Staking cryptocurrency: What it is

Cryptocurrency staking is a way of earning passive income where users lock their digital assets to support the network and receive rewards. What is staking and how does it work? Can you earn from staking? What returns can you expect from staking? How do you withdraw profits from staking? We’ll explain.

Advantages

The main advantage of staking is that you can earn without expensive equipment, unlike mining. You only need to buy cryptocurrency and freeze it in your account. The analogy with a bank deposit is appropriate: instead of a financial institution, it’s a blockchain, and instead of money, it’s tokens.

The platform and cryptocurrency determine the conditions for staking, including the expected percentage returns. The minimum amount, locking period, and commission may vary. Some networks have flexible mechanisms: even short-term locking of crypto can yield rewards. This increases liquidity.

The Role of Staking

Staking provides blockchain security. The more users hold coins, the more resistant the network is to attacks. This is especially important for new projects. Therefore, they often attract participants with generous rewards.

Staking token processes are based on Proof-of-Stake (PoS) and its variations: Delegated Proof-of-Stake (DPoS) and Liquid Staking. These mechanisms reduce energy consumption, whereas Proof-of-Work (PoW) requires powerful computations.

The best staking offers flexible conditions, high profitability, and fast withdrawal options. Staking risks include price fluctuations and withdrawal delays.

Types of Staking

There are several types of token staking:

- Delegated Staking (DPoS). Users delegate voting rights to validators who confirm transactions. This method is convenient because it allows users to earn rewards without managing a node themselves.

- Local Staking. Coins are stored in a personal wallet. The owner has full control over their assets and is responsible for their security.

- Staking on Exchanges. Funds are placed on centralized platforms like Binance, Kraken, or Coinbase.

- Fixed-Term Staking. Assets are frozen in the account for a specific period. In some cases, early withdrawal from staking is not possible.

- Liquid Staking. Assets remain available for use in DeFi applications, making this type of staking flexible. However, it involves additional risks.

The choice depends on the user's strategy. For example, staking with a fixed term can offer higher returns.

Popular Blockchains for Staking

Some networks offer highly favorable staking conditions and high security. Returns, locking periods, and participation terms depend on the network chosen:

- Ethereum (ETH). The largest PoS network offering staking. Returns depend on the network’s load. The minimum amount is 32 ETH. However, pools exist that allow participation with fewer tokens.

- Cardano (ADA). The Ouroboros mechanism allows participation in staking without freezing assets. One of the most stable options for long-term storage.

- Solana (SOL). Guarantees fast transactions and low fees. However, occasional failures can affect staking availability.

- Polkadot (DOT). Nominated staking (NPoS) allows users to choose validators and earn additional income from their work.

- Tron (TRX). Delegated staking with voting for super-representatives. Key benefits include low fees and high liquidity.

Before staking cryptocurrency, it's important to study the blockchain's features to understand potential limitations and profitability.

Popular Coins for Staking

The most attractive staking offers come from five cryptocurrencies:

- Ethereum (ETH). Offers stable returns and high liquidity.

- Cardano (ADA). Allows short-term staking.

- Solana (SOL). Holds low fees and processes transactions quickly.

- Polkadot (DOT). Participation in voting.

- Tron (TRX). One of the most accessible tokens.

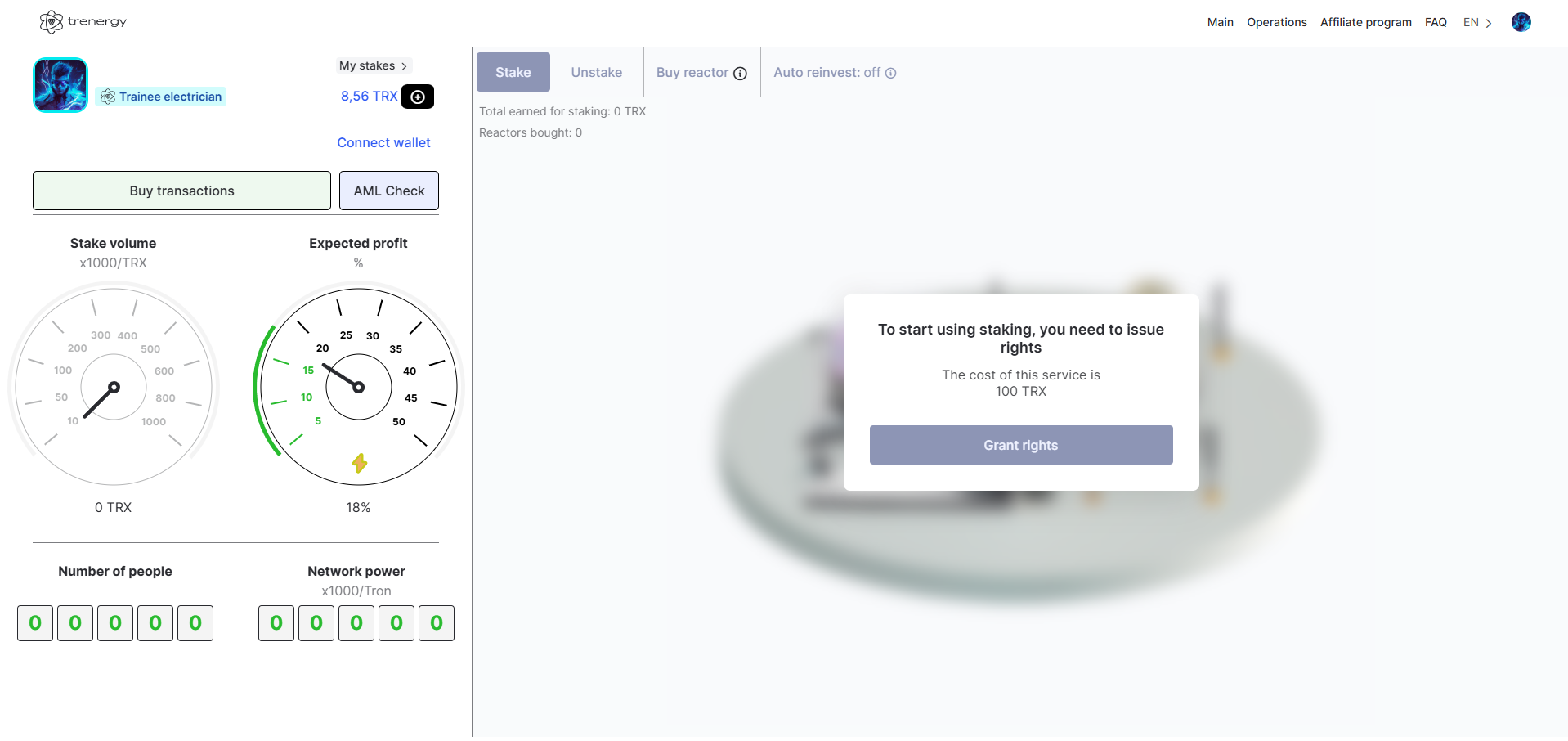

Staking Process

The staking process includes:

- Choosing a Cryptocurrency. You should consider: the conditions for staking, the percentage returns, and liquidity.

- Creating a Wallet. For freezing digital assets, you can use software and hardware wallets.

- Placing Funds. Open staking on one of the crypto exchanges.

- Receiving Rewards. Rewards are credited to your balance after you meet the staking conditions.

How to Withdraw Funds

The process of withdrawing earned assets depends on the platform and type of staking:

- Unblocking assets.

- Transferring funds to your balance or external wallet.

- Converting coins if necessary.

Platforms offer instant withdrawal or fixed waiting periods. For example, with Ethereum, the operation may take several weeks due to the PoS mechanism. Those who want to withdraw assets can check the user agreement.

Some platforms charge a commission for staking withdrawals, so you need to consider potential costs. The best platforms provide transparency regarding potential profits, allowing the investor to make an informed decision.

How to Earn from Staking

Staking is a form of passive income. To increase assets, the crypto investor does not need to constantly monitor the market or buy and sell tokens. The stages of staking are as follows:

- Choose a Platform. The place where tokens are locked affects the staking returns. Speed of withdrawal can vary. Some platforms offer a fixed interest rate, while others have floating rates based on supply and demand within the network.

- Choose a Cryptocurrency. Start by researching tokens: whether they provide liquidity, how secure they are, and what returns they offer. For example, staking ETH has a lower interest rate than many smaller projects, but the stability of the Ethereum network makes its token more predictable.

- Choose a Strategy. Before selecting a staking service, define the duration and amount of assets to lock. Some freeze coins for months or years, which helps avoid losses during periods of high volatility. However, long-term staking lowers the liquidity of crypto assets.

Experienced investors use combined strategies: they combine long-term staking with active trading. You can also stake part of your assets in fixed staking and use the rest for liquid staking. A popular approach among seasoned investors is to spread assets across several networks. Diversification helps reduce risks and manage assets more flexibly.

Commissions

Platforms may charge a commission for staking. Costs affect the final profits. There are several types of commissions:

- For depositing and withdrawing funds.

- For transaction confirmation.

- For network maintenance.

Some platforms automatically deduct part of the reward for validators or node operators. Others offer staking without commissions. Such platforms often have low returns and additional conditions.

Risks

Staking comes with risks. The three main risks are:

- Cryptocurrency Volatility. The price may drop significantly during the lock-in period.

- Asset Locking. Since staking often cannot be canceled, there is a risk of losing all invested assets.

- Platform Issues. Failures and hacks can affect staking efficiency.

To minimize risks, carefully read the staking instructions, including those on crypto exchanges.

Conclusion

Cryptocurrency staking is a mechanism for earning passive income by placing assets in the network. However, you need to consider returns, commissions, and potential risks. The effectiveness of the tool depends on various factors: market conditions, blockchain policies, and token volatility. Beginners should start with small amounts. Experienced investors can use complex strategies and combine different types of staking to maximize income.

Staking is an essential tool for decentralizing blockchain. The more users participate, the stronger the network is against attacks. Therefore, staking is not only a way to earn but also an opportunity to contribute to the reliability of crypto projects.