Proof of Work in Cryptocurrency: A Simple Explanation

In the world of cryptocurrencies, there are several ways to confirm transactions in the blockchain. One of the earliest and most well-known algorithms is Proof of Work. Despite the fact that it underlies cryptocurrencies such as Bitcoin and Litecoin, many still ask questions about proof of work: what is it and why is this algorithm needed at all? In this article, we will analyze how this system functions, what are its pros and cons, and how it differs from the Proof of Stake algorithm.

What is Proof of Work (PoW)?

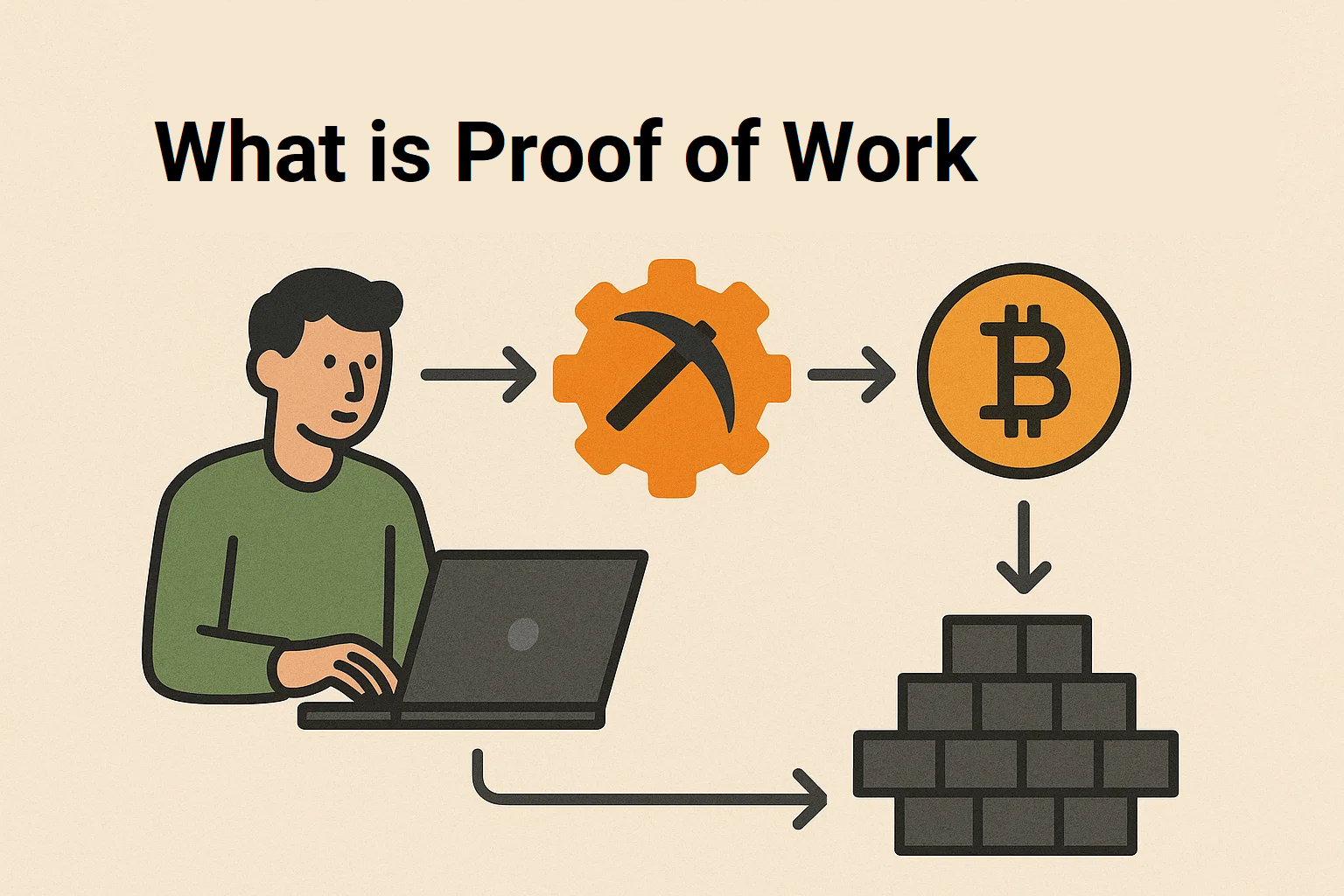

Proof of Work (PoW) is a consensus algorithm used in blockchain to confirm transactions and ensure network security. Its basic idea is that adding a new block to the chain requires performing a complex computational task. This solution cannot be found quickly and requires significant energy and computing power. This is why the high energy consumption of PoW is often mentioned.

The Proof of Work algorithm first became known thanks to Bitcoin, but was later used in other cryptocurrencies such as Ethereum (before switching to PoS), Litecoin, Monero, Dogecoin. It remains one of the most reliable ways to achieve decentralized consensus and evenly distribute data among network participants.

In simple terms, to make a change to the blockchain (for example, to record a new transaction), it is necessary to “prove” that a certain amount of work has been done. This proof is done in the form of calculations, and verification of the result takes a matter of seconds.

How Proof of Work Works

Let's say you're on a digital cash network where people are moving funds. All of these transactions get grouped into something called a block. Then, the mining starts.

Miners are participants on the network who use computers to try and guess a special number (a nonce). The aim is to get the block's ID (the hash) to be lower than a set number. Usually, this means the hash needs to start with many zeros.

The other people double-check the answer quickly. If it checks out, the block gets added to the blockchain, and the miner gets some coins and fees as a reward.

The Proof of Work setup uses some math tricks (cryptographic hash functions) to keep things secure. You can't guess the result of these functions, even if you know what goes in. Also, you can't change a hash that's already been recorded without redoing the whole chain

This is how Proof of Work helps make the blockchain reliable and safe. If you want to mess with the data in one block, you'd have to redo all the blocks after it, which is nearly undoable unless you control most of the network's computing ability.

Important features of PoW:

- High power consumption as it requires a lot of calculations;

- Security and protection from attacks (for example, a “51% attack” becomes extremely expensive and difficult to implement);

- Support for decentralization: every participant can become a miner;

- Reliable proof of work done;

- Difficulty increases depending on network activity.

As more people use cryptocurrencies, Proof-of-Work is getting heat for hurting the environment and putting mining control in the hands of big operations. So, people are looking for better options.

What is the Proof of Stake (PoS) algorithm?

In response to the problems of PoW, an alternative consensus algorithm was proposed - Proof of Stake (PoS), which does not require huge computing resources. In it, blocks are formed not by computing work, but based on the share of token ownership, that is, the share of participation in the network.

While PoW relies on the physical operation of hardware, the Proof of Stake algorithm uses cryptocurrency ownership as a form of trust and responsibility. Having more coins increases a user's odds of creating a new block and getting a reward.

This approach dramatically reduces energy consumption, makes the network more resistant to centralized control, and simplifies participation in maintaining the network. Still, it has issues like the nothing at stake problem, where validators can back many chains and not risk their stake, along with asset concentration risks.

Next, we’ll examine how PoS functions and its main differences from PoW.

How does PoS work?

Proof of Stake (PoS) is an algorithm where new blockchain blocks are created by people who hold a certain amount of a crypto token. Unlike Proof of Work, it doesn't require complicated math, so it uses far less energy.

How does it actually work? If you own 1% of all the coins, you have about a 1% chance of being picked to add the next block. This is called staking – like having a share or taking part.

To stake, you lock up some of your coins in a special wallet. This makes you a validator – sort of like a miner in PoW. You then get a reward for each block you approve. So, instead of spending money on equipment and electricity, you put in your share as capital. If you break the rules, like trying to make fake transactions, you could lose your coins. This keeps the network safe.

Some blockchains use mixed models, adding other ways to pick validators, like random selection or reputation, to the Proof of Stake algorithm. This helps make the network stable and more efficient.

Key features of PoS:

- Low power consumption and no need for expensive equipment

- Participants are incentivized to maintain integrity at the cost of losing their funds.

- Greater efficiency and scalability

- However, there may be risks of centralization if large coin holders gain disproportionate power.

Advantages and Disadvantages of Proof of Work

Even though the Proof-of-Work algorithm has been around for more than ten years, people still argue about it. Let's check out what it does well and where it falls short so we can better understand it.

Benefits of Proof of Work:

- Security. To attack a network, a bad actor needs to control over half of its computing power, which is really expensive and hard to do.

- Transparency. All transactions can be checked by anyone. They’re saved in blocks, and you can’t change them without redoing the whole chain.

- Decentralization. Any participant can connect to the network and become a miner.

- Reliability. The algorithm has proven its stability in practice. Bitcoin has been running on Proof-of-Work since 2009.

Disadvantages of Proof of Work:

- Power Usage. Mining needs powerful machines that run constantly, so it consumes a lot of power.

- Mining Groups. As it gets harder to mine, big mining groups control most of the computing power.

- Slow Transactions. Transactions might take longer to complete, especially during peak network times.

- Environmental Issues. The energy mining uses worries environmental activists and government agencies.

Many Proof of Work cryptocurrencies keep the blockchain running smoothly but have big downsides, like high energy use and mining getting centralized.

Proof of Work versus Proof of Stake

Both Proof of Work and Proof of Stake try to get everyone on a decentralized network to agree on the same thing, but they do it differently.

| Criterion | Proof of Work | Proof of Stake |

|---|---|---|

| Principle | Solving complex problems for adding a block | Validator selection based on coin share |

| Energy consumption | High | Low |

| Equipment | Miners (ASIC, GPU) required | A crypto wallet with coins is enough |

| Threats | 51% attack, mining centralization | Risks of coin accumulation for large stakers |

| Processing speed | Relatively low | Higher due to less load |

| Eco-friendliness | Low | Tall |

| Examples of cryptocurrencies | Bitcoin, Litecoin, Dogecoin, Monero | Ethereum, Cardano, Tezos |

Proof-of-Work is still seen as the gold standard for security, especially for major cryptos. But Proof-of-Stake coins are becoming a more eco-friendly and simple way to grow your money. Both have their uses, and you'll find them both in today's crypto market.

Main PoW cryptocurrencies

Even though there are other ways to do it, like Proof of Stake, lots of well-known cryptocurrencies still use Proof of Work. Here are some of the main ones:

Bitcoin (BTC) is the original and most well-known cryptocurrency. It relies on the Proof-of-Work (PoW) algorithm using SHA-256 and is still seen as a benchmark for being decentralized and secure. Given how hard it is to mine, you need special machines (ASIC miners) and a lot of power to get it.

Ethereum (ETH) used to run on Proof of Work until 2022 when it switched to Proof of Stake in a change called The Merge. It's important to note that the Ethereum team was the first to work on different ways to agree on things. Now, the Ethereum network uses an algorithm that is based on the Proof of Stake idea.

Dogecoin (DOGE) is famous as the meme cryptocurrency. Started as a joke, it's now quite popular. It runs on the Scrypt PoW algorithm and can be mined together with Litecoin. Even though it started as a joke, people do use Dogecoin a lot.

Litecoin (LTC) was made to be like digital silver, with Bitcoin being the digital gold. Litecoin uses the Scrypt PoW algorithm, which is made to process payments faster. That makes LTC good for everyday purchases since it's quicker than Bitcoin.

Monero (XMR) is a cryptocurrency that focuses on privacy. Monero uses the RandomX algorithm, which is set up for regular computer processors (CPUs) to keep mining spread out. All Monero transactions are private and can't be traced, which makes it liked by people who care about privacy.

Each of these cryptocurrencies puts Proof of Work to use in its own way, based on what the network wants to be: secure, private, fast, or easy to mine.

Conclusion

Proof of Work (PoW) has been key to how cryptocurrencies have grown. It was the initial way to get everyone to agree on a decentralized network, keeping projects like Bitcoin and Litecoin secure and stable. Using things like mining and cryptography, PoW makes sure everyone on the network is honest.

As tech has gotten better and blockchain has become more popular, things like energy use, how well it scales, and being eco-friendly have gotten really important. This has pushed new ideas in consensus algorithms to come out, like Proof of Stake, which try to cut costs and be more efficient. But despite this, Proof of Work remains a significant part of the crypto world - both from a historical and technical point of view.