How to Short Crypto: Complete Guide for 2025

Want to make money when crypto tanks? Short selling is is the way to do that. You borrow crypto, sell it fast, and buy it back later when it’s cheaper. This guide covers the basics and some smarter moves.

What’s Short Selling?

When you short sell, you borrow crypto from a platform, sell it at the current price, and plan to buy it back later at a lower price to return it. Your profit is the difference between your initial selling price and the buy-back price, minus fees and other costs..

Short Versus Long

A short position is a wager that crypto will fall, while a long position bets on it going up. In crypto, you can profit whether the market rises or falls — if you pick correctly. Short positions let you win when the market drops, which usually hurts regular investors.

Long positions mean you own the crypto. Short positions mean you borrow crypto that you don’t own. Long trades can make unlimited money because prices can always go up, but you can only lose what you invested. Short trades can lead to unlimited losses because prices can keep rising; a short’s maximum profit is limited by the asset falling to zero.

How It Works

When you short crypto, you’re doing the reverse of “buy low, sell high”. Instead, you sell high, buy low. You borrow crypto, sell it, and hope the price falls so you can buy it back for less. Then, you repay the loan and pocket the extra cash.

Why Short Crypto?

The crypto market is pretty unstable, which means chances to make money go both ways. Short selling can be used for more than just guessing which way the market will go.

Finding Opportunities During Downturns

Crypto markets are known for big price swings. When the market is down, short selling lets you profit from falling prices instead of just sitting there or losing money on long positions.

Protecting Your Crypto Investments

Short positions can act like insurance for your crypto holdings. If you hold Bitcoin for the long term but expect a short-term drop, a short position can hedge potential losses while you keep to your investment plan.

Making Money from Price Changes

Crypto’s instability means lots of chances for short-term traders. Many use short selling to make money whether prices go up or down, which doubles their chances compared to just buying and holding.

How to Short Crypto: The Ways to Do It

There are a few ways to short crypto, and each has its own pluses, minuses, and needs.

Margin Trading

Margin trading is the most common way to short crypto. You put up some money with an exchange, borrow the crypto you want to short, sell it right away, and then buy it back later to pay back the loan. Exchanges usually want you to put up 20-50% of the position’s value as money.

Here’s how it works: borrow the crypto, sell it at the current price, wait for the price to fall, then buy it back and repay the loan. Big exchanges like Binance, Kraken, and Bitfinex let you do margin trading for different cryptos.

Futures Contracts

Futures contracts let you agree to sell crypto at a price you set now, but at a later date. You don’t have to borrow any crypto. Instead, you make a deal that makes money when prices drop below the price you agreed to sell at.

Perpetual futures are popular in crypto because they don’t end at a specific date. These contracts use funding rates to keep prices close to the regular market prices, so they’re good for both short-term and long-term shorting strategies.

Options Trading

Crypto options give you the choice, but not the requirement, to sell crypto at a certain price by a certain date. Put options get more valuable when crypto prices drop, which is another way to short. Options trading doesn’t take as much money as margin trading, but it’s more complex.

CFDs and Derivatives

Contracts for Difference (CFDs) let you guess whether crypto prices will go up or down without owning the crypto. When you start a short CFD position, you make money when the price drops without borrowing any crypto. CFDs mean you don’t need crypto wallets or to deal with private keys.

Where to Short Crypto: Top Platforms

Picking the right platform is key for shorting crypto. Different exchanges offer different amounts of leverage, fees, and cryptos you can trade.

Shorting on KuCoin

KuCoin lets you short with up to 100x leverage on many crypto pairs. The exchange charges 0.020% for makers and 0.060% for takers, with more discounts if you have KCS tokens. KuCoin offers both spot margin and futures trading.

Shorting on Binance

Binance, the biggest crypto exchange, lets you short in a few ways, including margin trading with up to 125x leverage and futures markets. To short on Binance, send money to your margin wallet, pick the crypto to short, choose your leverage, and place a sell order. Binance charges 0.02% for makers and 0.05% for takers in futures trading.

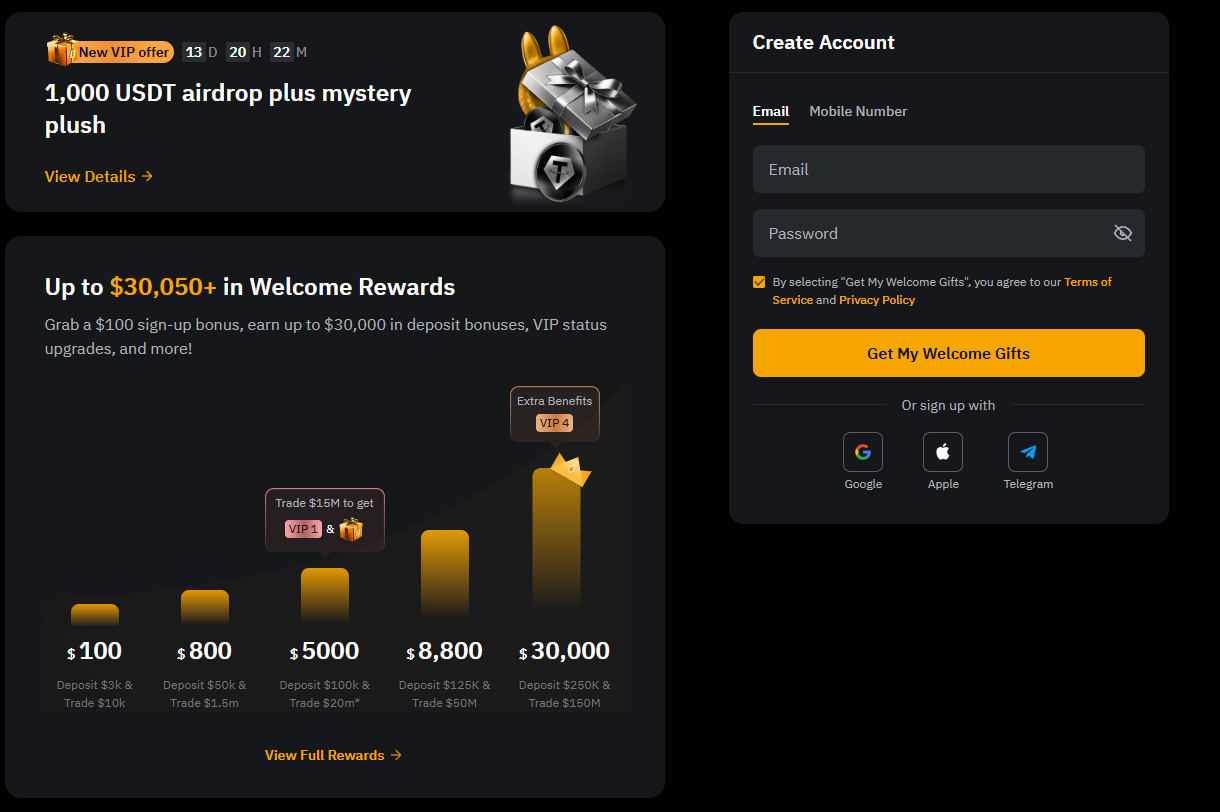

Shorting on Bybit

Bybit is known for derivatives trading, with up to 100x leverage on futures contracts. It executes orders fast and has fees of 0.02% for makers and 0.055% for takers. Bybit’s Smart Leverage gives you up to 200x leverage with no risk of being wiped out before settlement.

Shorting on Kraken

Kraken offers a safe place to short crypto with up to 5x leverage. While it doesn’t offer as much leverage as others, Kraken focuses on being secure and following the rules. It charges 0.02% for makers and 0.05% for takers, with good margin interest rates.

How to Short Bitcoin: A Step by Step Guide

To short Bitcoin well, first look into the market and technical indicators. Pick an exchange that lets you short Bitcoin, prove who you are, and add money. Choose how you want to short (margin trading or futures), set the amount and leverage, place your short order, and watch it with stop-loss orders.

How to Short Ethereum (ETH)

Shorting Ethereum is like shorting Bitcoin, but the price might change differently, which means different chances to trade. Big exchanges let you short ETH through margin trading and futures contracts, with leverage from 2x to 100x, depending on the platform.

Short Term Crypto Trading Strategies

Short-term crypto trading uses technical analysis and fast position management. Good strategies include scalping on minute charts, day trading using hourly patterns, and swing trading over a few days. Managing risk is important with short-term strategies because crypto can be very unstable.

Best Short Term Crypto Coins

Cryptos that are traded a lot, like Bitcoin, Ethereum, and other big coins, have the best trading action for short-term shorting strategies. Newer coins might have prices that change more, but they’re riskier because they’re not traded as much and can be manipulated.

Crypto Short Selling Strategies

To short crypto well, you need plans based on market analysis and managing risk.

Technical Analysis for Short Trading

Technical indicators help you find the best times to get in and out of short positions. Moving averages, RSI, MACD, and support/resistance levels show you when prices might change direction. Trend-following strategies do well in crypto markets because there’s strong momentum.

What Shorting Crypto Means - Risk Management

Managing risk is key when shorting crypto because you can lose unlimited money. Good strategies include position sizing (never risk more than 1-2% of your money per trade), setting stop-loss orders above where you got in, and using take-profit orders to make sure you get your profits.

Short Term Trading Crypto Methods

Good short-term methods include scalping (holding positions for minutes), day trading (closing positions within 24 hours), and swing trading (holding for a few days). Each method needs different ways to manage risk and different amounts of time.

Stop-Loss Orders and Position Sizing

Stop-loss orders automatically close positions when prices go against you. Position sizing makes sure that no single trade can wipe out your money – traders usually risk 1-2% per position. Position sizing is even more important with leveraged short positions because losses are bigger.

Market Changes and Unlimited Losses

Unlike long positions where the most you can lose is your initial investment, short positions can lose unlimited money. If you short Bitcoin at $30,000 and it goes to $60,000, you lose 100% plus interest and fees. Crypto’s instability makes these risks bigger than with regular investments.

Margin Calls and Getting Wiped Out

When your position goes against you, exchanges might ask for more money. If you don’t give them more money, they’ll automatically close your position, which means you lose money. High leverage makes it more likely you’ll get wiped out – a 10% price change against you with 10x leverage means you lose everything.

Tips for Shorting Crypto Well

To short crypto like a pro, you need to be ready, analyze the market, and trade in a disciplined way.

Research and Market Analysis

Do your homework before shorting. Look at market feelings, technical indicators, news, and regulations. Understanding market patterns and knowing when coins are overpriced increases your chances of shorting well. Use different timeframes and indicators to make sure you’re reading the signs right.

Managing Risk When You Short Sell Crypto

Good risk management means spreading short positions across different cryptos, using the right position sizes, setting stop-losses, and not letting emotions drive your trading. Keep track of your trades to learn from both wins and losses.

Timing Your Short Positions

Timing is important in crypto shorting because prices change fast. Look for signs that the market is tired, negative signals in technical indicators, and resistance at key price levels. Don’t short during strong uptrends – wait for prices to change direction or go down a bit.

Conclusion

Shorting crypto can be profitable in falling markets, but it is risky — losses can be unlimited. To do it well, choose reliable platforms, learn the mechanics, practise with small or demo positions, use stop-losses and proper hedges, manage risk carefully, and monitor the market constantly.