Pionex is a hybrid cryptocurrency exchange, launched in 2019. The platform focuses on active traders, investors, combining the functions of classical trading and advanced tools for trading automation.

In this article, we will take a closer look at what bots Pionex offers, the key advantages and capabilities of the exchange, and how to set up the Pionex Grid Trading bot.

What is Pionex in crypto?

Pionex is a hybrid trading platform for trading digital assets, such as Bitcoin, Ethereum, Tron and other altcoins of the crypto market. In addition, the platform interface is integrated trading bots, which allow you to automate trading strategies without having to write code or use third-party programs. The platform combines the functionality of spot and futures trading, and also supports margin trade.

One of the main advantages of Pionex is low commissions (from 0.05% for spot transactions), which makes it attractive for crypto traders. Unlike alternative services, Pionex provides access to bots for free. The platform claims a high level of security and the use of cold wallets to store users' funds. After creating an account, the platform requires mandatory two-factor authentication (2FA) setup.

Step-by-step registration and Pionex verification

To create an account on Pionex, you need:

- Go to the official Pionex website;

- Press «Registration»;

- Choose a convenient method, for example, «Sign Up with Email»;

- Enter your email address;

- Create a strong password;

- Enter the confirmation code that will be sent to your email;

Press «Confirm».

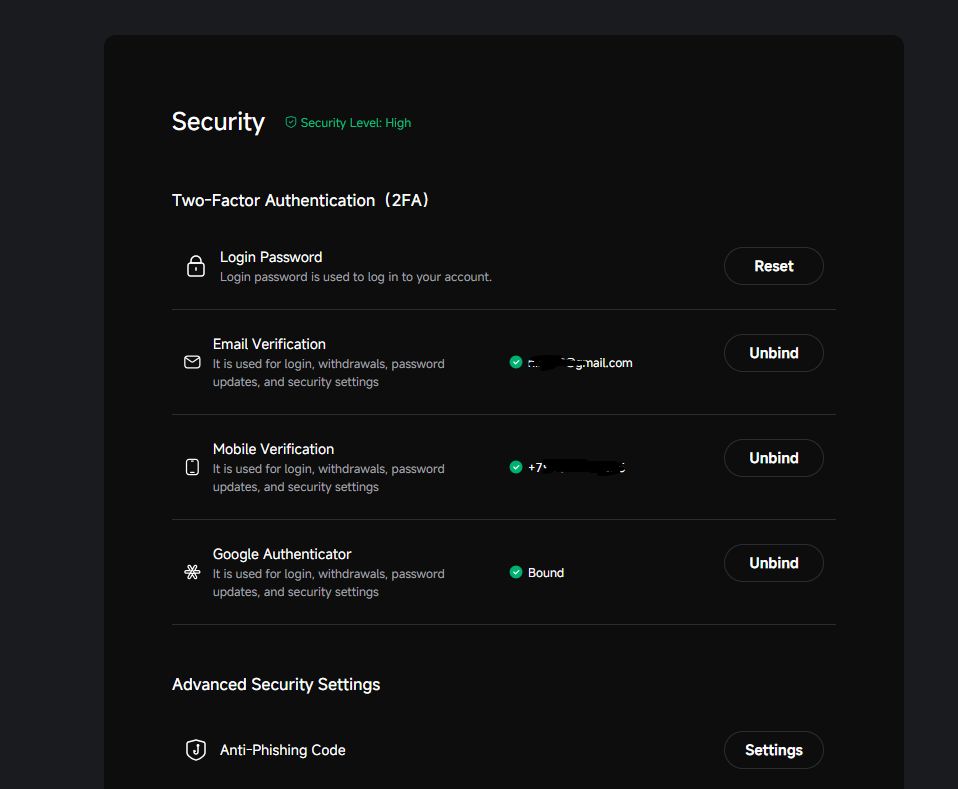

After creating a Pionex account, you should go to the section «Safety» and be sure to link your phone number and enable two-factor authentication via Google Authenticator.

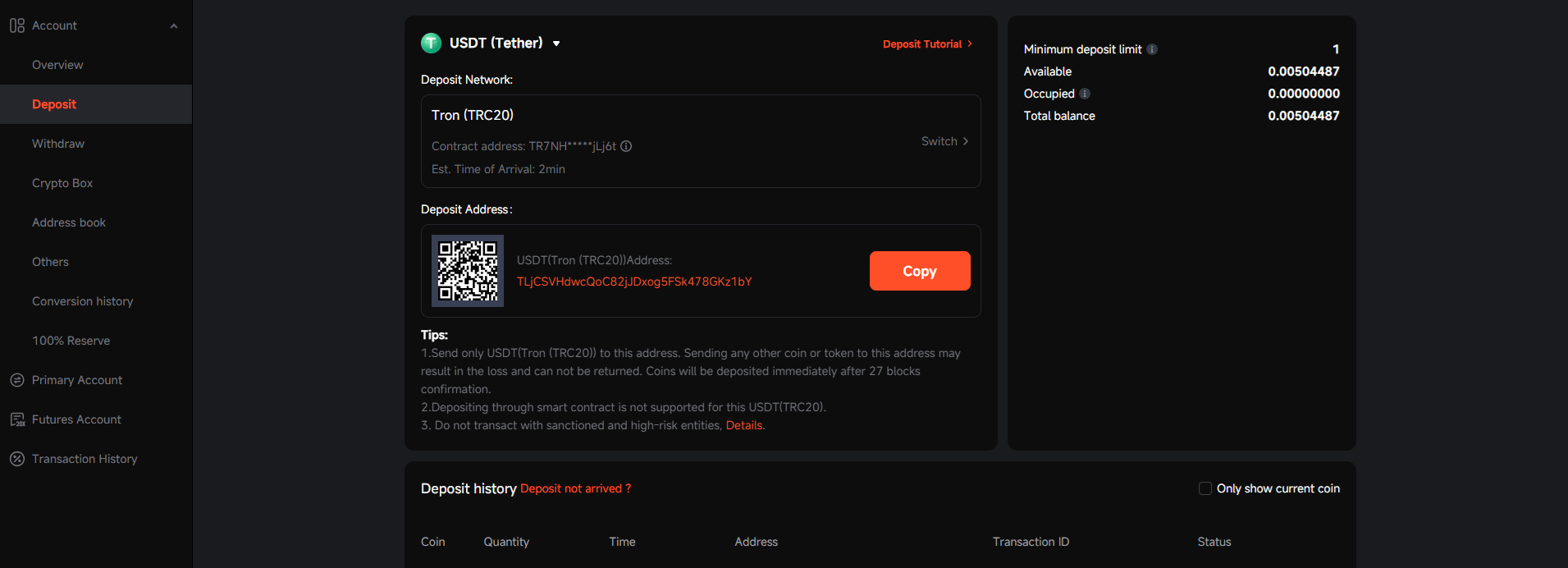

To top up your Pionex account, you need to:

- Go to section «Dashboard»;

- Log in «Deposit», copy the wallet address from the desired one crypto;

Top up your wallet, for example in USDT TRC20.

To fund your Pionex account, you can use either your own crypto wallet (with USDT) or exchange fiat funds via P2P platforms, exchange services, etc.

After creating an account, you need to pass KYC verification. To do this, you need to:

- Go to the KYC section;

- Press «Verify»;

- Select your country of residence;

- Enter your first and last name;

- Press «Send»;

At this stage, the account will receive a verification level.

To get full level 2 verification, you need to send a photo of your passport and take a selfie.

Types of trading bots Pionex

Platform offers a wide range of bots for trade crypto:

Grid bot

Grid bot is one of the most popular strategies for automation trading on Pionex. Algorithm works on the principle of creating a grid of orders in a given price range, automatically making purchases at the lower limits and sales at the upper ones.

Key features of Grid Bot:

- Optimal strategy for trading during a sideways trend (flat), when the price fluctuates within a narrow range.

Configurable parameters:

- Upper and lower boundaries;

- Number of orders;

- Grid step.

Grid bot in Pionex allows you to apply modifications with credit shoulder (Leveraged Grid) to increase profit potential.

How it works algorithm:

- User sets a price corridor (for example, for BTC $100,000 - $105,000);

- The bot evenly distributes buy and sell orders within this range;

- When the price reaches each level, the corresponding orders are automatically executed;

- The process repeats cyclically, securing profits from multiple small transactions.

The advantage of this strategy is its effectiveness in volatile markets. However, it is important to remember that with a strong trend (a sharp rise or fall in price beyond the grid), the effectiveness of the bot decreases.

DCA bot – a strategy model with averaging

The DCA (Dollar Cost Averaging) bot implements a position-averaging strategy, which is especially popular among long-term investors. This approach helps minimize risks associated with crypto market volatility.

How the DCA strategy works:

- The order amount is divided into multiple parts;

- The asset is purchased at regular intervals;

- The average purchase price is leveling off.

DCA bot settings in Pionex:

- Possibility of choosing time intervals;

- Customize each position’s size;

- Automatic calculation of optimal entry points

- Integration with stop-loss and take-profit orders.

Advantages of the strategy:

- Reduces psychological pressure on traders;

- Helps avoid poorly timed single entries;

- Particularly effective for long-term investments;

- Minimizes the impact of short-term volatility.

TWAP (Time Weighted Average Price) bot

TWAP bot is a professional tool for large traders and institutional investors. The Algorithm is designed to execute large orders with minimal impact on the market price.

Features of the TWAP strategy:

- Splitting a large order into many smaller ones;

- Even distribution of transactions over time;

- Automatic adaptation to current market liquidity;

- Minimizes market impact (slippage).

Using TWAP bot:

- Large investors use it to accumulate/distribute positions;

- Arbitrage strategies between exchanges;

- Rebalancing crypto portfolios.

Advantages of TWAP on Pionex:

- Flexible settings of time intervals;

- Possibility of combining with other strategies;

- Professional tools for order execution analysis.

TWAP is especially useful when dealing with low-liquidity assets or when you need to make a large trade without significantly affecting the market price. Unlike simple bots, TWAP takes into account not only price parameters, but also time factors, which makes it extremely effective tool for experienced traders.

Smart Trade – for risk management

Smart Trade is a professional Pionex tool, which combines the functions of a manual trade and elements automation execution of orders. It helps traders control risks and reduce emotional decision-making.

Key features of Smart Trade:

- Possibility of exhibiting trailing stop with automatic adjustment;

- Simultaneous setting of take profit and stop loss orders;

- Possibility of partial closing of positions;

- Visualization of potential profit/loss.

Benefits of using:

- Risk control – automatic stop of losses when a specified level is reached;

- Flexibility – the ability to manually adjust parameters in the process trade;

- Efficiency – manage multiple orders simultaneously;

- Automation– execution of strategy without constant monitoring.

Infinite Grid

Infinity Grid is a modification of the classic Grid bot, eliminating its main limitation – the need to set the upper price of the asset. That is, the bot works continuously during price growth. Unlike the classic Grid strategy, the Infinity Grid bot uses geometric order distribution, which provides:

- Sale of tokens with profit fixing in parts;

- Automatic creation of new orders to fix profits;

- Constant availability coins for sale at every price level;

- Enables trend participation without premature exits..

Key differences from Grid:

- No upper price limit;

- Automatic expansion of the grid when the price increases;

- Percentage step instead of fixed price;

- Continuous work in an uptrend.

Technical features:

- Uses a percentage ratio (usually up to 5%) between orders;

- Automatically creates new sales targets;

- Maintains base position during strong growth;

- Optimal for cryptocurrency with a steady upward trend.

Grid with credit shoulder

The Leveraged Grid (credit shoulder) enhances the classic Grid strategy’s potential by using leveraged funds, which allows for increased potential returns.

Main characteristics:

- Supports leverage up to 100x on futures;

- Automatic risk management;

- Optimization under volatile markets.

Mechanism of operation:

- The bot uses part of the funds as collateral;

- Borrows additional funds from the platform;

- Creates an extended order grid;

- Automatically rebalances position when prices change.

Risk Management:

- Automatically triggers stop-loss upon reaching liquidation price;

- Slippage control;

- Risk warning system;

- Stop loss and take profit orders;

- Possibility of manual intervention.

Reverse grid

The Reverse Grid is designed for bearish markets or for traders who are accumulating tokens as the price falls.

Features of the strategy:

- Selling at the top levels of the grid;

- Buying at lower levels;

- Increases coin holdings as the price drops;

- Useful for trade in a sideways trend with a downward slope.

Settings:

- Determining the price range;

- Number of grid levels;

- Position volume in the order;

- Rebalancing factor.

Reverse grid with credit shoulder

The Leveraged Reverse Grid combines two strategies’ benefits of two strategies, allowing a trader to strengthen his position in a falling market.

Key Features:

- Uses borrowed funds for shorting;

- Automatic control shoulder;

- Protective mechanisms against sharp turns;

- Optimization under different trend conditions.

Advantages:

- Increased return potential in a bear market;

- Automation complex algorithms;

- Integration with tools risk management;

- Flexible settings to suit individual preferences.

Each of these bots in Pionex is accompanied by detailed analytics, historical performance data and tuning recommendations, making the platform a universal tool for traders with different levels of experience and different trading approaches.

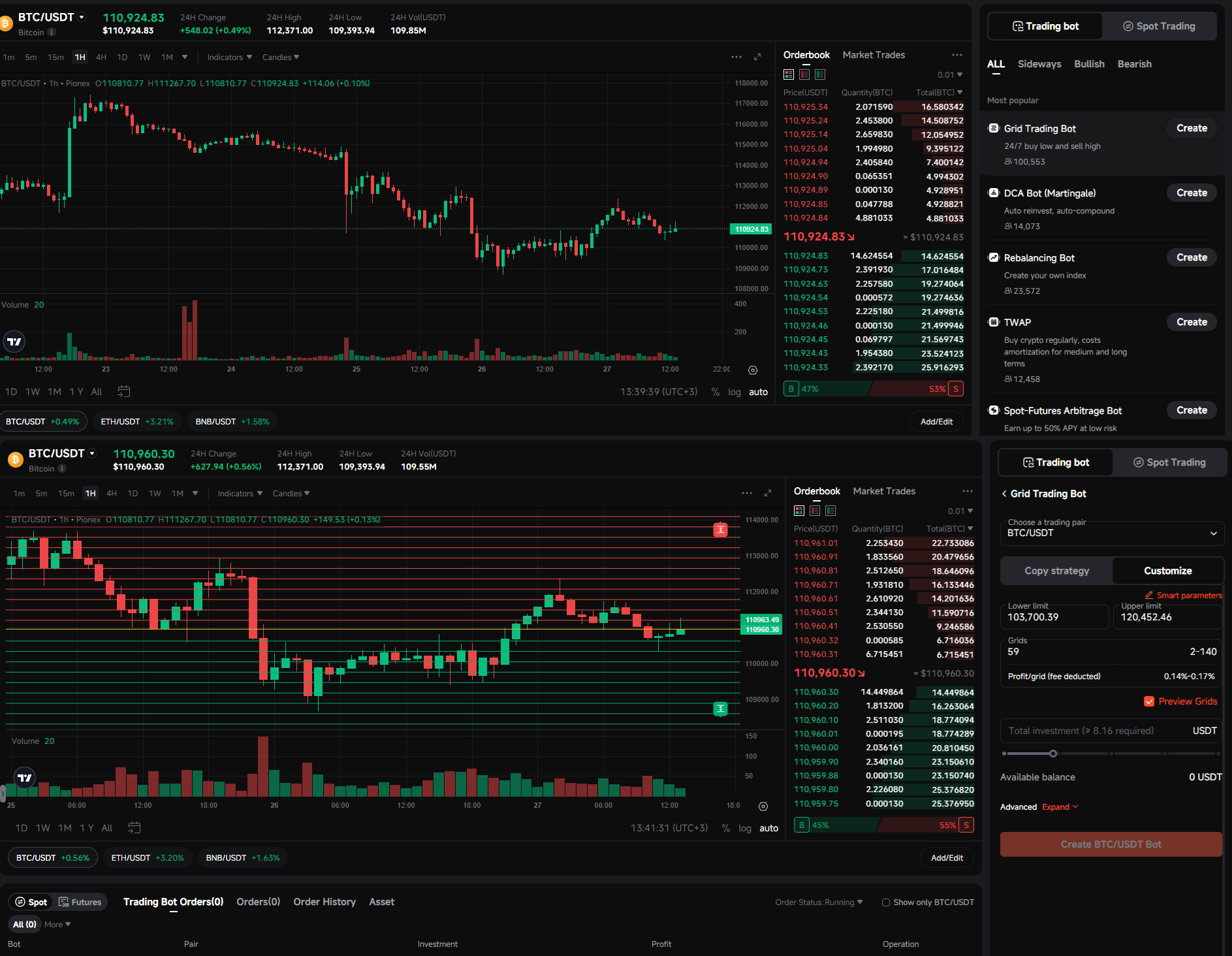

How to connect Pionex trading bot

Launching a bot on Pionex takes only a few minutes. To use Pionex bots, you need to:

- Go to the Pionex main page;

- Press «Create a bot»;

- Select the bot type, for example «Trading grid bot»;

- Select a trading pair, for example, BTC\USDT;

- Press mode «Manual setting»;

- Specify the lower price level;

- Specify the upper price level;

- Specify the deposit amount;

- Press «Create a BTC\USDT bot».

How to set up pionex grid bot tutorial?

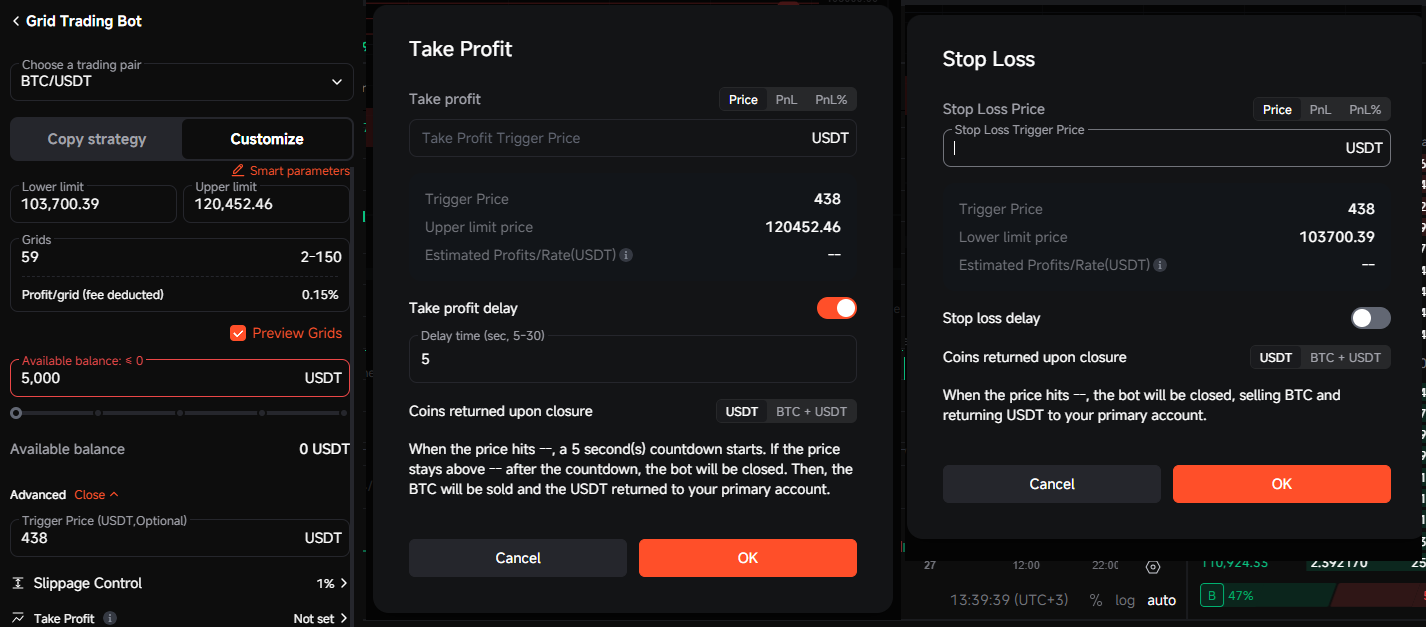

In the manual mode of the Pionex bot, traders have the opportunity to configure more detailed parameters. To do this, click on the created bot «Advanced settings» and set the required parameters.

Users can add a take profit or stop loss order, as well as adjust the bot's operating mode.

In addition to creating your own algorithms trading, users Pionex can copy strategies of other platform participants or use AI-based strategies integrated into the platform.

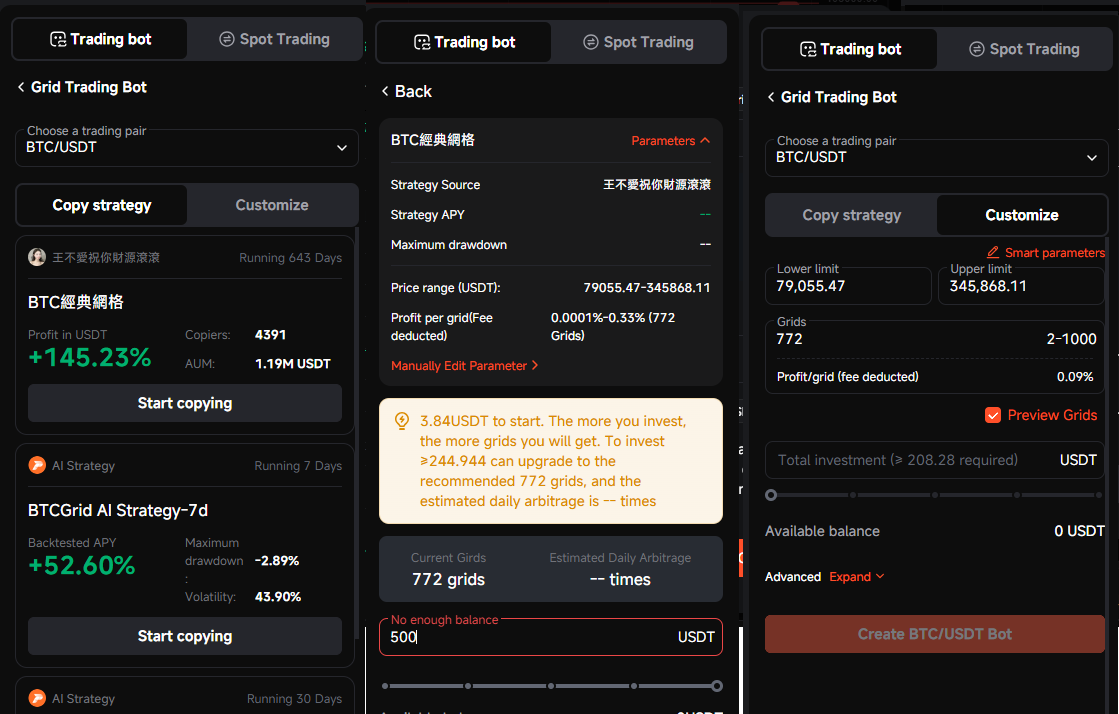

To copy other traders' trades, you need to:

- In the Grid Bot creation section, select «Copying strategy»;

- Select the desired one from the list algorithm;

- Press «Start copying»;

- Enter the deposit amount for the order;

Press «Create Bot BTC\USDT».

In the copy trading mode, traders can go to «Parameters» – «Manual Edit Parameters» and adjust bot configuration as it should be.

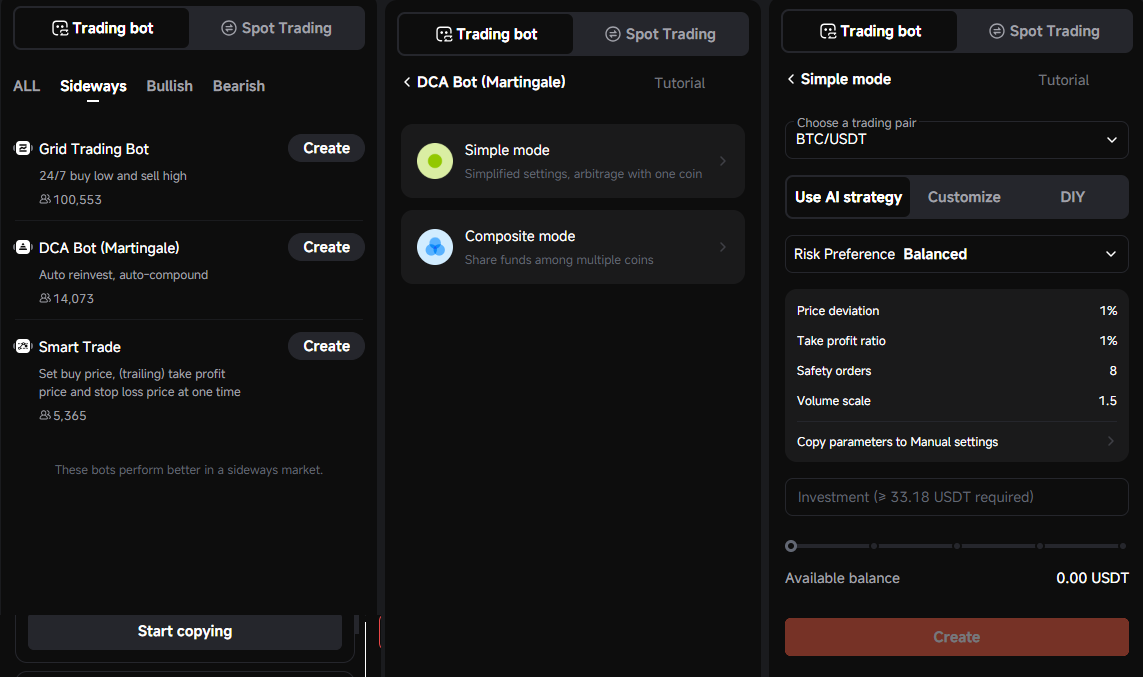

To apply Pionex AI-based bot strategies, you need to:

- Select, for example «DCA bot (Martingale)»;

- Choose «Use AI strategy»;

- Enter the deposit amount;

Press «Create».

Pionex trading bot review

The community of traders and investors speaks positively about Pionex, especially highlighting its ease of use, reliability and variety of strategies. Also, users note access to built-in trading bots without the need to install software or connect to external services. Sometimes, reviews of Pionex also mention the platform's weaknesses. The support service is most often criticized. Users complain about formal responses and the inability of managers to promptly resolve complex issues. Despite these shortcomings, experienced traders admit that Pionex is one of the convenient services for automation of trading.

Conclusion

Platform Pionex combines functionality of a trading exchange with powerful algorithmic trading tools. Key features include free trading bots, low fees for traders and liquidity from leading brokers cryptocurrency exchanges. The exchange occupies a solid niche among trading solutions, offering an optimal balance between functionality and cost.