What is Crypto Futures and How to Start Trading

There are different trading formats available on the crypto market. The simplest is spot, where the coin is bought and immediately delivered to your wallet. There are margin transactions with loans and options for insurance positions. But derivatives are the most active instruments: futures account for more than 80% of the daily trading volume. In the first quarter of 2025, traders traded $21 trillion in them, while spot markets accounted for about $4.6 trillion. Many newcomers seek articles where crypto futures trading is explained without excessive financial jargon to avoid costly mistakes. What is crypto futures trading? Let's figure it out.

What are crypto futures

Contracts to buy or sell cryptocurrency at a fixed price - these are futures. Unlike spot, where the asset is immediately credited to the account, here you trade a contract that represents an obligation. Contracts are of two types.

- With expiration. Settlement occurs on the set day.

- Perpetual. Can be kept for any amount of time.

Leverage is used for transactions: it increases the position several times and requires a margin - a deposit that protects the contract from non-fulfillment.

What is a perpetual futures contract

A perpetual future has no expiration date and can be held for as long as desired. To ensure that the price matches the spot, a funding mechanism is used. The exchange charges or debits a commission several times a day: If the contract price is above the market price, long positions pay funding to short positions. If it is below, shorts pay to longs. This mechanism maintains balance and makes perpetual futures the most popular type of contracts. Today, it is this format that occupies the bulk of trading on crypto exchanges, while futures with expiration are used less frequently and are used mainly for long-term strategies.

Spot and Futures: What's the Difference?

Spot trading is a transaction with real tokens at the current price. The transaction is executed instantly; the coin is added to the balance and can be stored for a long time. New assets most often first appear on the spot, where the liquidity is formed and access to transfer or use in projects is provided.

Futures work differently: cryptocurrency is not transferred, but traded contract on its price. Unlike spot, here you can open positions in both directions - both on the rise and on the fall. There is also a significant difference in leverage: on spot it is limited to 3x - 10x, while on futures it reaches 100x - 125x. These differences become especially noticeable when comparing trading conditions, using order book and work with indicators.

Comparison of Spot and Futures Trading

On spot, income only appears when the price rises. Here, transactions are simple, but the instruments are limited to buying and selling. Futures offer more options: stop orders, trailing, margin calculator and a built-in liquidation system. Additionally, algorithms analysis, divergence and impulse signals. On spot, the loss is limited by the size of the transaction, and on futures, when the margin falls, position closes automatically. Therefore market futures are chosen by active users and institutional, for whom flexibility of strategies is important and and diversification of risks.

Why Choose Futures Trading?

Futures offer more opportunities than spot trading. They allow you to earn on both price increases and decreases, use leverage, and manage large amounts with less capital. Contracts suitable for hedging portfolio and price fixing, which is especially important in the conditions volatility and market corrections. An additional advantage is high liquidity: market makers ensure the execution of transactions, and brokers and exchanges offer access to different trading modes. Often, new instruments and tokens first appear in futures, which gives access to their trading earlier than on spot and allows you to find the optimal entry price.

Hedging risks

Futures are used to protect against a fall in asset value. If there are coins on the spot, you can open an opposite position in futures. The mechanism is easy to show with an example.

When buying 1 BTC at $60,000 and opening shorts for the same volume, the loss from a price reduction to $55,000 is offset by a profit contract. The final result remains zero, and the capital is preserved.

If you bought 2 ETH at $3,500 and opened shorts only 1 ETH, then if the price drops to $3,000, the loss will be $1,000, but the profit from the contract will return half the amount. This approach reduces drawdown and leaves the opportunity to make money if the market continues to grow.

Crypto Futures – How to Choose Exchanges?

The choice of exchange depends on liquidity, fees and available instruments. It is important that the platform has a convenient terminal and account protection. The leading platforms offer perpetual contracts, leverage and built-in risk management mechanisms. Among the popular solutions, it is worth highlighting three leaders - OKX, Bybit and Binance.

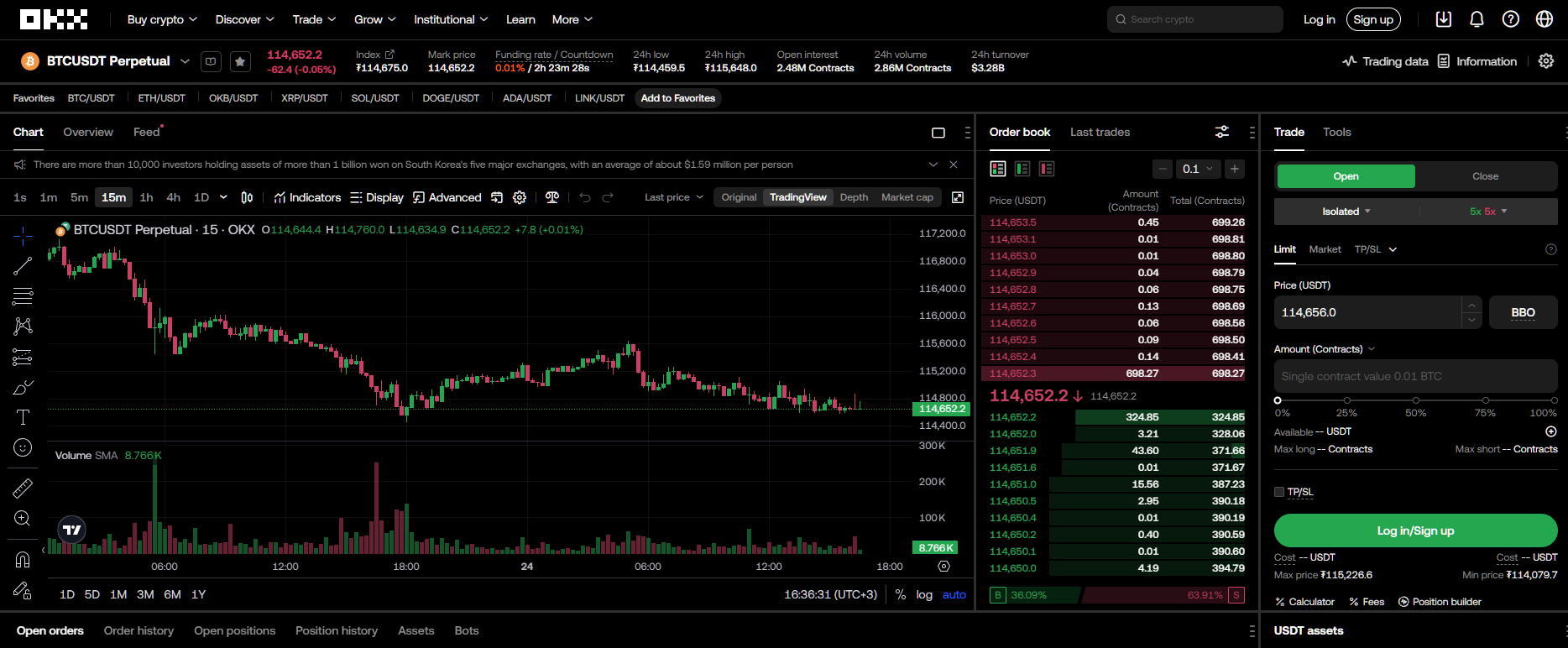

OKX

OKX is a leader in derivatives volumes. The exchange offers perpetual contracts and deliverable futures with leverage up to 125x. Settlements are supported in USDT, USDC and cryptocurrency. To control risks, there is an auto-liquidation system and a fund for insurance of positions. The terminal has a liquidation price calculator and isolated and cross margin modes. Additionally, a “Multi-currency margin” has been implemented – the ability to use different coins as collateral.

Bybit

Bybit is known as a derivatives-focused exchange, with about 80% of its turnover coming from futures. Leverage of up to 100x is available, and the minimum margin starts from 1%. Both perpetual and quarterly are supported. contracts. Risk management is provided by dual liquidation price (Mark Price and Last Price), PnL calculator and flexible stop order settings. An additional advantage of Bybit is trading options and USDC-margined contracts, which expands strategic opportunities.

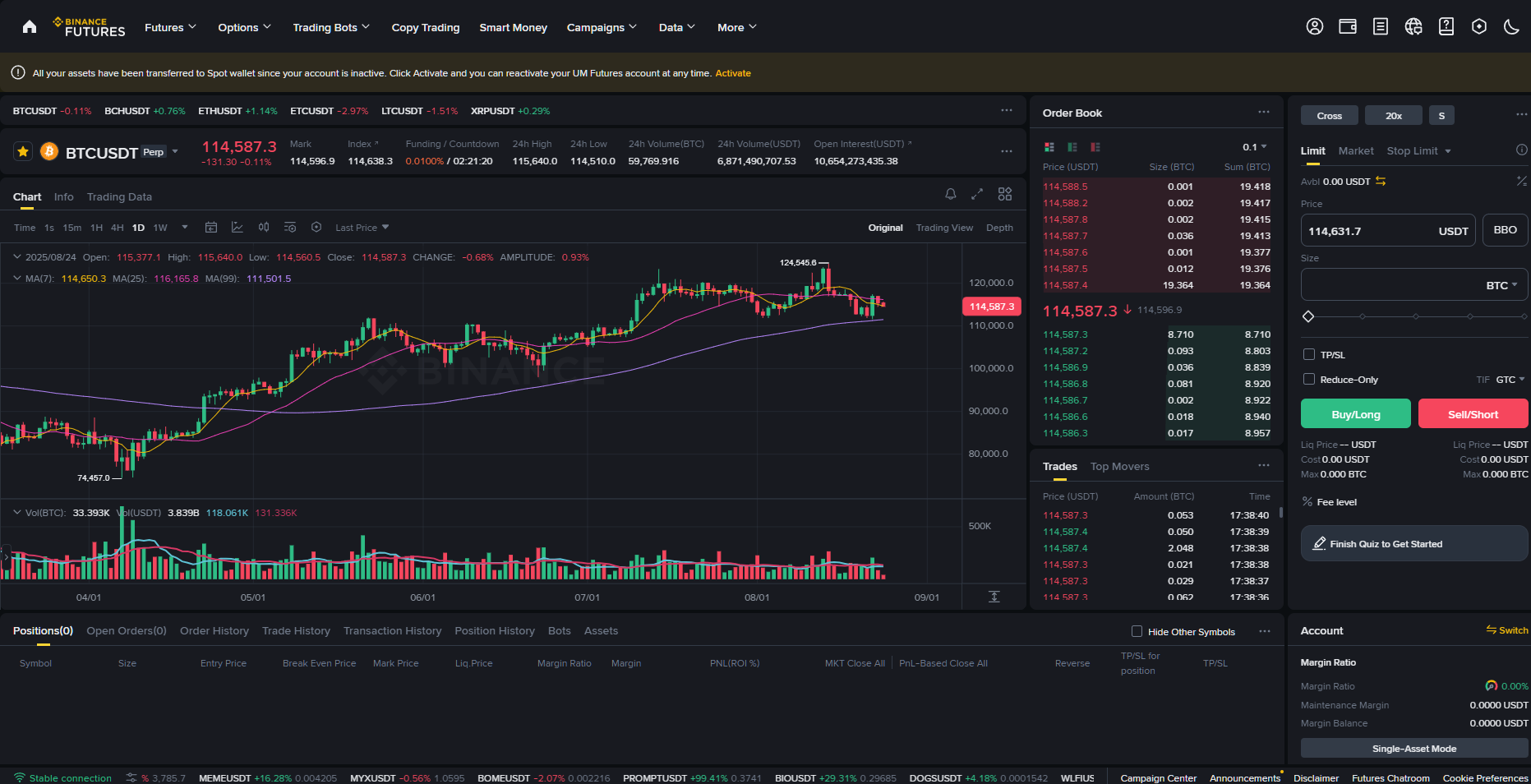

Binance

Binance remains the largest futures platform, with daily volumes on Binance Futures exceeding $50 billion. The platform offers over 200 contracts with leverage up to 125x. USDT and BUSD margin futures are supported. The system has two modes - cross margin, where the total balance acts as collateral, and isolated margin, where the risk is limited to a specific position. Additionally, protective mechanisms are in place: double liquidation price, "Insurance Fund" and Auto-Deleveraging (ADL), which reduces the risk of chain liquidation during periods of high volatility.

How to start trading futures on a crypto exchange

Futures trading begins with preparing an account and choosing a suitable exchange. It is important to consider fees, support for the required assets, and the convenience of the interface. After registration and verification, you can top up your futures wallet and proceed to setting up a deal.

- Selecting an exchange and registration. Open the crypto exchange website and create an account. Use the official domain and create a strong password.

- Passing KYC. Most platforms require identity verification. Upload a document and take a selfie to activate your account.

- Replenishment of the futures wallet. Transfer funds in USDT, BTC or other supported coins. Replenishment is made from a card, P2P or from the main balance.

- Selecting a contract. In the Futures section, open the list of available contracts. Specify the trading pair and determine the position size.

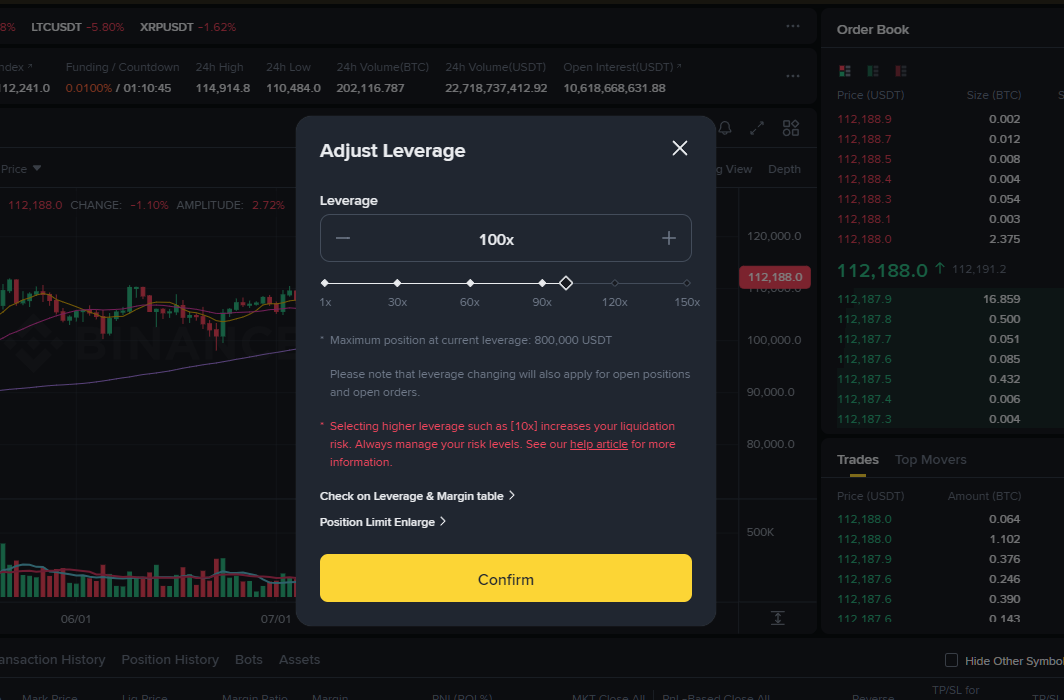

- Setting up leverage. In the interface, select the leverage level. For example, a deposit of 100 USDT and leverage ×10 allow you to open a deal for 1000 USDT.

- Selecting the direction of the transaction (Long or Short). If the asset price is expected to rise, Long (Buy) is opened. If a decline is predicted, Short (Sell) is opened. Profit is formed from the difference between the entry price and the position closing price.

- Setting stop loss and take profit. Before confirming an order, set protection and profit-taking levels. This will help limit losses and secure the result in advance.

- Opening a position. Confirm the order. The deal will be displayed in the terminal with the following parameters: margin size, liquidation price and current result.

Leverage and Margin

Leverage allows you to open a position larger than the deposit size. With a balance of 100 USDT and a leverage of 10x, the transaction size will be 1000 USDT. A 5% price increase will bring about 50 USDT profit instead of 5 USDT without leverage. But with a decrease of the same 5%, the loss will completely wipe out your margin, and the position will be liquidated. Margin acts as collateral that holds the trade and protects the exchange from default.

Risk Management and Liquidation

Crypto futures trading for beginners requires a solid understanding of leverage and risk management. The main tools are stop loss, take profit and position size limitation. If the balance falls below the margin level, the exchange automatically liquidates contract. To minimize risks, use moderate leverage, set protective orders in advance and distribute capital between several transactions. This approach reduces the likelihood of a complete loss of the deposit and allows you to control the result even in conditions of high volatility.

Conclusion

Crypto futures allow you to earn on both the rise and fall of the market, use leverage and manage capital more efficiently than on spot. Contracts are used for speculations and hedging, and large exchanges provide high liquidity and built-in risk management. When used correctly, futures expand trading opportunities and make strategies more flexible.