How and Where to Buy Bitcoin (BTC) in 2025

Bitcoin is the most popular digital asset with the largest capitalization. On the first cryptocurrency accounts for more than $1.5 trillion. Buy Bitcoin– this is a serious decision associated with risks.

Where and how to buy bitcoin? Should you worry about it? We'll tell you.

What is Bitcoin and why buy it

Bitcoin is the world's first digital currency, based on technology blockchain and operates in a decentralized manner. Net was launched in 2009 by an anonymous developer or community of programmers under the pseudonym Satoshi Nakamoto. Unlike fiat currencies, Bitcoin is not subject to the control of central banks and government agencies: The network users themselves confirm that they act as nodes or miners.

What you need to know before buying

Safety,commissions, choice of platform,regulation – the main criteria before purchasing BTC. Each of these factors must be taken into account.

Where can I Store bitcoins

Storing BTC– one of the most important aspects. There are two types of wallets:

- Cold wallets are physical cryptocurrency storage devices in the form of flash drives. They are disconnected from the Internet.

- Hot wallets – online services: cryptocurrency exchanges (Binance, ByBit, OKX, etc.), applications for storage tokens (Trust Wallet, Metamask, TR.ENERGY Wallet).

Before buying Bitcoin, you need to pay attention to:

- BTC price. The first rate cryptocurrencies – one of the most volatile. Therefore, before and after buying Bitcoin, the user needs to carefully monitor the financial chart.

- Commissions. Cryptocurrency exchanges and exchangers charge fees for trading, exchange, and withdrawal of funds.

- Wallet address: Always check the wallet and recipient address before sending or receiving funds.

- Verification: Most platforms require identity verification to protect against fraud.

Main ways to buy Bitcoin

You can buy Bitcoin in 2025 on crypto exchanges, P2P platforms or through exchangers. Each platform differs in the degree of anonymity provided, speed transactions, size commissions.

Cryptocurrency exchanges

Crypto exchanges offer a high level of liquidity, a wide choice of trading pairs, and many tools for managing digital assets.

The most reliable cryptocurrency exchanges:

Features of buying bitcoin on exchanges:

- Fiat gateways. The deposit is received on the account from bank cards Visa, Mastercard, MIR and other payment systems.

- Verification. Usually for purchase cryptocurrency on the stock exchanges. You must go through the Know Your Customer (KYC) identity verification procedure.

- Commissions. Exchanges retain a portion of funds for trading, transfers, and withdrawals.

- Safety. Trading platforms protect accounts using two-factor authentication (2FA), account passwords.

- Liquidity. On crypto exchanges, you can quickly buy or sell digital assets at market prices.

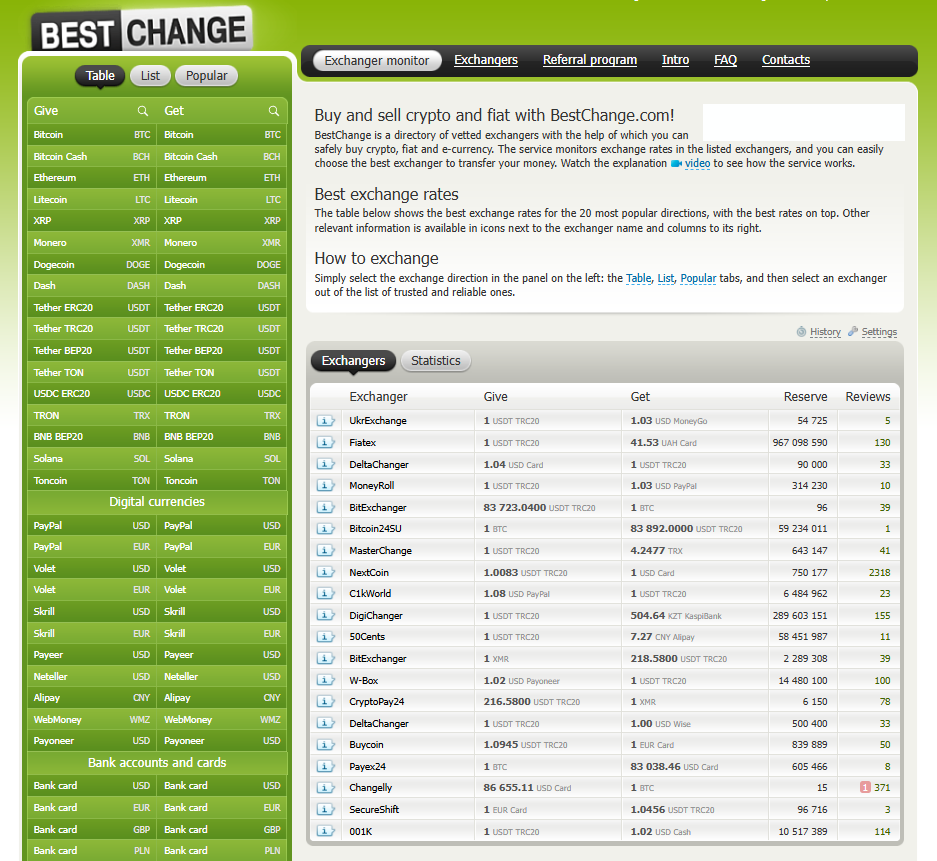

Cryptocurrency exchangers

Exchangers allow you to quickly purchase bitcoin for dollars and other fiat currencies.

Popular exchangers for buying bitcoin:

- Changelly;

- AlfaBit;

- Finex24;

- XChange.

Features of using exchangers:

- Speed transactions. The financial transaction takes a few minutes;

- Anonymity.Many exchangers do not require verification;

- Commissions may be higher than on cryptocurrency exchanges;

- Risks: There is a possibility of encountering fraudulent platforms.

Some exchangers sell bitcoins for cash. The transaction takes place during a meeting with platform representatives.

P2P platforms

P2P services allow you to buy bitcoin from other users without intermediaries.

Examples of platforms for P2P exchange:

- Coinex

- Binance P2P

- ByBit P2P

- OKX P2P

- MEXC P2P

Features of buying bitcoin via P2P:

- A variety of payment methods: bank transfers, cards, cash;

- Verification. Each P2P platform requires mandatory KYC procedure with provision of personal data;

- Lower risks. Crypto exchanges guarantee the security of transactions;

- Escrow protection. The sender's and seller's funds are blocked until the transaction is confirmed by both parties.

Ways to Buy Bitcoins

You can invest in digital assets: buy, store, sell. Transactions are subject to income tax. The trader must declare the profit independently.

Some tips for buying Bitcoin:

- Use trusted exchanges that support fiat currencies (USD);

- To minimize fees, purchase tokens through P2P systems;

- Keep up to date with changes in legislation.

Instructions for buying Bitcoin on the ByBit crypto exchange

ByBit Exchange – one of the highly liquid cryptocurrency exchanges. The platform offers to buy bitcoins for dollars.

Registration

To buy bitcoins on the ByBit crypto exchange, you need to create an account. The algorithm is as follows:

- Go to the official website;

- Click “Sign Up”;

- Enter your email or phone number. You will receive an SMS or email with a six-digit combination of numbers;

- Paste the code into the empty line;

- Create a password for your account;

- Confirm registration.

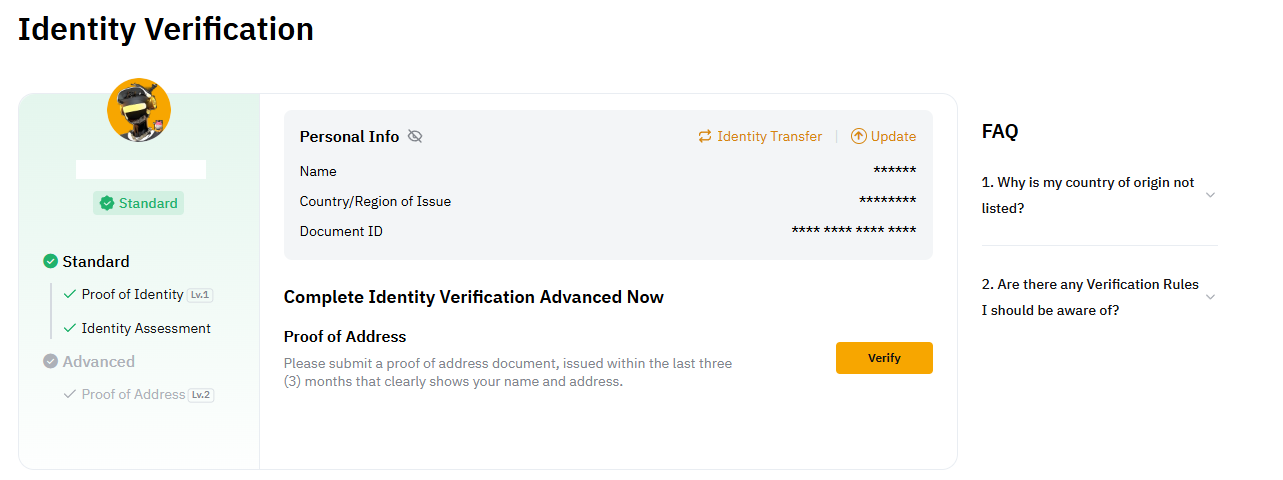

Verification

After creating an account, you need to go through KYC to verify your identity. You need to take a photo of your passport or driver's license. Then:

- Go to the “Overview” section (for the desktop version) or “Settings” (in the application);

- Select “Identity verification” and click “Pass verification”;

- Confirm location;

- Click “Confirm”, select the country and document type for verification;

- Click “Continue”;

- Take a photo of the front of the document and a selfie with the document;

- Upload photos.

The system will check the information, and after some time (from several minutes to a day) the user's account will receive the status “Standard verification”.

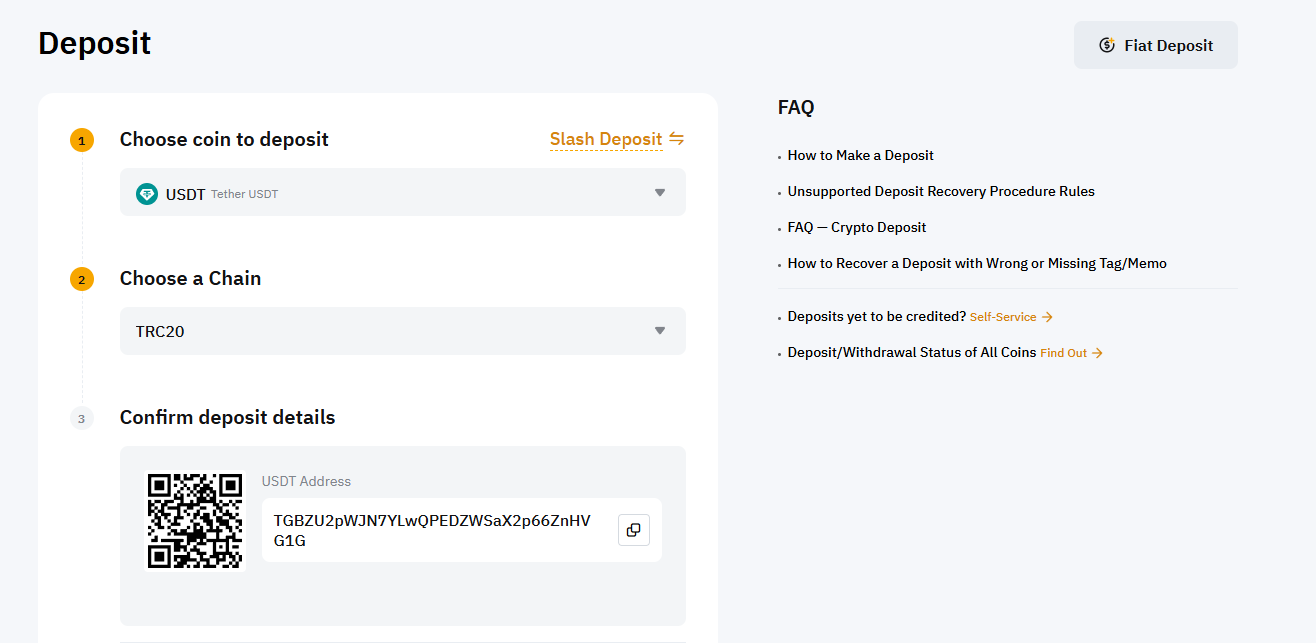

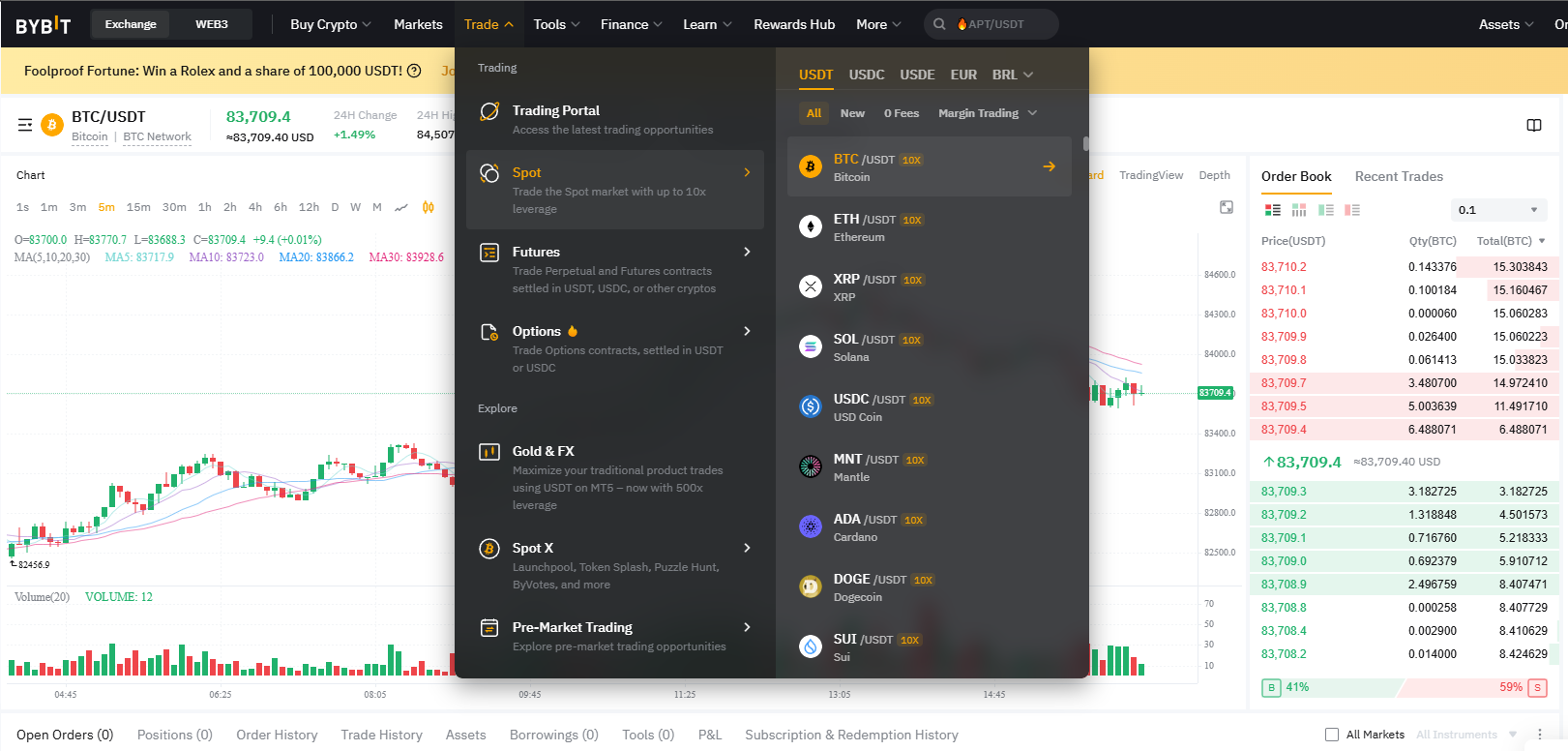

Guide to Buying Bitcoin on ByBit for USDT

After completing registration and verification, the user can buy bitcoins in the trading section. The spot market is suitable for purchasing.

To buy BTC for USDT on ByBit, you need to top up your account balance in USDT. This is how it's done:

- Open the “Assets” section;

- Click “Deposit”;

- Select USDT for deposit and network;

- Copy the wallet address;

- Confirm the operation.

After replenishing your account, you need to:

- Go to the spot trading section;

- Find the pair “BTC\USDT” in the search bar;

- Select the order type (for example, “Market”);

- Enter the amount of BTC or the amount in USDT;

- Click “Buy BTC”.

Once the buy order is executed, BTC will be instantly credited to the account balance.

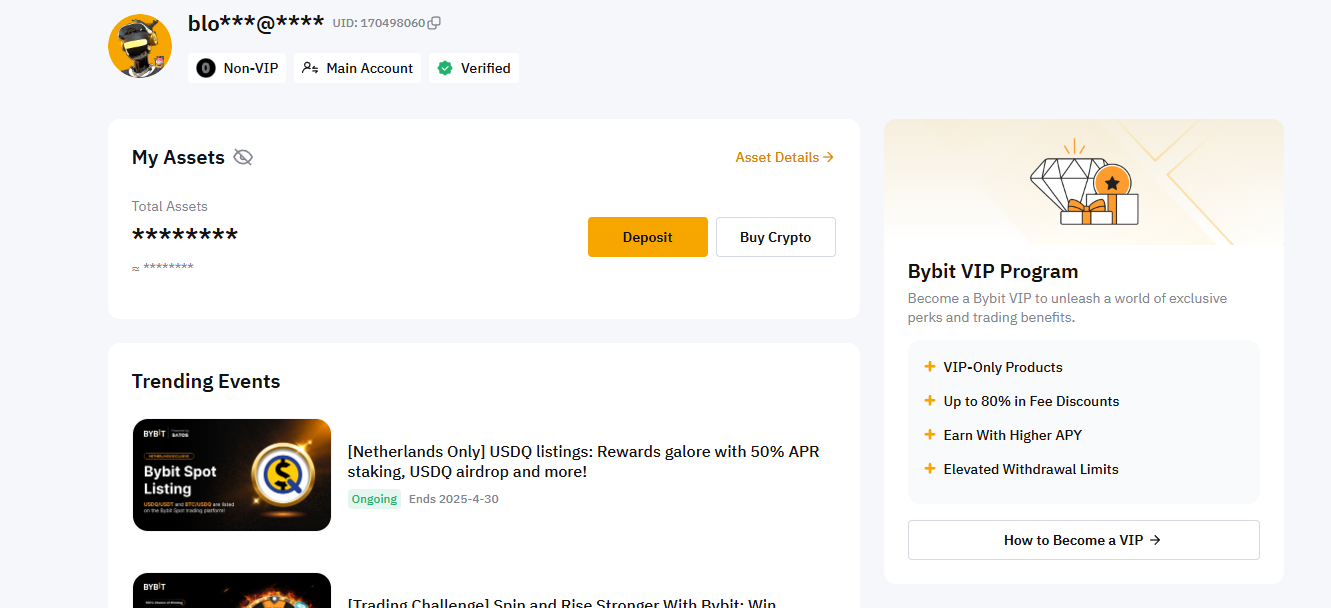

To check your account status, you need to:

- Go to the “Overview” section;

- Click “Asset Information”.

Information about the user's accounts on the exchange is displayed here.

Ensure maximum account security on crypto exchange will be helped:

- Two-factor authentication (2FA). You can activate the function in your personal account settings;

- Connecting Google Authenticator;

- Complex password for logging into your account. It should be different from the combination for other services;

In addition, you should not follow links to the exchange from unknown sources.

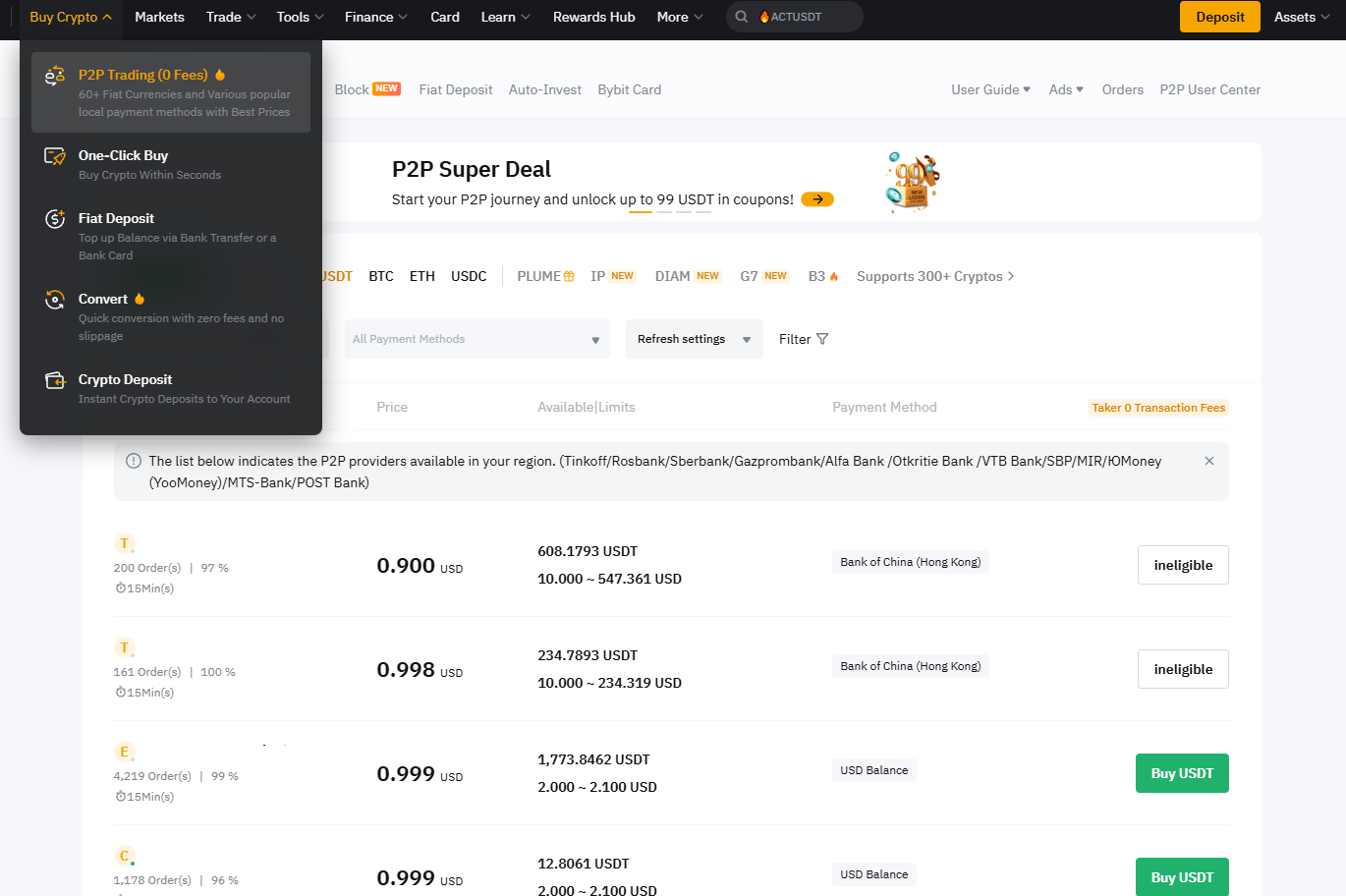

How to buy BTC via P2P on ByBit for USD

P2P exchanges on ByBit – an opportunity to buy bitcoin from other users. To make a purchase, you need to:

- Open the “P2P trading” section in the “Buy cryptocurrency” tab;

- Select BTC as the token for purchase and USD as the payment currency;

- Specify the payment method: bank card, electronic wallet, etc.;

- Find a suitable seller and click “Buy BTC”;

- Carefully read the terms of the transaction;

- Get payment details;

- Send the wallet address to the seller in the chat;

- Make a transfer and confirm sending funds;

- Wait for the seller to transfer the BTC and confirm the transaction.

Always communicate with the seller via the platform's internal chat, do not transfer money outside the system and clarify the details.

Ways to store bitcoins

The next step after buying Bitcoin is to choose a method for storing the digital asset. This can be a hot or cold crypto wallet.

Cryptocurrency wallets

Cryptocurrency wallet – is a computer program, mobile application, online service or physical medium that allows you to store, receive and send bitcoins to other users on the blockchain. IN wallet it is not the tokens themselves that are stored, but the private and public keys – they give the right to manage the cryptocurrency in blockchain.

- The public address or key is the account number to which the user receives funds;

- A private key is a secret code that provides the owner with access to their assets and gives permission to perform transactions.

If the private key is lost or stolen, the user permanently loses access to their bitcoins.

Types of crypto wallets

All wallets can be divided into two main categories: hot and cold.

Hot wallets

Hot wallets require an internet connection to function and provide quick access to funds online.

Popular Hot Wallets:

- Trust Wallet;

- Metamask;

- TR.ENERGY Wallet;

- Phantom;

- TronLink;

- Exodus;

- Electrum;

- Mycelium;

- ZenGo Wallet;

- Atomic Wallet.

Hot wallets are typically installed as software or browser extensions.

Advantages of hot wallets:

- Instant access to funds;

- Convenient to use for trading and transfers;

- Integration with crypto exchanges and DeFi applications.

Cons:

- High risk of hacking;

- Vulnerability to phishing attacks and viruses;

- Dependent on device and platform security.

Cold wallets

Cold or hardware crypto wallets are wallets that come in the form of a physical device, similar to a flash drive, for storing data.

Popular cold wallet manufacturers:

- Ledger;

- SafePal;

- Trezor;

- KeyStone;

- KeepKey;

- CoolWallet.

Cold wallets operate offline, private keys are stored only on the user's device. At the same time, hardware wallets can connect to exchanges and decentralized applications (dApps). Cold wallets are safer than hot ones, they are better suited for long-term storage of bitcoins.

Advantages of cold wallets:

- Maximum protection against hacking and hacker attacks;

- Does not depend on internet connection;

- Suitable for long-term storage of tokens.

Cons:

- Not convenient to use for frequent use transactions and trade;

- Losing your device will result in loss of funds unless the private key is saved.

What type of wallet to choose for storing Bitcoin

To effectively store Bitcoin, we recommend combining the use of cold and hot wallets.

For example, if a user trades, exchanges daily cryptocurrency, it is better to use hot wallets. Small amounts can also be stored on online wallets and exchanges. Large amounts of assets are preferable to be kept on cold wallets.

Conclusion

Bitcoin maintains its leading position among all cryptocurrency by capitalization. High volatility of Bitcoin is a risk for the investor. However, the first cryptocurrency is much more stable than most altcoins. Therefore, buying a token can be an excellent step in mastering the cryptocurrency market.

Every Bitcoin investor needs to choose a trusted exchange (such as ByBit) or exchanger to buy the coin. The platform's reputation can be assessed ratings and user reviews. The most suitable long-term storage for bitcoins is a cold wallet. Active crypto traders should choose a hot wallet.