How to Trade Cryptocurrency for Beginners

By 2025, the crypto market is still seeing rapid growth worldwide. You can trade coins using methods like spot trading, futures, P2P platforms, and decentralized exchanges. Just remember to be careful and stay secure when using these tools. If you're interested in learning how to trade crypto, this guide gives you the basics and tells you how to avoid common errors.

What is Crypto Trading?

When you trade crypto, everything goes on the blockchain. This system verifies each transaction across its network.

To trade crypto well, keep an eye on market prices, transfer costs, transaction times, and the security of sending and receiving tokens.

How to Trade Crypto for Beginners

If you’re new to crypto and want get into trading, here are the main steps.

Picking a Platform: Exchange, P2P, or DEX

There are a few trading options on crypto platforms:

- Exchange trading (spot or futures): People can trade with each other directly on the exchange. Traders use charts and order books to help them decide when to buy and sell.

- P2P trading: With this, you trade crypto directly with another person. The platform holds the crypto until payment is verified. This is usually the simplest way to move funds in or out, mainly if regular bank options are limited.

- Decentralized exchanges (DEX): These exchanges allow direct trading through automated agreements, so there’s no middleman. You have complete control over your digital wallets and security.

When you pick a platform, consider payment methods, ID checks, and trading fees. This is key if you want to trade crypto with responsibility and make money.

Choosing Cryptocurrencies and a Plan

Next, decide what to trade: Bitcoin, Ethereum, stablecoins, etc. Your pick depends on how you plan to trade:

- Day trading – You open and close trades in a single day. Great if you want to benefit from quick price changes.

- Swing trading – Holding positions for several days or weeks.

- HODL – Long-term holding of assets regardless of price fluctuations.

For beginners who want to learn how to trade crypto, it’s useful to follow market updates, use analytics tools, and always check publication dates — outdated charts can be misleading.

Practice With Demo or Paper Trading

Before using real money, try demo accounts or paper trading to practice.

- Demo trading lets you play with fake money on an exchange, which copies real market conditions, but you can't lose anything.

- Paper trading lets you test trading strategies without any actual financial risk.

Think of it as a practice ground where you can learn to place orders, observe price movements, and refine your approach using fake money. It's a safe way to get comfortable with the market.

How to Trade Crypto on Exchanges

By 2025, traders worldwide have access to a wide variety of methods. Let’s review the main ones.

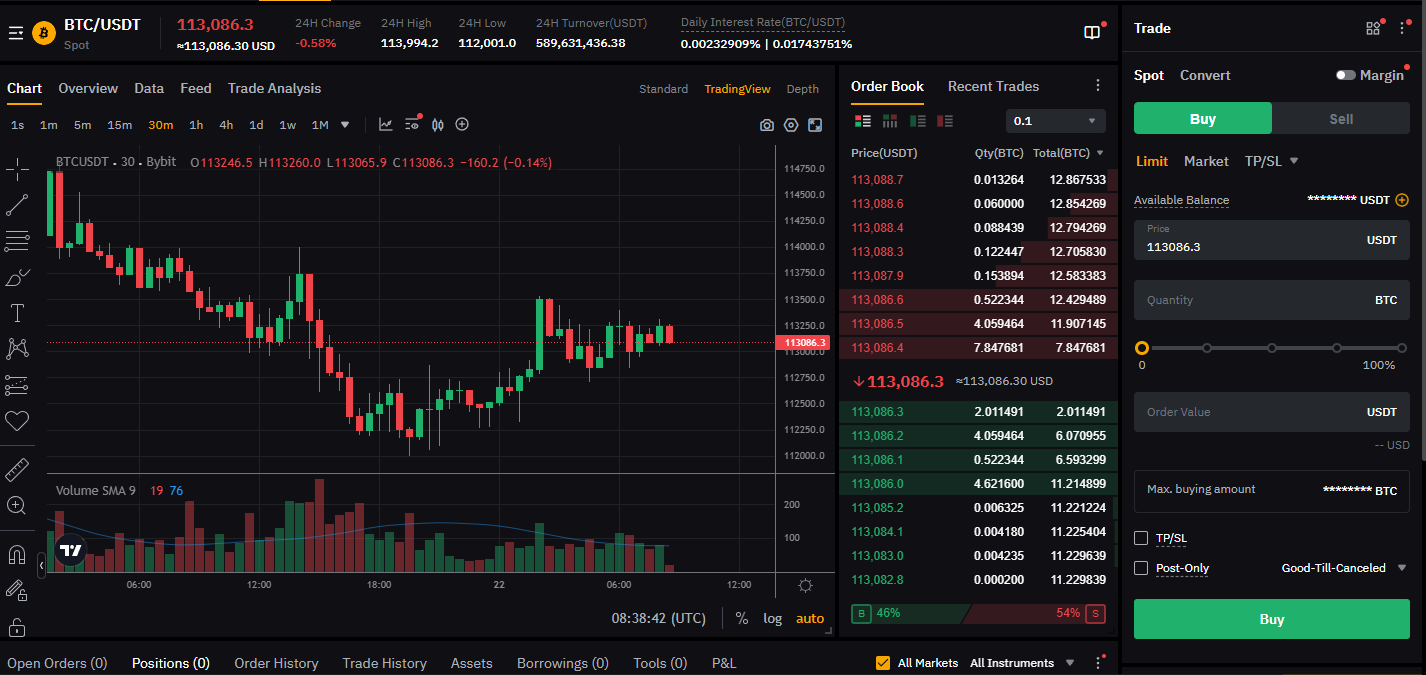

Spot Trading

Spot trading is the classic form where you buy an asset at the current market price and receive it directly in your wallet. Some platforms also support instant swaps — exchanging one coin for another.

Advantages of spot trading:

- Direct control over your coins and withdrawals.

- Simple and transparent process.

- Suitable for long-term investment strategies.

Disadvantages:

- High volatility — prices can change rapidly.

- Requires constant market monitoring.

Spot trading is where most beginners start when learning how to trade crypto currency because it’s straightforward and less risky than advanced tools.

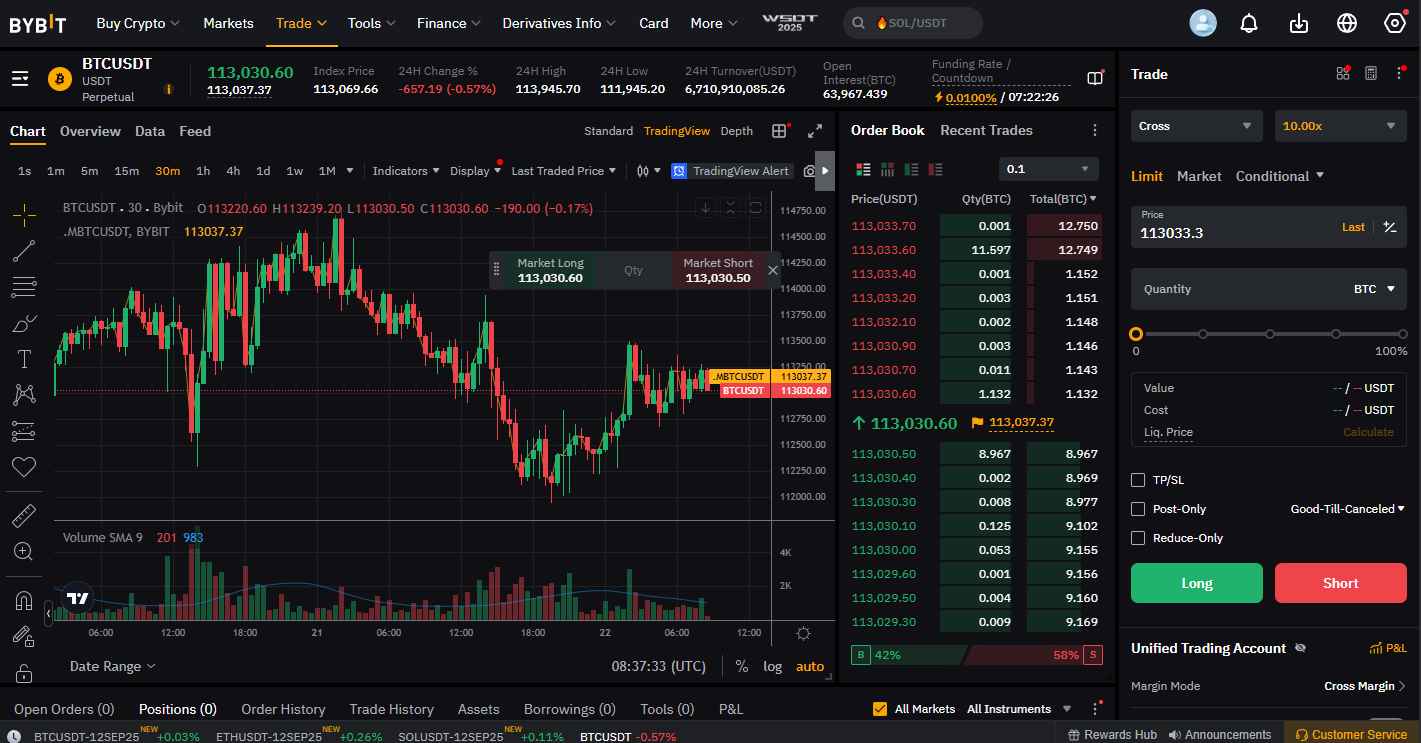

Futures Trading With Leverage

Trading futures lets you bet on crypto prices without actually owning any. The main thing to know is that futures use leverage. This can increase your possible gains, but it also increases the risk.

For example, with 5x leverage, a 2% price move in your favor equals 10% profit. But if the market moves against you, losses increase fivefold.

By 2025, you can trade futures on big exchanges globally, such as Binance, Bybit, OKX, and Bitget. Before you use leverage in crypto trading, make sure you learn about risk management. It's really important.

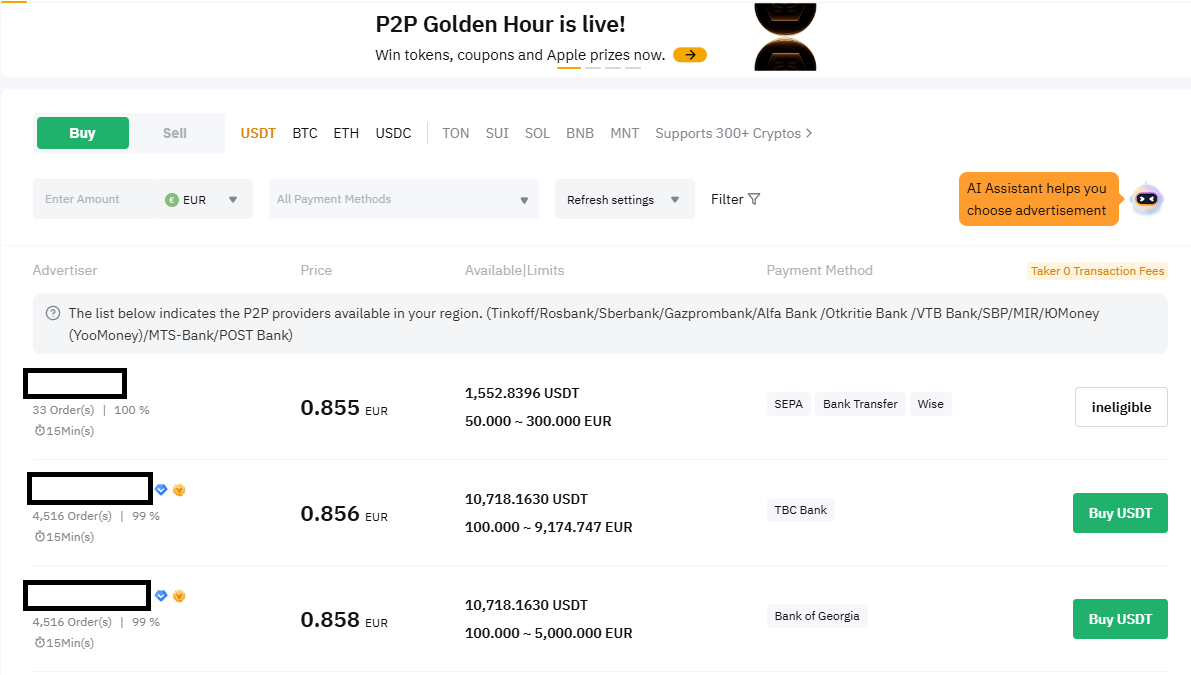

P2P Trading

P2P allows users to trade directly, with the platform acting as a guarantor. Cryptocurrency is held in escrow until payment is confirmed.

Pros of P2P trading:

- Wide choice of payment methods.

- Flexible deal conditions.

- Convenient for deposits and withdrawals.

Cons:

- You must carefully check the counterparty’s reputation.

- Possible delays in transfers.

- Some sellers may set higher commissions.

In many countries, P2P is one of the best answers to how to trade in cryptocurrency when banking restrictions make traditional transfers difficult.

How to Choose a Platform for Cryptocurrency Trading

In 2025, choosing the right platform remains one of the most important decisions for traders. Several options are available:

- International exchanges – Platforms such as Binance, Bybit, OKX, Bitget, and Kraken provide a wide range of tools: spot, futures, P2P, staking, and copy trading.

- P2P platforms and exchangers – Services that allow direct swaps between users. Aggregators help find the best rates and reliable partners.

- Telegram and Web3 services – Quick ways to trade directly through messaging apps or decentralized applications.

When learning how to trade cryptocurrency and make profit, always consider not just fees and prices but also reputation, transaction speed, and security. Local exchanges in some countries also offer easier deposits and withdrawals via national payment systems.

How to Trade Crypto on Bybit

Bybit remains one of the top international exchanges offering spot, futures, and P2P trading. For beginners looking for how to trade crypto for beginners, it provides a user-friendly interface and multiple payment methods.

Funding via P2P

- Open the P2P section in the app or website.

- Select a seller with strong reviews.

- Check payment terms and the exchange rate.

- Send funds to the seller.

- Wait for confirmation.

- Receive your crypto balance.

Choosing the Market

Bybit offers two primary options:

- Spot market – Buying and selling cryptocurrencies directly.

- Futures market – Trading contracts with leverage for higher potential gains and losses.

Choosing a Trading Pair

Traders can pick pairs such as BTC/USDT, ETH/USDT, or other altcoins, depending on what they're trying to do.

Order Types

- Market order: Fills right away at the current price.

- Limit order: Fills at the price you set.

- Stop order: Triggers when the price hits a certain point.

After you enter the amount and confirm, your order goes through. This step is important for anyone learning how to trade crypto safely and make money.

Crypto Trading: Legal in 2025?

Whether or not trading is legal depends on where you are:

- Crypto is seen as a financial asset and taxed in Japan, Germany, Switzerland, and most of the EU.

- Trading is legal in the U.S., but you have to follow KYC/AML rules and report your taxes.

- China and some Middle Eastern countries still have rules or bans.

- governments in the UAE and Singapore are actively helping the crypto space.

Look into your local laws before you jump in. Knowing how to trade crypto responsibly means following the rules.

Conclusion

In 2025, crypto trading mixes old methods with new chances. More traders are now trying out P2P platforms, decentralized services, and automatic trading plans.

To trade crypto well, make sure you have a strategy that matches what you want to achieve, how much risk you can handle, and the rules in your area. If you’re a beginner, start by investing small amounts, pick exchanges that you trust, and build up your portfolio slowly.

DeFi and Web3 are still popular because they offer access to markets all over the world, without needing a middleman.These improvements provide new chances in digital currency for those interested in how to trade crypto and make money.