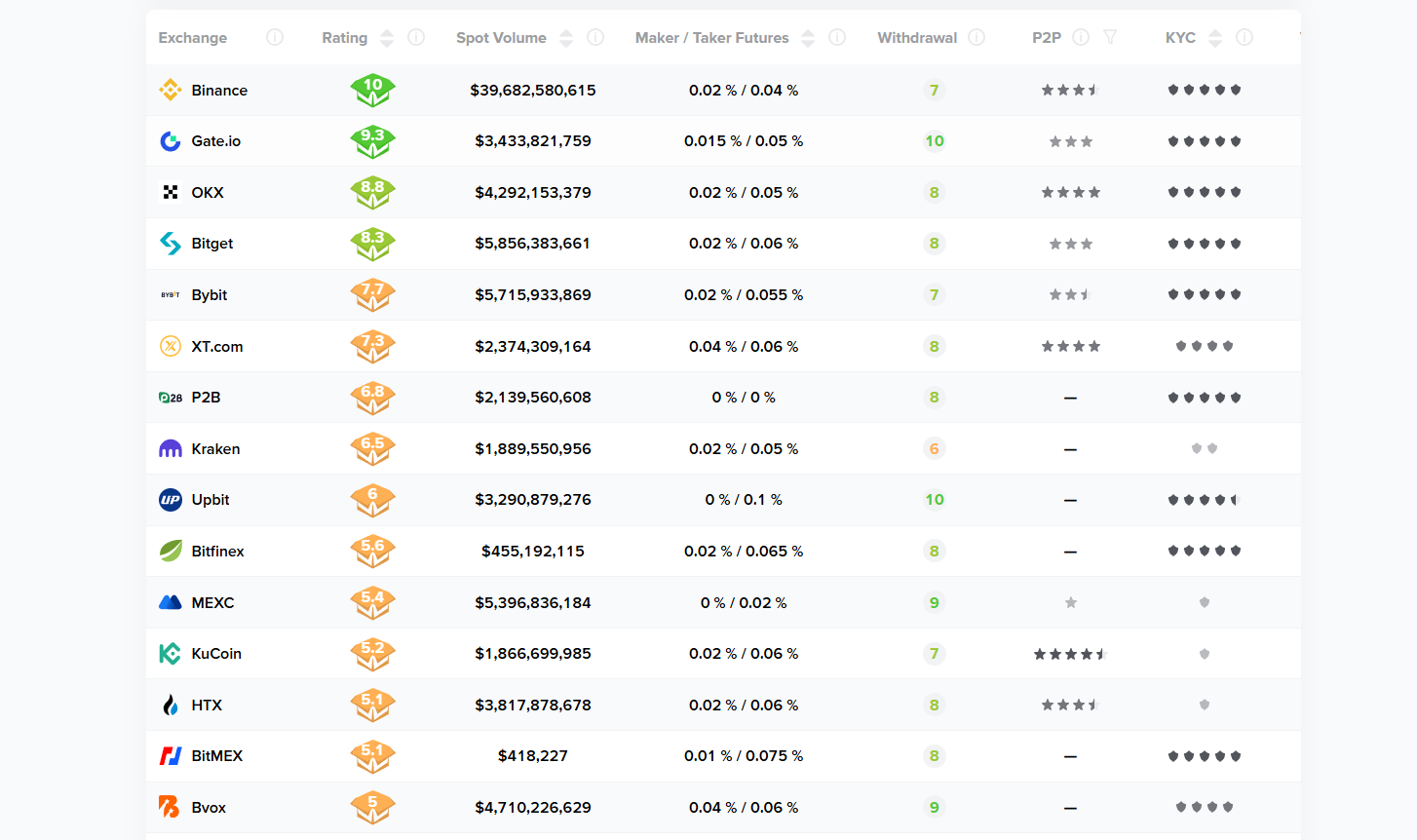

The exchange is an environment for buying, storing, and trading assets. The platform must be available in the country, have low transaction fees, support fiat currencies, popular trading instruments and security measures.

Highly competitive exchanges liquidity and optimal conditions:

- Bybit. One of the largest crypto platforms by trading volume. Supports P2P, spot, futures, options, margin trading with leverage up to x100.

- HTX (Huobi). Around 700 are traded tokens, there is access to spot, futures, P2P, bots, staking. Commissions – from 0.09%. The exchange is integrated with Trading View.

- OKX. Focuses on derivatives and futures. Can be used P2P, there is cold wallet protection, insurance fund. Commissions – from 0.08%.

- KuCoin. Supports trading via P2P, bots, futures (up to x75), Launchpad. Charges reduced commissions when paying at KCS.

- MEXC. Over 2300 trading pairs available. No mandatory verification. P2P trading, for trading individual pairs, commission not charged.

- Gate.io. More than 3800 assets are traded on the platform. You can buy tokens via P2P. Commissions make up from 0.1%. There is cold storage, volume bonuses and an insurance fund.

- Bitget. Supports copy trading with access to over 100,000 strategies. Clients trade spot and futures contracts.

- BingX. Platform social trading. You can copy the trades of experienced traders, use ready-made strategies.

The reliability of the exchange can be checked by the trading volume, reputation, reviews, availability of licenses. Safe platforms provide instructions, 24/7 technical support, tools for protecting funds and data.

Conclusion

We talked about how to make money on crypto exchange platforms. In 2025, cryptocurrency is a promising financial instrument for generating income. Users have access to spot trading, staking, airdrop campaigns, and automatic strategies. Exchanges have simplified interfaces and support unlimited P2P input. To reduce risks, it is important to undergo verification, enable 2FA and use cold wallets to store part of the funds. The choice of approach depends on the goals, amount, level of preparation.