Why Go With an Indonesian Crypto Exchange?

So, why bother using an Indonesian crypto exchange in the first place? Well, the crypto scene here has some cool perks for both locals and folks tuning in from other parts of the world. The way the government is handling things is a mix of being open to cool new stuff while trying to keep everyone safe and sound. Exchanges have to get their licenses in order, have super-tight security, and make sure everyone is who they say they are (that’s the whole KYC thing) while keeping an eye out for anything fishy (AML). That sort of environment has drawn in some of the big names in global crypto, as well as helped local exchanges get off the ground.

Plus, the exchanges that deal in Indonesian Rupiah (IDR) make it super easy to switch back and forth between regular money and crypto. That takes a lot of stress off the average Indonesian investor who wants to get their feet wet. And hey, with the tax changes in 2025, buying crypto is now a little easier on the wallet because VAT obligations were replaced with income tax withholding.

Top Crypto Exchanges in Indonesia Right Now

When it comes to crypto exchanges in Indonesia, you’ve got a mixed bag – some big-time international players and homegrown platforms. Each one comes with its own set of things it does best. So, keeping things like playing by the rules, how much trading goes on, how secure they are, and how easy they are to use in mind, here are some of the top dogs for Indonesian users.

KuCoin’s Automated Trading & Income Tools

KuCoin is a great option for Indonesians because it’s one of the most comprehensive cryptocurrency exchanges out there. They support over 900 cryptocurrencies and offer different products, like spot, margin, futures, and options trading. They’ve become a top-five exchange in the world, making around $1.48 billion in trades every day and holding $2.22 billion in reserves as of 2025.

The fees are pretty good. You’ll pay 0.10% for both making and taking on spot trades. If you use KuCoin’s token, KCS, you get some extra goodies, like a 20% discount on fees, daily bonuses for staking, and VIP perks. The more you trade, the lower your fees go. If you’re a high-volume trader, you can get some serious discounts.

One of the things that stands out about KuCoin is the automated trading tools, like grid bots, DCA (Dollar-Cost Averaging) bots, systems that rebalance your portfolio, and even AI-powered ways to trade. You can also make some passive income, like by putting your crypto in savings, staking it, or lending it out – with rates from 8-12% APY.

Bybit Trading Excellence in Indonesia

Bybit has become a major player for people trading derivatives all over the world. They’re also pretty big with Indonesian traders. They’ve got all the bases covered with spot trading, futures that never expire, and options. Their fees are pretty good too.

The way Bybit handles fees is kind of like a VIP club. Regular users pay 0.10% whether they’re making or taking on spot trades. But if you move up the ranks, you can score some pretty sweet discounts. If you climb all the way to VIP 3, you’re looking at just 0.075% for making and 0.0625% for taking. And if you make it to Pro 5, you don’t pay a thing for making futures contracts! Depositing crypto is free, and when you take your crypto out, the fees are competitive. For example, withdrawing Bitcoin will cost you 0.0005 BTC.

When it comes to keeping things safe, Bybit uses multi-signature cold storage, encryption that’s high-tech, and even insurance. They also have the Bybit Card, which lets you spend your crypto like cash at stores, and you can get up to 7% back on some purchases.

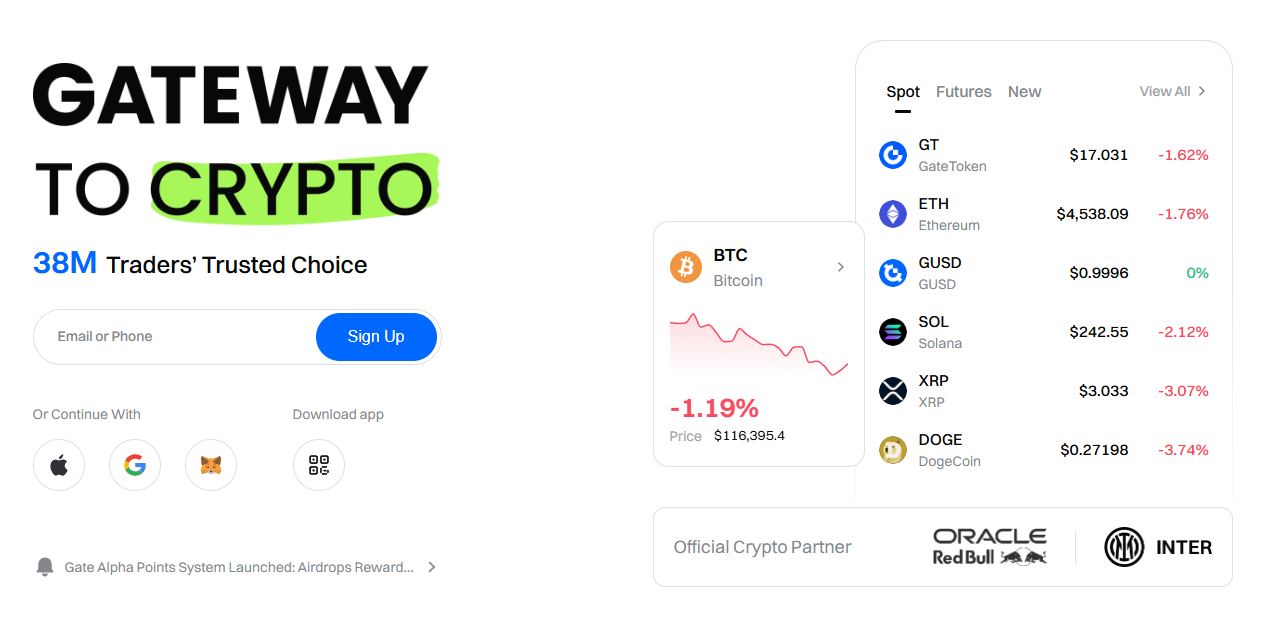

Gate.io’s Vast Crypto Selection

If you’re looking for variety, Gate.io pretty much has it all. They list a ton of different cryptocurrencies – over 1,400 and serve users in more than 200 regions worldwide. And the trading volume is high, coming out to over $4.95 billion every day. Gate.io has been around since 2013 and has a history of getting on board with new and buzzworthy cryptos before other major exchanges.

Gate.io uses a maker-taker fee setup. The standard deal is 0.20% for both makers and takers. But if you’ve got GateToken (GT), you can get those fees down to 0.15%. And for you high-volume traders, there are even better rates. VIP 16 users only pay 0.02% for takers, and makers get to trade for free if they are dealing with over $3 billion monthly.

Security-wise, Gate.io goes all out. They have 100% proof of reserves, which is checked out by auditors. Big transactions need the okay from multiple administrators, and most of the user money is kept in cold wallets. They also have things like grid bots, copy trading, leveraged ETF tokens, and chances to stake your crypto – supporting over 800 cryptocurrencies.

MEXC’s Strategic Indonesian Expansion

MEXC has been making some smart moves to get bigger in Indonesia. They bought a stake in a local exchange called Triv. This shows they’re serious about Southeast Asia. This translates to Indonesian users getting better access to all the crypto goodies MEXC has to offer.

MEXC has a list of over 1,700 cryptocurrencies. They’re available in over 170 countries, however, trading is not allowed in the United States and Canada. MEXC’s fees are good, and they have lowered or removed fees from select trading pairs at times.

The deal with Triv helps Indonesian users by giving them more liquidity, more coins to choose from, and better local support. It also helps MEXC follow Indonesian rules while offering users a mix of international markets and local regulatory protection.

Binance’s IDR-Friendly Global Platform

Even though Binance doesn’t have a direct license from OJK in Indonesia, it is still accessible to users and operates in partnership with Tokocrypto to meet local requirements. As the largest crypto exchange in the world, Binance gives Indonesian users access to hundreds of currencies with deep liquidity.

Indonesian users pay 0.10% for trades, but you can make that 0.075% if you use BNB tokens. And for the big players, the VIP program can get you as low as 0.011% for makers and 0.023% for takers. Recent research has shown that a $100 BTC purchase will cost you around $0.10 in fees, which is much less than local exchanges.

Binance is working with Tokocrypto, which is an exchange registered in Indonesia. This partnership is another way that Binance may be able to meet regulatory requirements for Indonesian users. Binance also lets people trade directly with each other (P2P) using IDR. So, you can skip the international wire transfers and go straight from regular money to crypto.

Comparing Crypto Exchanges in Indonesia

How top exchanges stack up against each other across key metrics to help you identify the best platform for your trading needs.

Trading Fees

The fees for trades change a lot between exchanges in Indonesia. This makes a real difference in how much cash traders actually pocket. Bybit and KuCoin both have about 0.10% for spot trades, but Gate.io starts at 0.20%. MEXC has been known to run deals to lower the fees.

If you trade a lot, you can save a chunk of cash. If you are a Bybit Supreme VIP, you will pay only 0.045% to make and 0.03% to take. You would pay 0% maker fees if you trade more than $100 million monthly on Gate.io. If you use native coins like BNB, GT, and KCS, you can get another cost reduction of around 20%-25%.

Security

All the big exchanges operating in Indonesia use really strong security. Bybit uses multi-signature cold storage and covers assets with insurance. Gate.io has 100% checked proof of reserves. KuCoin has stepped up how they provide security since past incidents and uses encryption along with multi-factor authentication.

The big difference between exchanges comes down to regulation. Licensed local exchanges will have some kind of direct regulatory protection, and global exchanges partner with local companies to comply with those regulations.

Cryptocurrencies Supported

Gate.io’s list has over 1,400 assets, MEXC supports over 1,700, and KuCoin supports over 900. Binance lags with just 350, but they have high liquidity across all of their trading pairs. Getting a chance to use these different exchanges gives Indonesians the chance to use popular coins, or get in early on new coins ahead of other traders.

What should you consider when choosing between exchanges?

When comparing exchanges, evaluate factors like fee structures, security protocols, available cryptocurrencies, liquidity levels, user interface quality, customer support responsiveness, and local fiat on-ramp options to ensure you choose a platform that fits your trading style and risk tolerance.

Regulation

Indonesian cryptocurrency regulation says exchanges have to get a license from OJK. International exchanges might not have a license directly from Indonesia, but they have to play by the local rules for AML and KYC. Users should look for exchanges that are operating above board and have transparency measures.

OJK replaced BAPPEBTI. This gives OJK more regulatory power and requires exchanges in Indonesia to meet requirements. Exchanges must keep $3.3 million in capital and have protection measures in place for consumers.

Payment Methods

It is really important for users from Indonesia to be able to deposit money. Major exchanges support IDR through bank wires, credit cards, and P2P trading. The Binance P2P platform lets people directly trade in IDR and local exchanges offer direct bank integrations.

It takes different amounts of time to process wires and each method charges different fees. Bank wires will have the lowest fees. However, processing may take 1-2 business days. Credit cards are instant, but incur fees of 1.5-3% of the transaction.

User Interface

Exchanges like Binance and KuCoin are beginner-friendly and have easy-to-understand interfaces alongside advanced trading tools. Mobile applications should have full functionality.

Trading bots can make trading easier for experienced users.

Customer support

The support team should be helpful when there are issues. Support teams should be multilingual and available through live chat, email, and phone.

Indonesia Crypto Exchange Regulations

Indonesia’s evolving crypto regulations aim to balance market innovation with investor protection. The transition from BAPPEBTI to OJK oversight introduces unified standards for licensing, capital requirements, and consumer safeguards, ensuring that exchanges operate transparently and securely under a single regulatory umbrella.

OJK Regulatory Framework

OJK took on regulatory oversight of digital financial assets in January 2025, replacing the BAPPEBTI framework. This is intended to reduce the load for market participants while adding protection measures for the consumer.

Exchanges must get a Digital Financial Asset (DFA) Exchange license and comply with operational standards. Licensed exchanges gain authority to list crypto assets.

Crypto Tax

Indonesia changed tax laws and replaced VAT obligations with income tax withholding. This makes crypto easier while establishing collection mechanisms for traders.

Exchanges must implement tax reporting systems and keep track of all transactions.

Legal Status

It is fully legal to trade crypto. You can trade, invest, and diversify. However, you cannot use crypto as a payment transaction in the domestic economy.

The legal framework provides clarity while maintaining monetary policy control. Current regulations are about encouraging market integrity, consumer protection, and compliance with money laundering standards.

Getting Started

Prepare by gathering your ID documents, selecting the right exchange, and ensuring a secure internet connection - this will make your registration quick and hassle-free.

Account Registration

Registration requires full identity verification. Users must provide identification, proof of address, and get through Know Your Customer (KYC) verification.

Binance requires email verification, document upload, and facial recognition. Gate.io offers verification levels with withdrawal limits.

KYC Verification

KYC compliance includes photo identification, proof of residence, and biometric verification.

More advanced verification requires bank statements and verification of funds.

Making Your First Deposit

Users can deposit through bank transfers, wire transfers, credit/debit cards, or P2P trading platforms.

Bank transfers have the lowest fees and credit card deposits are instant. P2P platforms have competitive rates and faster processing times.

Safe Trading

Safety includes applying multiple security layers. Users should enable two-factor authentication, use unique passwords, and confirm all URLs. Hardware wallets provide security for storage.

Users should diversify across multiple cryptocurrencies and reduce the value of each trade to minimize losses.

Conclusion

In 2025, Indonesia will offer sophisticated options for traders at all levels. The choice depends on trading preferences. Traders benefit from tools, beginners benefit from educational resources.