Altrady offers crypto traders the opportunity to automate trading. Designed to meet the needs of both beginners and experienced users, the platform uses smart orders and market scanners.

Does the service help to increase trading efficiency? How much does the service cost? Let's find out.

What is Altrady?

Altrady is a crypto platform for automated crypto trading. For algorithmic trading the service offers built-in bots for Signal, DCA, Grid and QFL strategies. It also supports the functionality of the trading terminal with advanced settings orders. Users can connect to fifteen spot and futures exchanges. All assets are managed in a single interface.

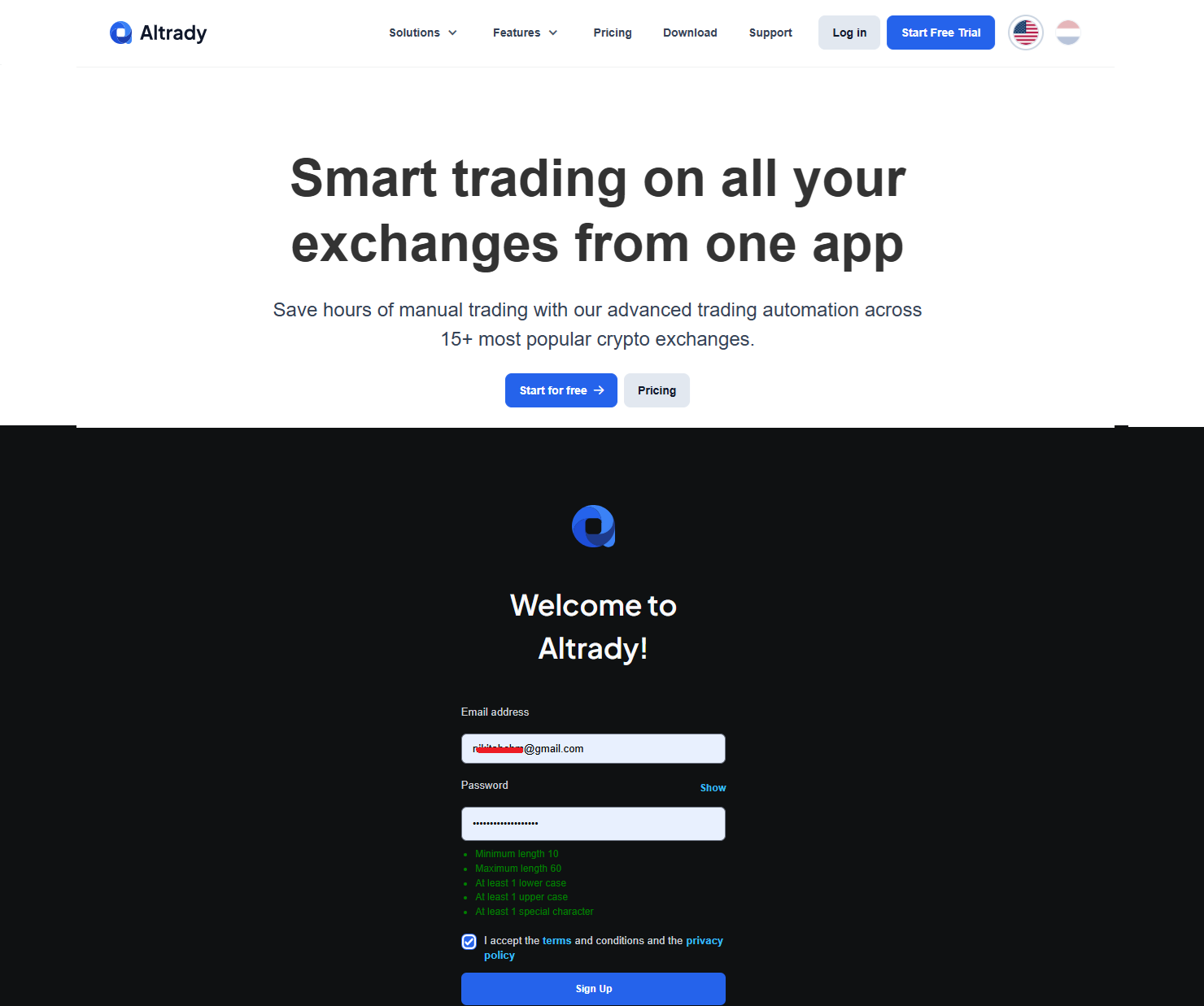

Step-by-step registration on the Altrady platform

Only registered users can work with Altrady. An account is created in several steps.

- Open the official website of the platform.

- Click “Start Free Trial” (top right).

- Enter your email.

- Create a password (at least ten characters with letters of different upper and lower case and special symbols).

- Click “Sign Up”.

Confirm registration: follow the link that will be sent in the email.

After registration, the user will be offered the chance to watch. The videos talk about the capabilities of the service and give recommendations on setting up account.

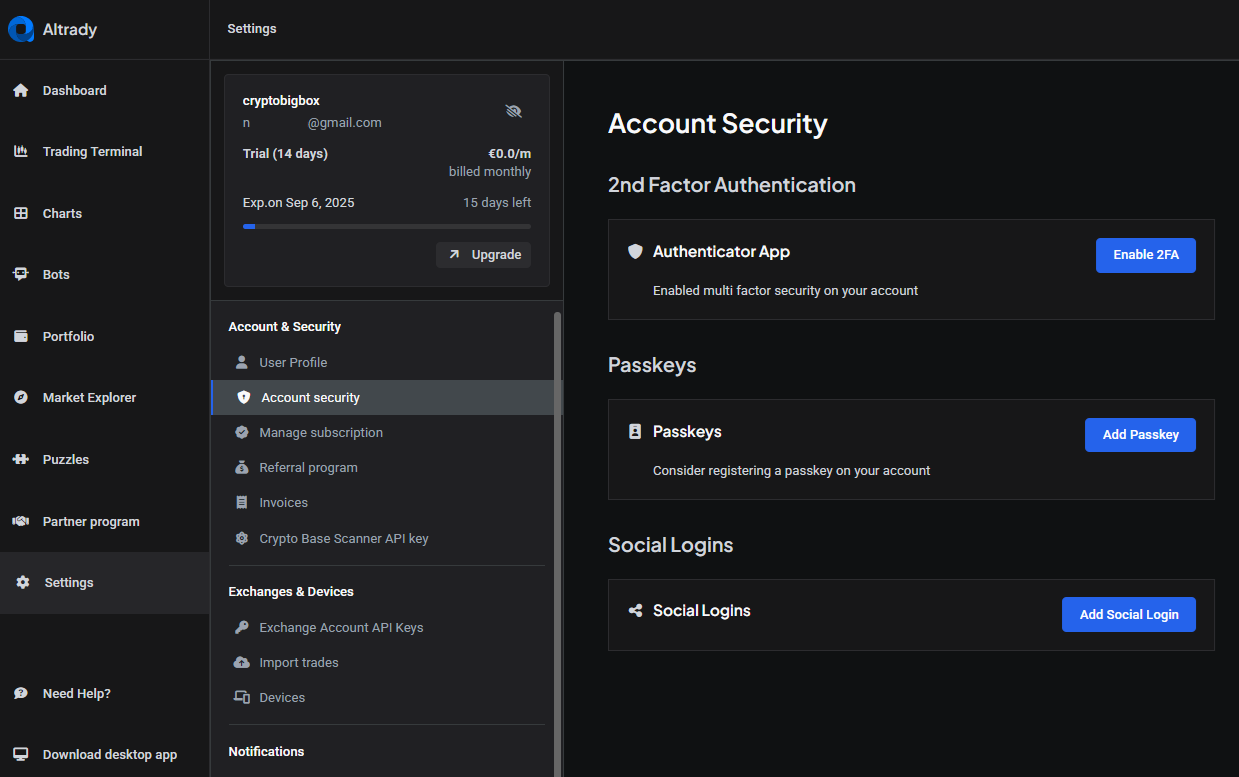

Security is a priority. It is mandatory to install two-factor authentication (2FA). This is how it is done:

- Open the “Settings” section in the account window.

- Select “Security Account”.

- Click “Enable 2FA”.

Enable two-factor authentication using Google Authenticator.

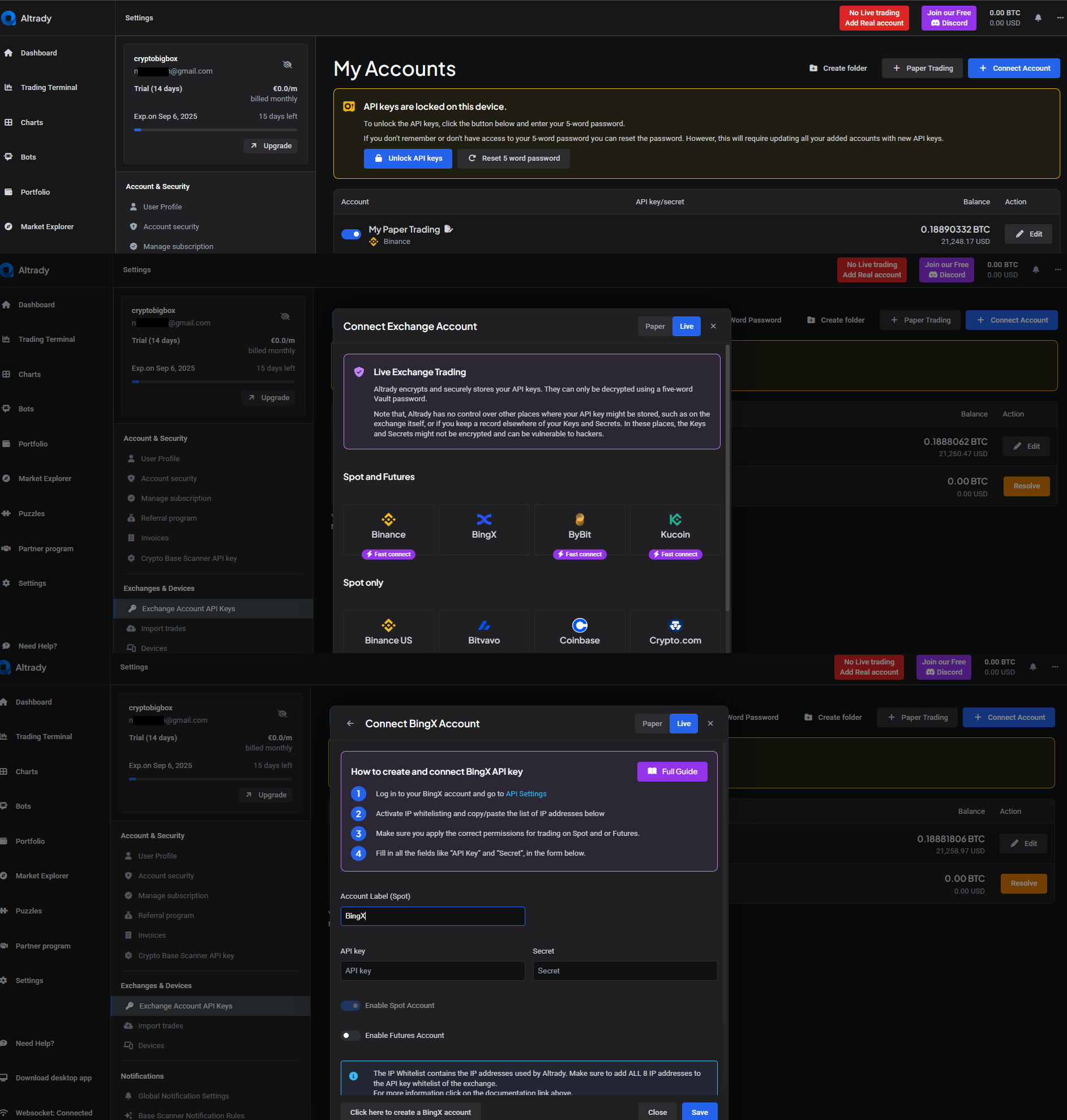

Next, you need to connect your Altrady account to to a cryptocurrency exchange. First, create API keys on the exchange and copy them to your Altrady account.

- Click “Settings” and then “Exchange Account API Keys”.

- Click “Add API Key”.

- Select a crypto exchange.

Copy the API key and Secret key on the exchange and paste them into the empty lines of the new window in your Altrady account.

You can also customize your workspace:

- add trading pairs to favorites;

- tune widgets for market alerts, orders, on-chain metrics.

Tools

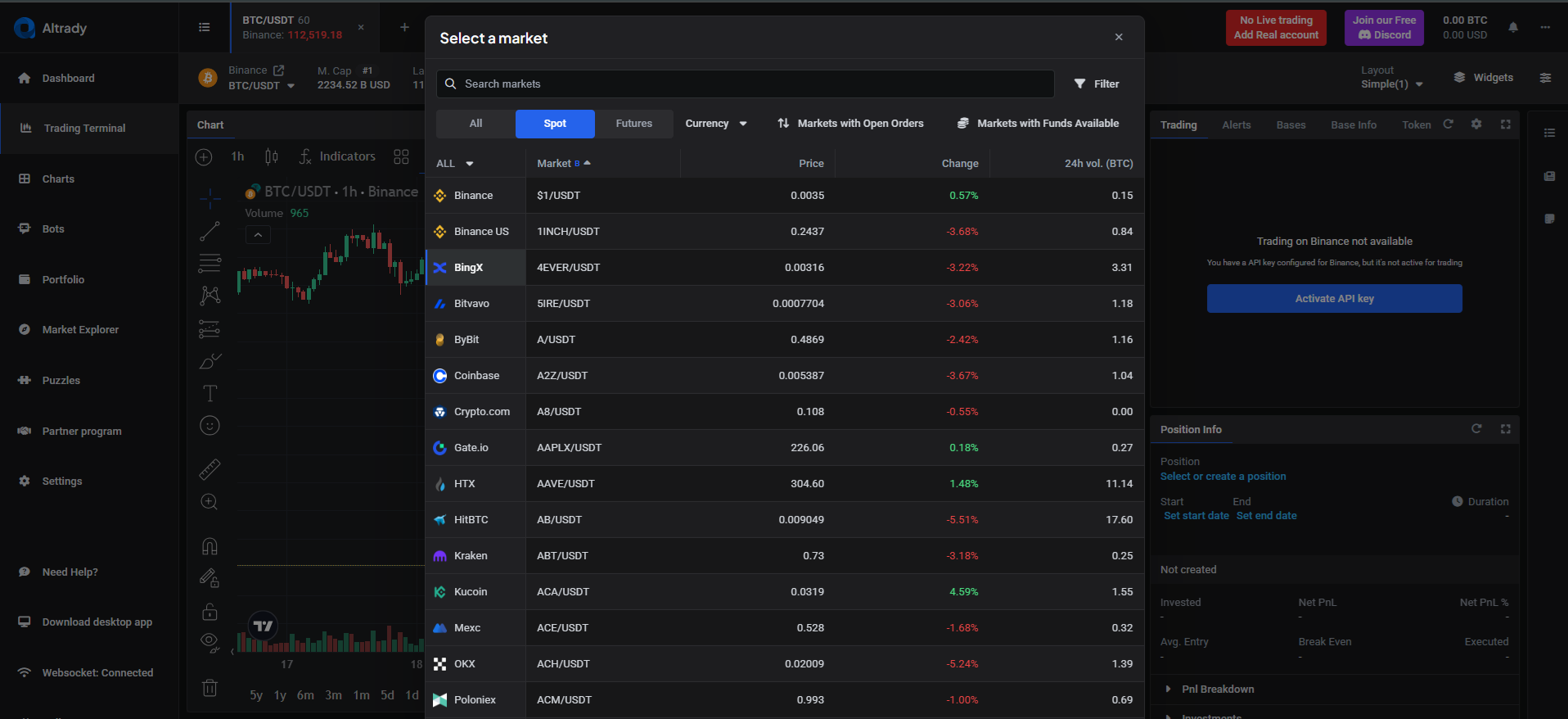

The platform contains five tools: Multi Exchange, Trading Terminal, Charts, Market Explorer, Portfolio. Let's look at each in more detail.

Multi Exchange

General module of the platform terminal. Allows you to connect exchanges and manage them and trade simultaneously on several platforms.

It can:

- open, close positions and orders;

- synchronize balances tokens;

- use trading instruments for all connected accounts.

Trading Terminal

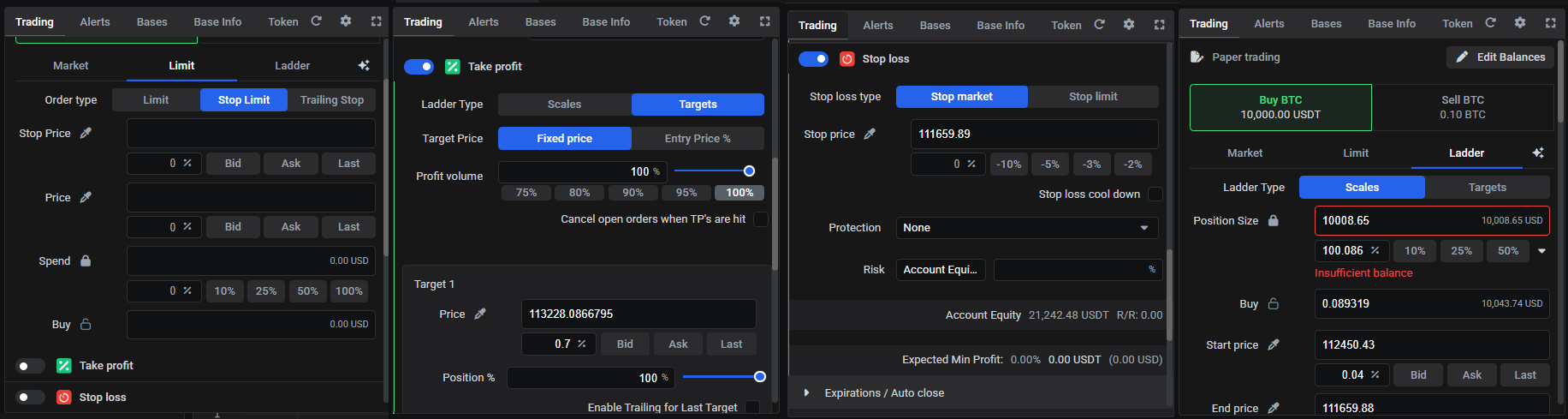

In the terminal, the user makes transactions - manually and automatically. It is possible to work with different orders:

- limit and market;

- OCO (One-Cancels-Other) – automatic cancellation of one order when another is executed;

- take profit – to fix profit for each order;

- stop loss – to minimize losses;

- trailing stop – dynamic movement of stop loss when the price rises coins;

- grid orders – mass transactions with a specified step.

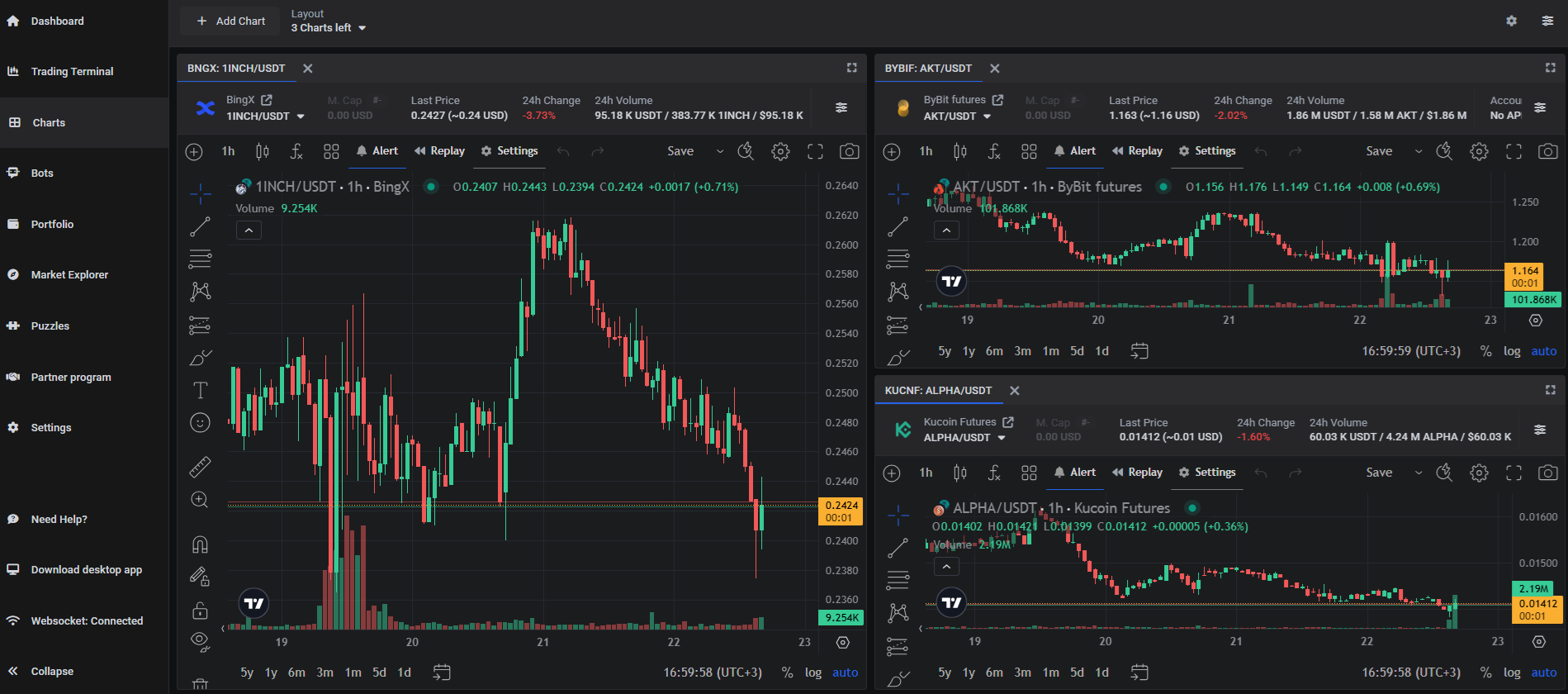

Charts

Allows you to connect charts of different trading pairs with personalized settings. Altrady is integrated with TradingView. The introduction of professional technical analysis tools allows you to:

- Tune indicators MACD, RSI, Bollinger Bands;

- Mark support and resistance levels;

- Analyze volumes and candlestick patterns.

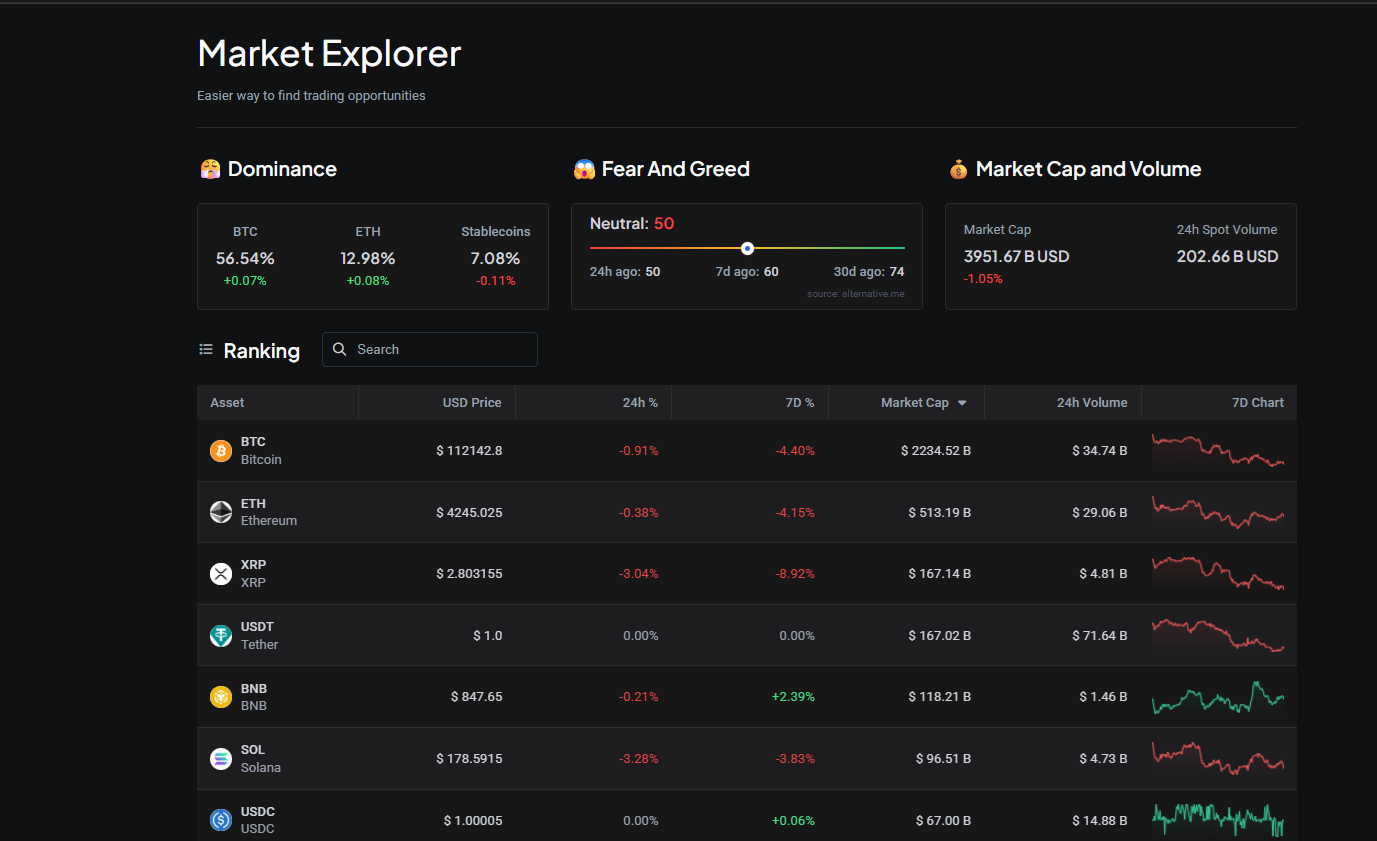

Market Explorer

Helps to find promising tokens for trade. Includes features:

- filters by liquidity, volatility, volumes;

- tracking trends and abnormal activity;

- notifications about sharp changes in the price of an asset.

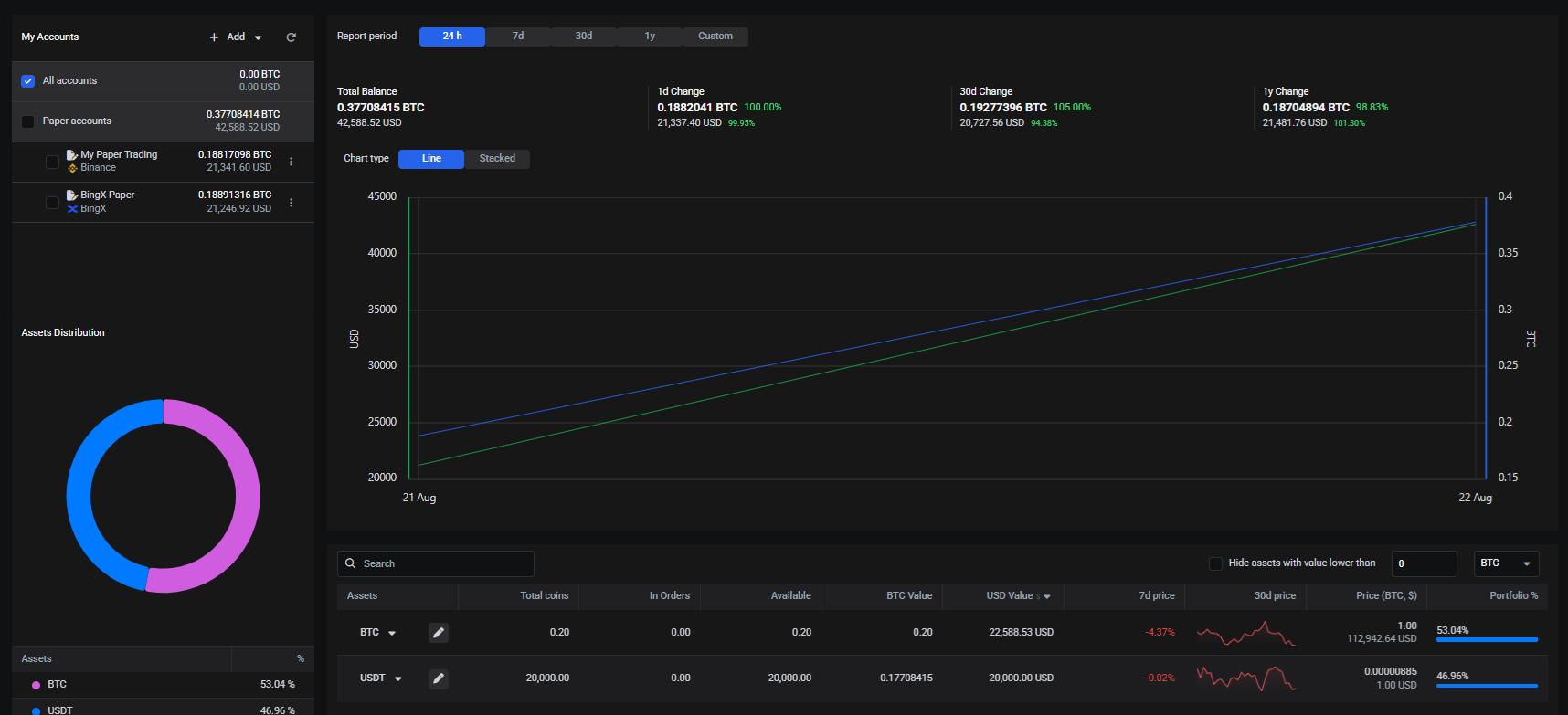

Portfolio

Allows you to track statistics of traders' portfolios. In one window - data from all connected exchanges:

- balances in BTC, USDT, and other cryptocurrencies;

- transaction history with filters by date and exchange;

- profitability and asset allocation analysis.

In Portfolio you can connect both exchanges and cryptocurrency wallets.

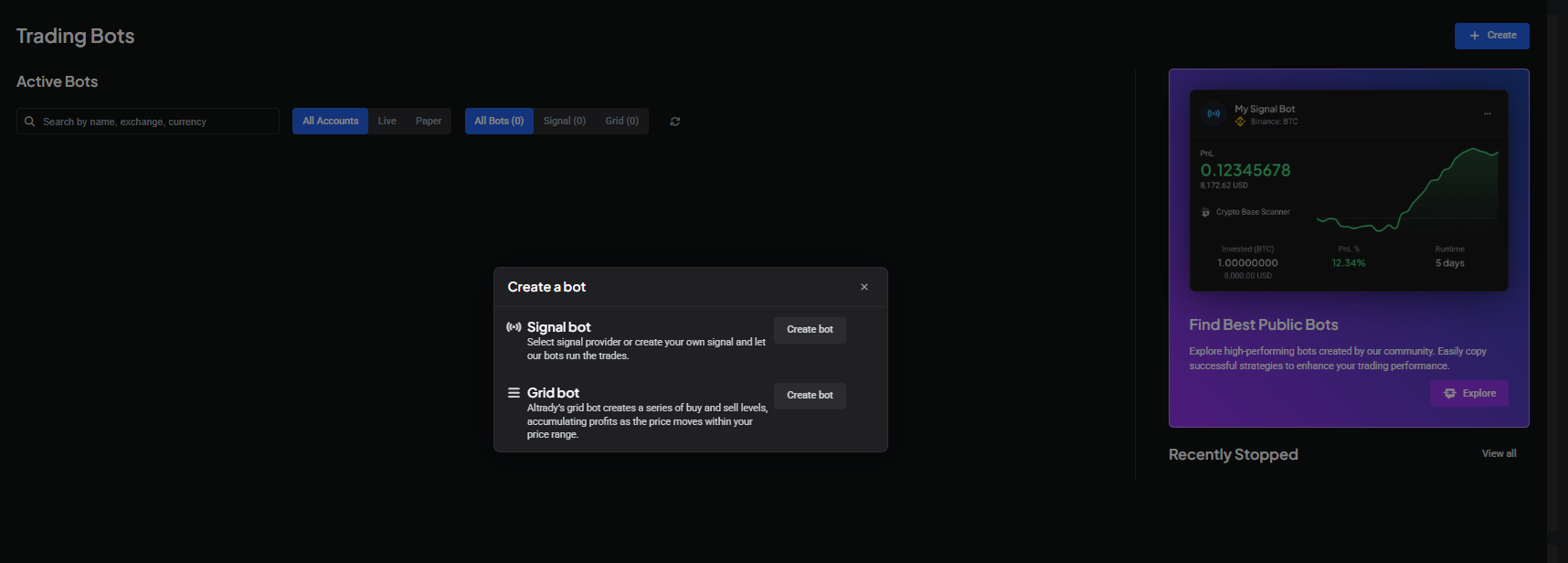

Bots for automated trading Altrady

Altrady’s cryptocurrency trading automation tools are trading bots. They are divided into several types.

Signal bot

Trade based on recommendations. Bot integrated with the platform's internal scanners: Crypto Base Scanner (CBS), The Better Traders, Fox Signals. In fact, these are signal providers.

Altrady signal-based strategies can be connected using Webhooks. Signals can also come from third-party sources (for example, TradingView – based on technical indicators).

Peculiarities:

- Setting filters by volume, volatility, trend indicators;

- Checking signals for three or more technical indicators;

- Automatic calculation of the position as a percentage of the deposit;

- Waiting for signal confirmation (candle closing price/level breakthrough).

Grid bot

Designed for grid trading, mainly during sideways market movements.

Peculiarities:

- automatic range expansion/contraction when levels are reached;

- increasing the volume of the Martingale transaction when the market moves against the position;

- fixing profit on a take profit order when the specified yield value is reached.

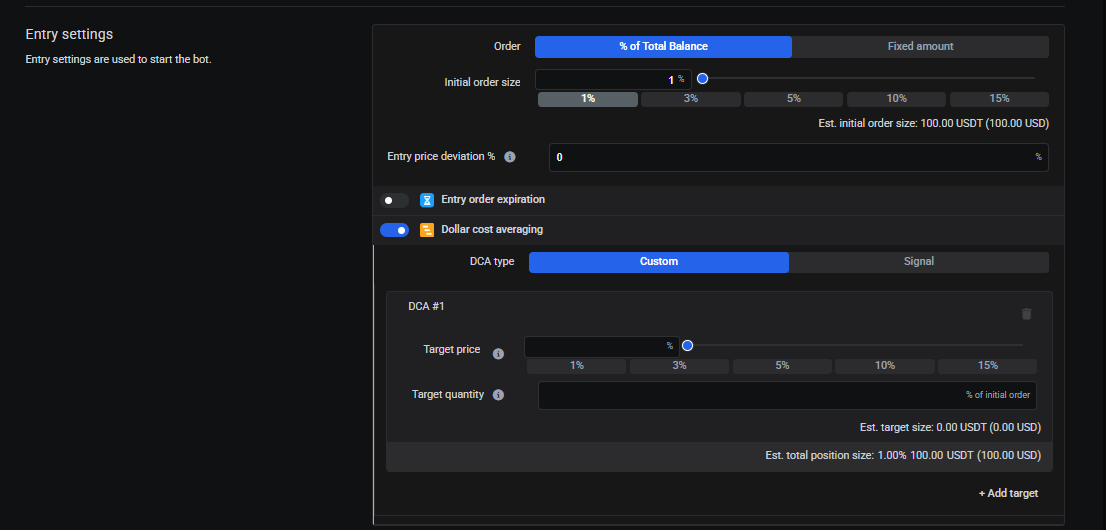

DCA bot

Strategy to average the trader's positions when the rate falls cryptocurrencies. Bot automatically makes purchases according to specified parameters to obtain more tokens.

To activate the mode, you need to launch and set the parameters of the signal strategy: click on the slider in settings Signal Bot parameters.

QFL-model

Allows you to make trades based on specified parameters at support or resistance levels.

Automation of trading processes

To enable automated trading, the platform integrates Smart Trading, Trading Presets, Positions with PnL functions. Now in more detail.

Smart Trading

Intelligent order execution. The mechanism allows to minimize manual operations with orders and reduce emotional stress when trading.

Peculiarities:

- you can create cascading Take-Profit and Stop-Loss orders;

- automatic calculation of profit-taking levels based on the ATR (Average True Range) indicator;

- dynamic adjustment of orders when volatility changes market;

- trailing stop with adaptive parameters;

- setting trailing order step in percentage or absolute values;

- setting support or resistance levels;

- automatic activation of orders when the specified transaction parameter is reached;

- paired placement of OCO (One-Cancels-Other) orders;

- integration with technical indicators;

- visualization of active orders on the chart in real time.

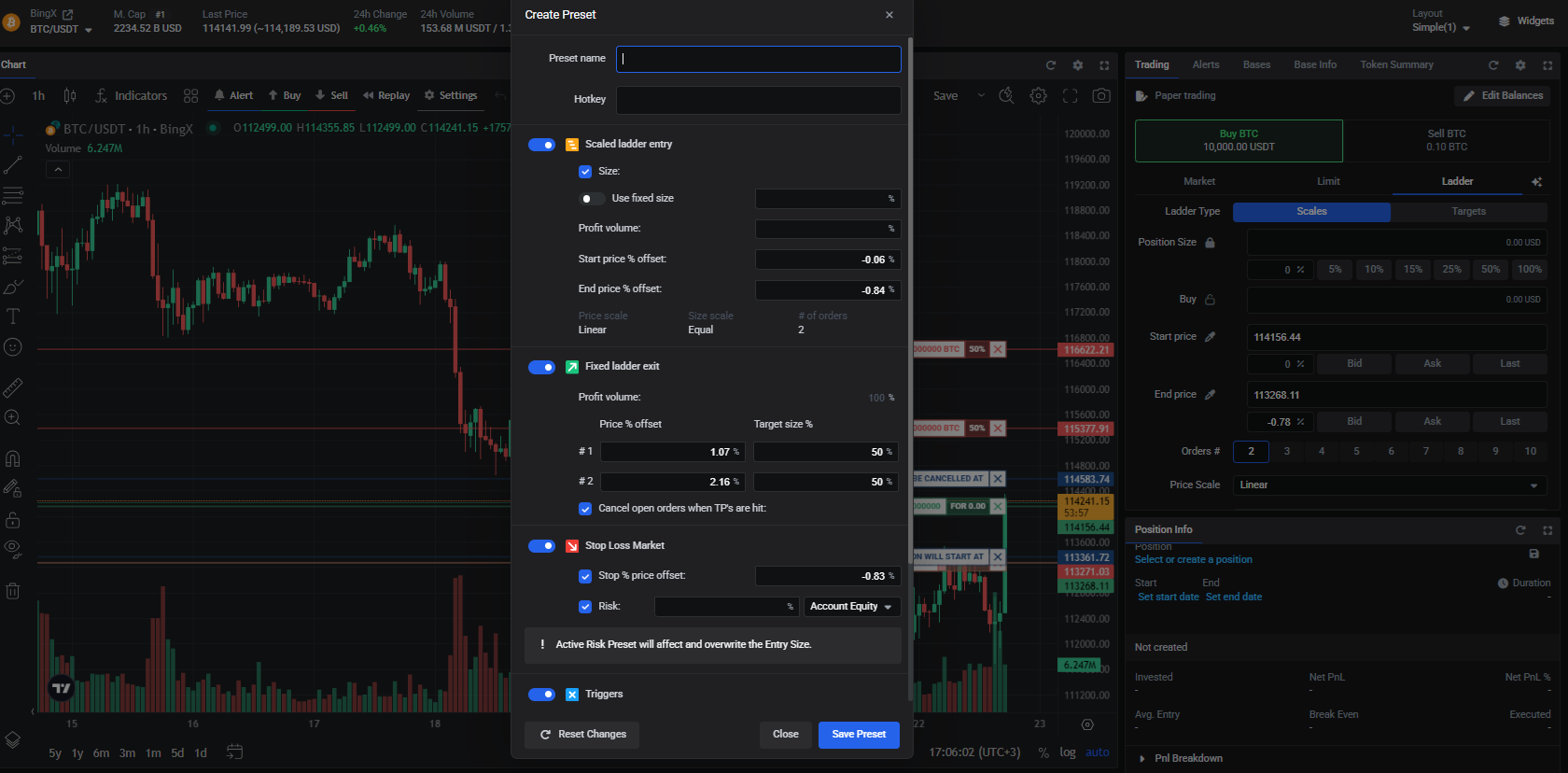

Trading Presets

Templates for quick deployment of strategies. The user can pre-configure and add a ready-made algorithm to the library is the increasing the speed of order placement.

Possibilities:

- Сreating templates for any type trade;

- Switching presets between exchange accounts;

- Automatic selection of order parameters depending on the asset volatility;

- Integration with Risk-Reward calculator;

- Setting up hotkeys to instantly launch a preset.

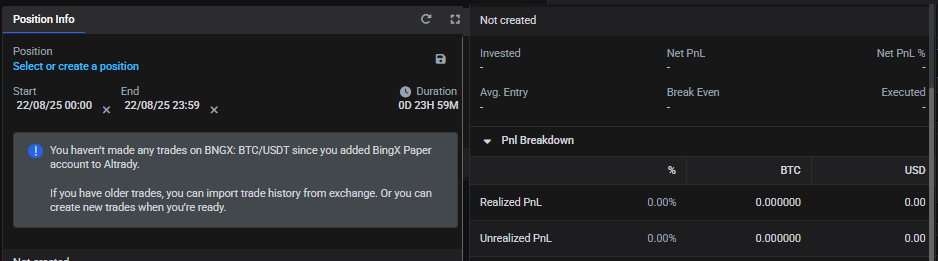

Positions with PnL

Real-time position monitoring. Detailed analytics displayed in the terminal. The tool automatically processes and calculates the trader's positions.

Possibilities:

- calculation of unrealized PnL taking into account exchange commissions;

- profit/loss displayed in percentages and absolute values;

- visualization of break-even zones;

- warnings when drawdown limits are exceeded;

- comparison of current position with historical data;

- data export for on-chain analysis.

Paper Trading - Altrady Demo Mode

Altrady provides two weeks of free access. During this time, you can test strategies in the Paper Trading demo mode. The function completely imitates real market conditions.

Peculiarities:

- real market data with minimal delay;

- modeling extreme market conditions;

- tips, training, recommendations;

- testing different types of orders.

For experienced traders, the demo mode helps optimize strategies, test new approaches in a safe environment, and calibrate bot parameters.

Creating a demo "Paper" account in Altrady

“Paper” account or demo mode can be connected immediately after registration. To do this you need:

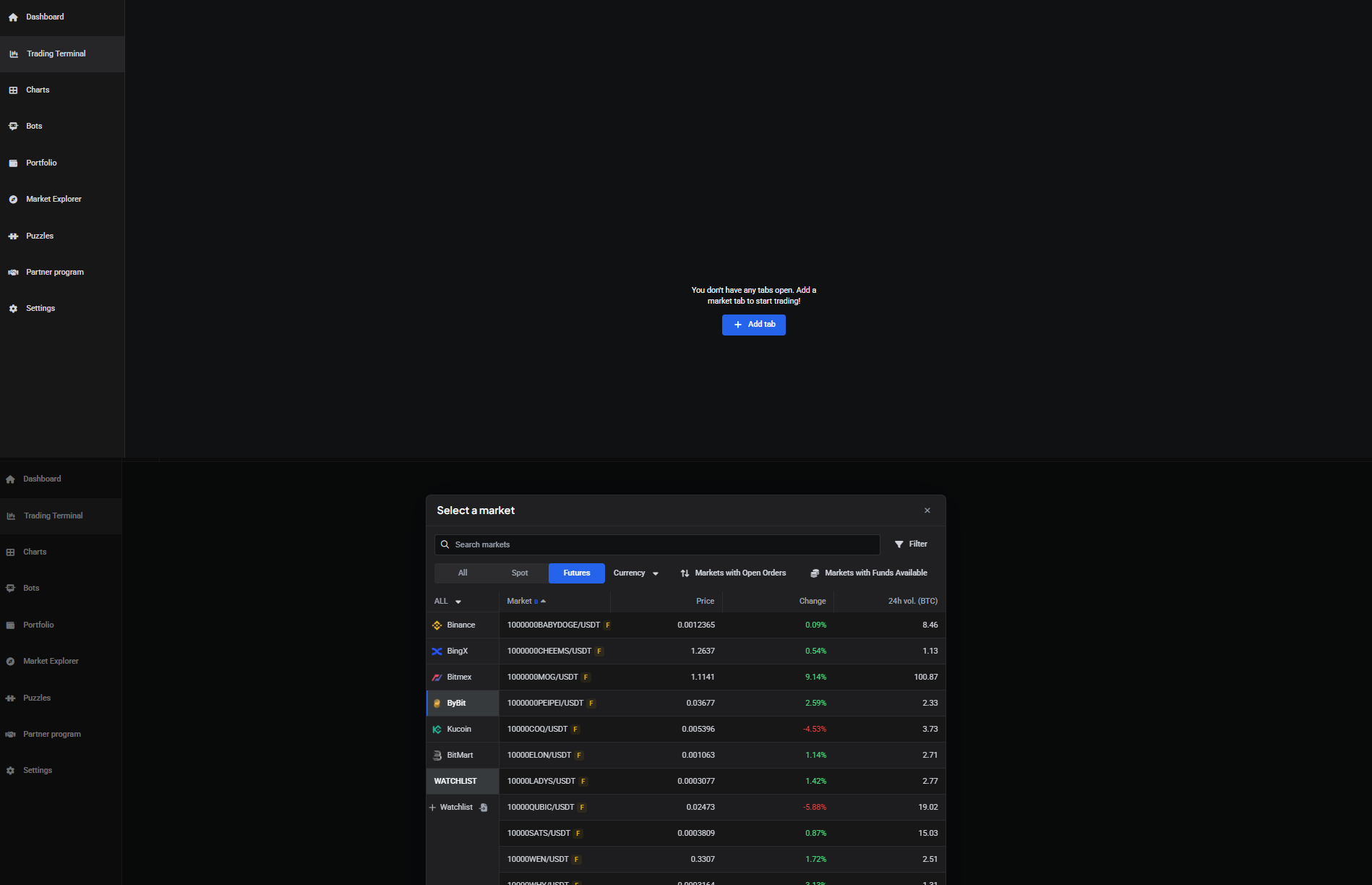

- Go to the Altrady trading terminal.

- Click “Add Tab”.

Select a cryptocurrency exchange and token.

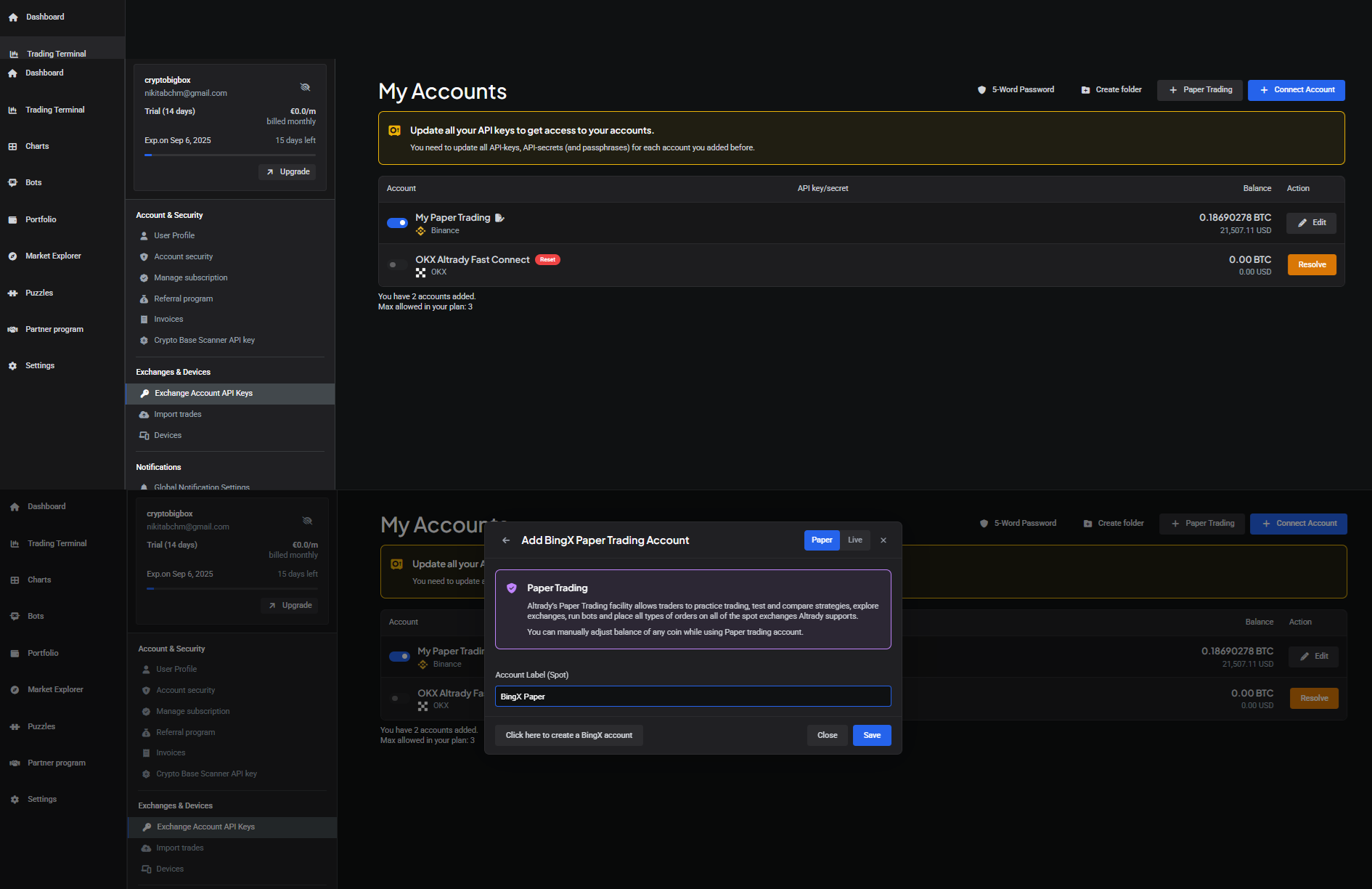

To start trading in demo mode, you need to create an account. The steps are as follows.

- Open account settings.

- Click “Exchange Account API Keys”.

- Click “+ Paper Trading”.

- Select an exchange from the list of available ones (the platform will automatically insert the name of the previously selected trading platform).

Save settings.

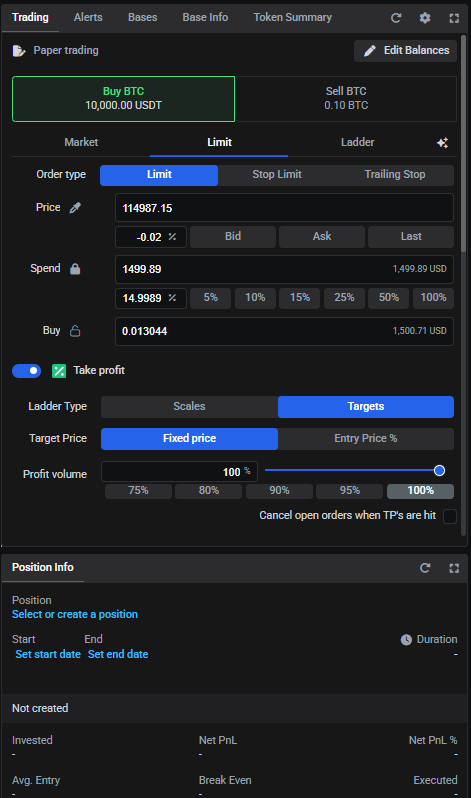

Placing orders

After creating an account and connecting the exchange, you can start trade. In interface the terminal interface offers several modes of purchase and sale cryptocurrency:

- Market – for placing transactions at current market prices;

- Limit – for placing transactions at the specified price value;

- Ladder – for placing a grid or several orders with detailed settings.

More detailed settings are also available in the terminal: stop loss, take profit, trailing stop.

To place a buy order crypto, need to:

- Select a trading pair (BTC\USDT, etc.);

- Click “BUY BTC”;

- Enter the purchase amount in BTC;

- If necessary, set up the order type and configure other parameters (limits, stop-loss, take-profit, trailing, etc.);

Click “Place Order”.

Below the terminal, the trader can see details about completed transactions, open and closed positions, and set alerts.

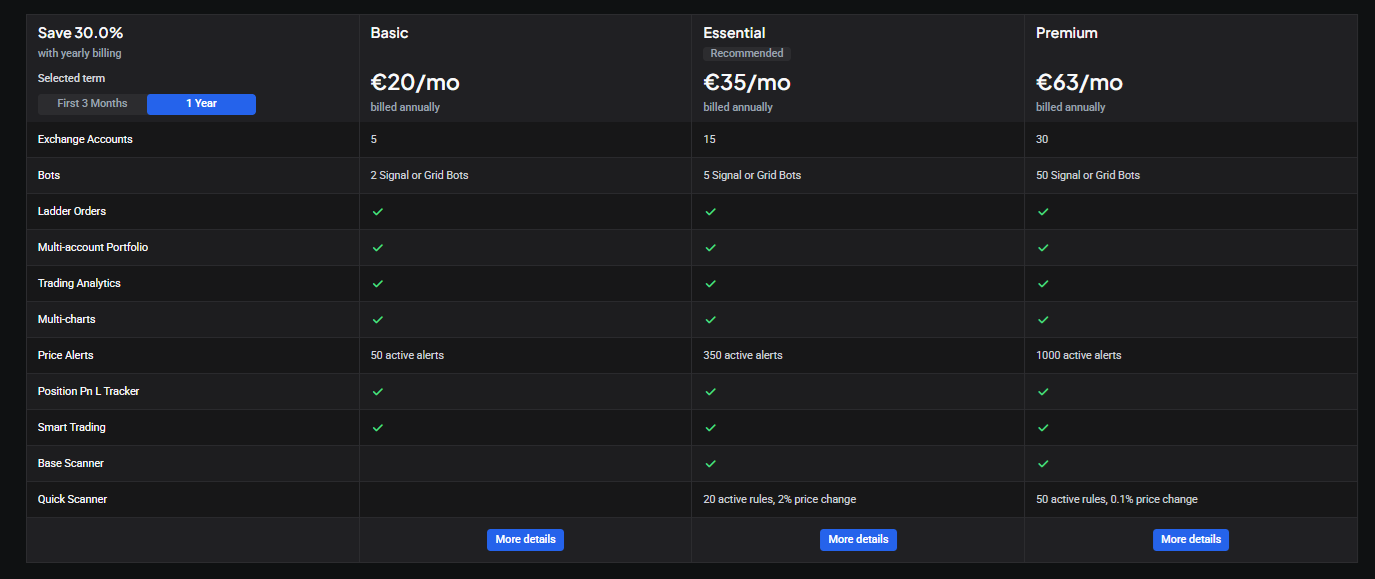

Altrady Tariff Plans

Altrady offers three plans, paid for in three months or a year. The annual subscription gives a 30 percent discount.

Basic: 28 EUR/month.

- Access to two bots:

- Signal or Grid;

- 5 connected exchange accounts;

- 50 active alerts;

- Basic terminal with Smart Trading.

Essential: 50 EUR/month.

- 5 active bots of any type;

- 15 connected crypto exchange accounts;

- Access to Quick Scanner;

- 350 active alerts.

Premium: 90 EUR/month.

- 50 active bots (Signal, Grid);

- 30 exchange accounts;

- 1000 active alerts;

- Priority technical support;

API for your own developments.

You can pay for your Altrady subscription using Visa and Mastercard bank cards, as well as cryptocurrency (BTC, ETH, altcoins).

Conclusion

Altrady is a crypto trading platform for automated trade, combining a multi-exchange terminal, algorithmic bots, advanced analytics. The platform can be useful for professional traders working with complex strategies and a large portfolio of digital assets. The optimal scenario for using Altrady is an active trade on several exchanges with a large deposit. In such a situation, the fee for automation and deep analytics quickly pays for itself.