Liquidity in Cryptocurrency – Everything You Need to Know

Liquidity in cryptocurrency refers to how easily you can buy or sell a digital asset without causing major price changes. It's super important for trading, investing, and choosing your crypto platform. This is a quick breakdown of liquidity in crypto: what it is, how it's measured, what affects it, and why it matters to you.

What does liquidity mean in crypto?

Liquidity crypto is how easily you can swap one digital asset for another—like trading a token for a stablecoin or regular money—without сильно changing the going rate. When there's more liquidity, trades are easier, faster, and can earn more money.

For example, imagine you're selling one Bitcoin. If many buyers and sellers are, you will quickly find someone to pay close to the current market price. If not a lot of people are trading, finding a buyer might be hard, or they might offer you a lower price. There are two main types of liquidity:

- Global liquidity – How easily you can trade in the whole market (like all Bitcoin trades).

- Local liquidity – How easily you can trade on one exchange or with one pair of tokens (like trading Bitcoin for USDT on Binance).

What is liquidity pool in crypto?

It's a smart contract where people put in pairs of tokens (like ETH/USDT). This lets you trade without needing an order book. Liquidity pools are essential for decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and PancakeSwap.

How it works:

- Liquidity providers (LPs) deposit token pairs into the pool.

- Traders swap tokens using the pool’s liquidity.

- Liquidity providers earn a portion of the trading fees, which varies by platform. For instance, Uniswap V3 fees could be 0.05%, 0.3%, or 1%.

This system removes intermediaries and allows instant token swaps with transparent conditions. However, pools come with risks such as impermanent loss — a temporary loss of funds caused by price fluctuations between deposited tokens. If prices return to their original levels, the loss can be mitigated.

In other words, what is crypto liquidity in the context of pools? Think of it as a shared wallet where, for example, ETH and USDT are stored. When someone wants to swap ETH for USDT, they do so via the pool instead of searching for a direct counterparty.

Liquidity vs. Liquidity Pool – Key Difference

Crypto liquidity and a liquidity pool are related but different.

- Liquidity – refers to how easily an asset can be traded at a fair price.

- Liquidity pool – a tool used to provide that liquidity in decentralized protocols.

Liquidity is the result, and the pool is the method. Liquidity pools enable decentralized exchanges to run without traditional order books, which is needed for decentralized trading.

How does liquidity work in crypto?

To measure liquidity in crypto, traders use several metrics:

- Trading volume – the total amount of an asset traded in a set period (usually 24 hours). Higher volume usually means higher liquidity.

- Spread – the difference between the highest buy order (bid) and lowest sell order (ask). A smaller spread means better liquidity.

- Market depth – the number of buy and sell orders at different price levels. A deep market reduces the risk of slippage.

- Order execution speed – liquid assets tend to execute instantly when traded.

What affects crypto liquidity?

Several factors influence liquidity meaning in crypto:

Trading volume

When a market has high daily trading volume, it just means things are moving. You'll find it easier to buy and sell. Big names like Bitcoin and Ethereum? They see billions change hands daily, meaning they're super liquid.

Now, with smaller altcoins that don't trade as often, you could be stuck waiting for a buyer.

Spread

In markets where there's a lot of trading activity, spreads are usually very small, which is good for both buyers and sellers. But in markets where trading is slow, spreads get bigger, and traders might experience slippage. Slippage happens when an order is filled at a worse price than expected because there aren't enough orders available.

Exchange coverage

The more exchanges list a coin and the more trading pairs it has, the higher the potential liquidity.

Market conditions

Things like economic news, rules, and how investors feel can all change how easy it is to buy or sell things.

The role of liquidity in the crypto market

Liquidity in cryptocurrency impacts the market’s stability, reliability, and efficiency:

- Price stability – High liquidity reduces sharp price swings during large trades.

- Execution speed – Liquid markets process trades instantly.

- Lower volatility – Crypto is known for its ups and downs, but liquidity can help smooth out the big ones.

- Investor appeal – Big investment firms usually stay away from assets that aren't easy to trade, so liquidity is super important.

Basically, liquidity does more than just help with trades. It shows how grown-up a market or project is.

How to assess liquidity

Before investing or trading, check an asset’s liquidity using:

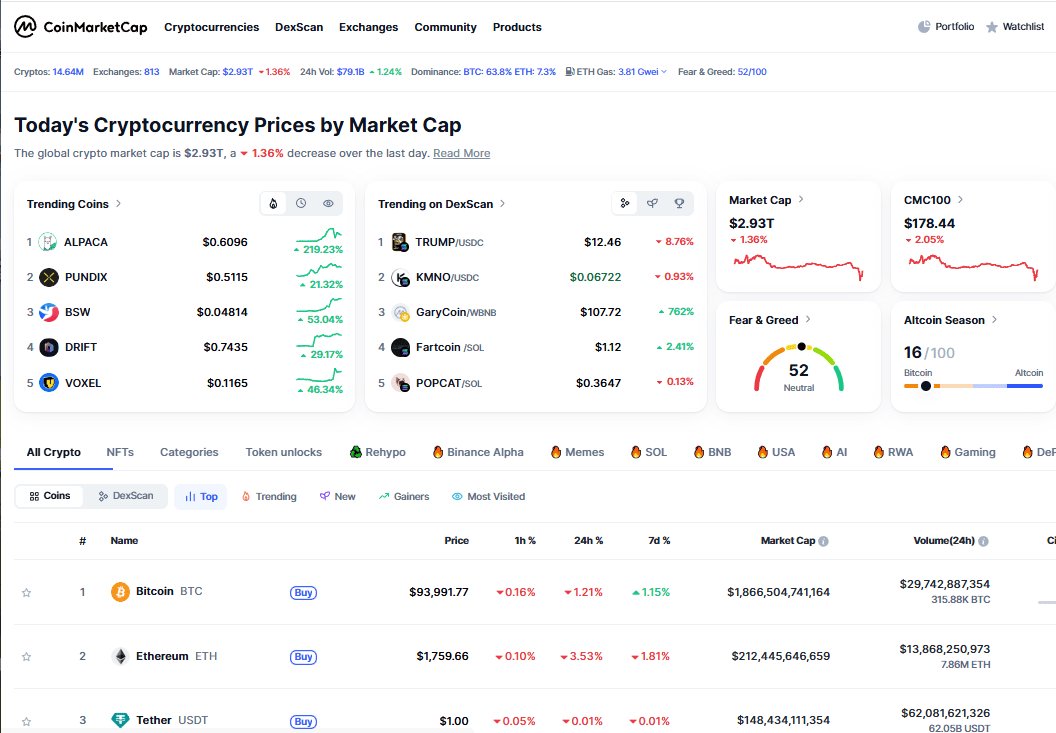

- CoinMarketCap & CoinGecko – for daily volume, number of trading pairs, and exchange listings.

- Order book depth – available on centralized exchanges and some DEXs like dYdX.

- DEX liquidity pool size – Uniswap and PancakeSwap show the funds in each pool.

- DeFiLlama metrics – to compare liquidity across DeFi protocols.

- Order activity – lots of active trades indicate strong liquidity.

The higher these metrics, the safer it is to trade the asset.

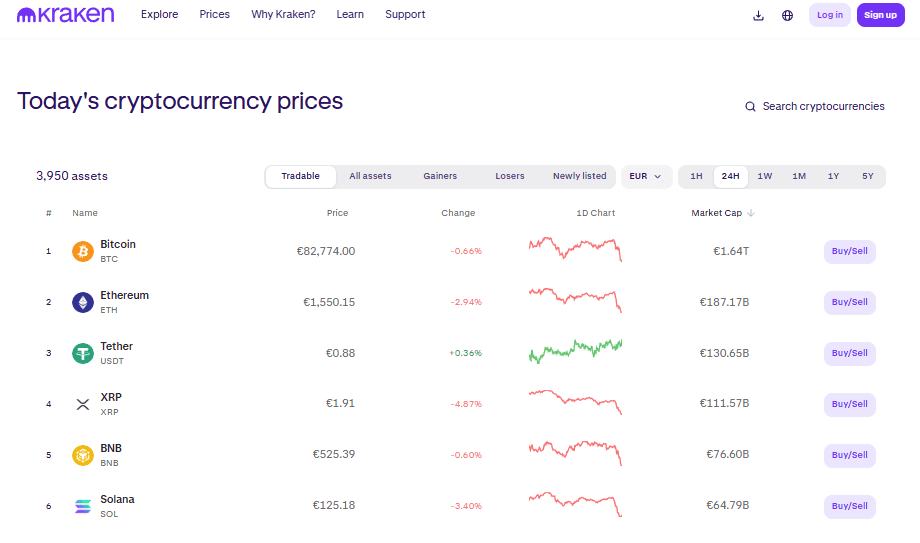

Examples of highly liquid exchanges

- Binance – the world’s largest centralized exchange with massive trading volume and liquidity pools.

- Coinbase – trusted by U.S. investors with strong liquidity.

- Kraken – offers deep liquidity for spot and margin trading.

- Bybit & OKX – fast-growing platforms with active user bases.

- Uniswap (DEX) – top decentralized protocol with concentrated liquidity features in V3.

- Curve – specialized in stablecoin swaps with high liquidity.

- Balancer – customizable liquidity pools with various assets.

Choosing a liquid exchange reduces financial risk and improves trade execution.

Conclusion

So, what is liquidity in crypto in plain terms? It’s the ease of trading an asset without significant price change. When liquidity dries up, trading slows down, spreads get bigger, and prices get wobbly. Liquidity pools have changed decentralized finance by making it possible to trade without the middleman.

But even with a pool, high liquidity isn't a sure thing. Trading volume, spreads, the number of participants, and the total value locked all matter. Keeping an eye on crypto liquidity is important for traders and investors who want to avoid risks and make smart choices.