Delisting of USDT in Europe: reasons, consequences, and what to do

One of the most discussed topics of the past year is the delisting of the USDT stablecoin on all cryptocurrency exchanges in Europe by December 30, 2024. This initiative has sparked widespread debate and raised many questions in the crypto community. Today, we’ll explore how the delisting of USDT might affect the market, the risks investors might face, and the future outlook for the industry.

Why is USDT being delisted?

The primary reason for the delisting of the USDT stablecoin lies in the new requirements of the European Union under the MiCA (Markets in Crypto-Assets) legislation.

MiCA is a regulatory framework for cryptocurrencies, adopted in September 2024, aimed at ensuring investor protection in the digital market and combating money laundering. On one hand, these measures aim to reduce risks for investors and prevent illegal activities. On the other hand, they may create liquidity challenges and increase costs for exchange clients.

Pascal Saint-Jean, CEO of 3iQ Corp, noted that most cryptocurrency transactions are conducted in USDT primarily due to its ease of use and low fees. Consequently, investors will need to exit USDT pairs to buy the same asset trading with another stablecoin, leading to disruptions.

What does MiCA require?

MiCA introduces strict requirements for stablecoin issuers, including the need for a license to issue and operate such assets within EU countries. The rules apply to both cryptocurrency exchanges and stablecoin issuers. Key requirements include:

- Full disclosure of stablecoin reserves;

- Liquidity guarantees;

- Compliance with security and data protection standards;

- Registration and licensing within EU jurisdictions;

- Cooperation with law enforcement agencies.

What led to the decision to delist USDT?

НDespite the popularity of USDT and the lack of full transparency in Tether’s reserves, EU regulators have viewed the stablecoin as a potential risk to financial stability for several years.

Currently, Tether does not meet the new MiCA requirements. As a result, all cryptocurrency exchanges in the EU are required to delist USDT by December 30, 2024.

Notably, Tether responded to the initiative by ceasing support for the EURT stablecoin in early December 2024. Additionally, on December 17, Tether invested in StablR, a stablecoin issuer, as a strategic move to introduce regulated stablecoins EURR and USDR to the European market.

“Tether’s investment in StablR demonstrates our support for the European digital asset ecosystem,” said Tether CEO Paolo Ardoino.

Furthermore, Tether partnered with Quantoz Payments, enabling the issuance of EURQ and USDQ stablecoins on the Hadron platform.

How will the delisting of USDT impact the market?

The delisting of USDT from European exchanges could have a significant impact on traders and the cryptocurrency market. Let's examine the main consequences:

Liquidity reduction

USDT is the most popular stablecoin in the cryptocurrency market. The majority of trading pairs on exchanges use USDT as a base asset. Consequently, delisting Tether could significantly reduce trading volumes and complicate trading operations for users.

Increased popularity of alternative stablecoins

Following the delisting of USDT, traders will be forced to seek alternative stablecoins, such as USDC by Circle. These assets have already gained popularity due to their compliance with European standards. However, this shift may lead to additional challenges for investors, including higher fees.

Market volatility

Removing USDT from listings could lead to increased volatility, especially in trading pairs where USDT was previously the primary currency. Significant price fluctuations could result in losses, prompting investors to reassess and adapt their trading strategies accordingly.

The state of the stablecoin market

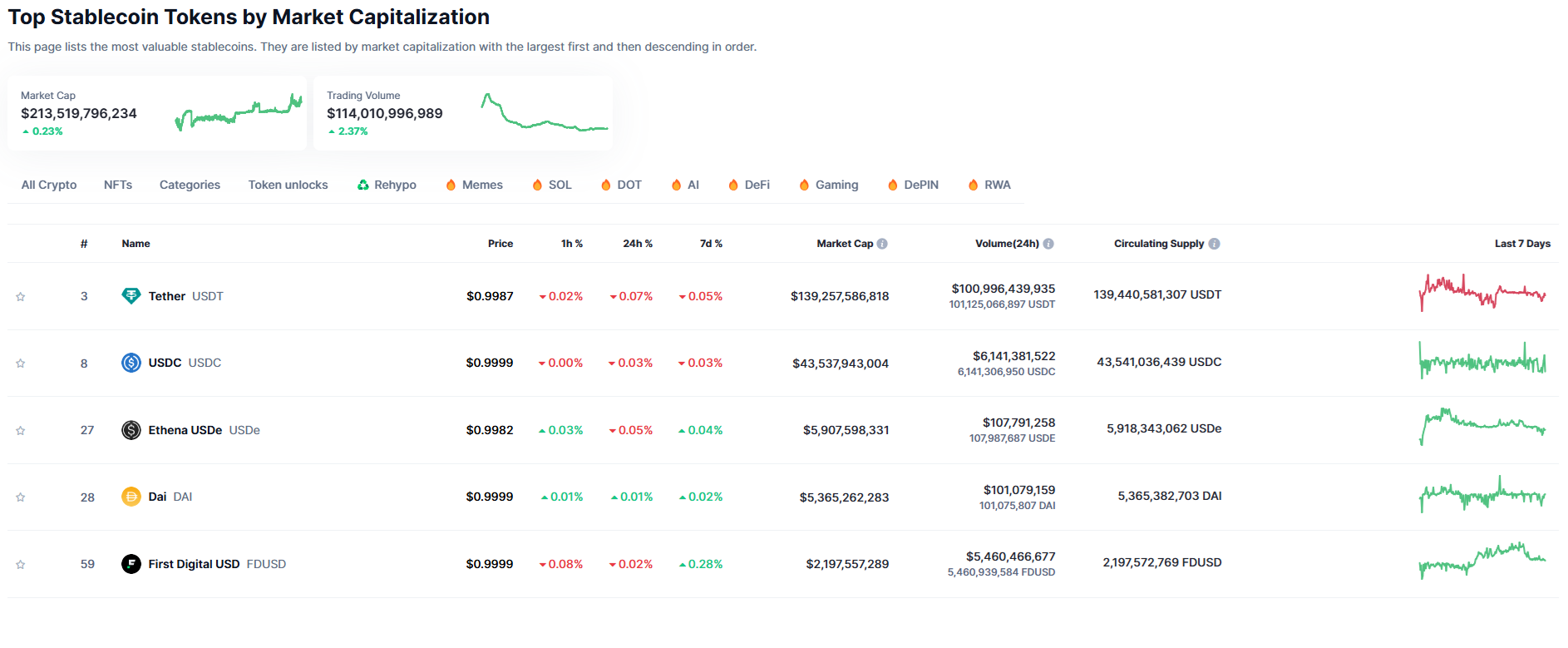

According to CoinMarketCap, the total capitalization of stablecoins in the cryptocurrency market exceeds $200 billion. USDT accounts for over $139 billion, while USDC comprises more than $43 billion.

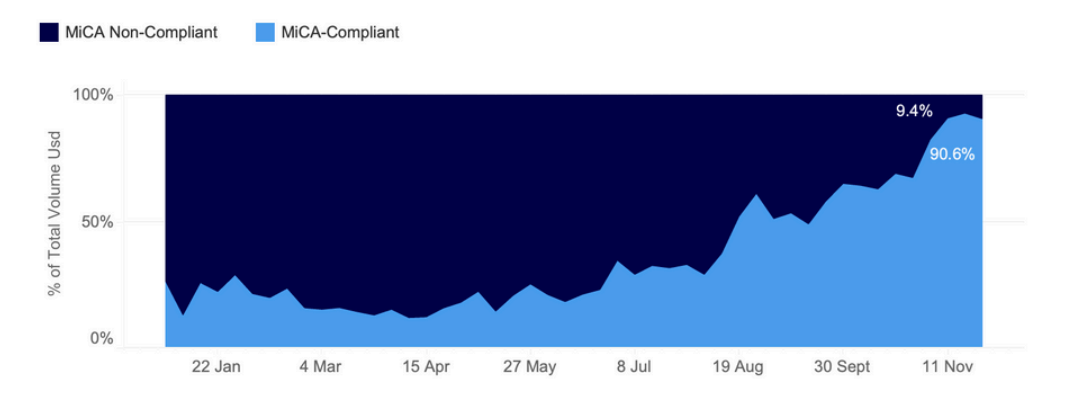

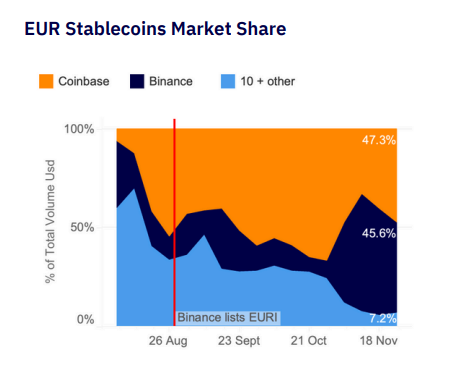

Despite potential challenges with USDT's delisting, the market share of MiCA-compliant stablecoins is growing. According to a study by Kaiko and the Dutch cryptocurrency exchange Bitvavo, stablecoins such as EURC (issued by Circle), EURCV (by Societe Generale), and Eurite (EURI, issued by Banking Circle S.A.) captured 91% of the market in 2024.

The cryptocurrency exchange Binance has almost caught up with Coinbase after adding the EURI stablecoin in the summer of 2024.

Meanwhile, Coinbase remains the leading player, holding 47% of the market share.

Risks for investors and traders

Switching to less commonly used stablecoins or other cryptocurrencies involves significant risks, including:

- Higher transaction fees;

- Lower liquidity compared to USDT;

- Reduced access to familiar trading tools.

Projections and long-term prospects

Although the delisting of USDT is a significant event for the crypto market, the long-term consequences may be less dramatic than expected. Possible scenarios include:

- Strengthening USDC's position: Due to its compliance with MiCA requirements, USDC may become the dominant stablecoin in Europe.

- USDT’s return: If Tether adapts to the new regulatory standards, USDT could quickly return to European exchanges.

- Increased interest in decentralized stablecoins: Growing demand for decentralized stablecoins like DAI, USDe, or FDUSD may stimulate their development and strengthen their market positions.

Conclusion

The delisting of USDT on European cryptocurrency exchanges underscores the increasing role of regulators in the crypto industry and the desire to create a safer, more transparent environment for investors. However, many investors and traders believe that MiCA's requirements will inevitably lead to serious challenges, including reduced liquidity, diminished anonymity, and excessive regulation.