What is P2P and how it works

The cryptocurrency world is full of terms that may seem complicated at first but often turn out to be simple and clear. One such term is P2P. P2P trading is a system that allows people to exchange cryptocurrencies directly, bypassing intermediaries.

In this article, we’ll explain what P2P trading is, how P2P works, and why this method has become so popular. We’ll keep things as simple as possible, so even beginners can follow along.

What is P2P?

P2P (Peer-to-Peer) translates to "equal-to-equal." Imagine a market where sellers and buyers negotiate directly without intermediaries. This is similar to how it works on cryptocurrency exchanges: one person sells cryptocurrency, another buys it. The exchange only provides a platform to ensure secure transactions.

Unlike traditional exchanges, where all trades go through centralized systems, in P2P everything is decided between participants. It’s convenient, flexible, and often helps avoid extra fees.

How does P2P work?

To understand how P2P works, imagine a simple scenario. You want to buy Bitcoin but avoid losing money to large exchange fees. Instead, you visit the P2P section of a cryptocurrency exchange, find an offer from someone willing to sell Bitcoin, and purchase directly from them.

Here’s how the process works:

- Sellers post their ads with prices and conditions.

- Buyers select a suitable offer.

- The exchange locks the cryptocurrency in escrow. This is like a temporary safe that ensures the funds don’t disappear.

- The buyer sends the payment.

- Once the seller confirms payment, the cryptocurrency is transferred to the buyer's account.

Escrow protects both parties from fraud. The cryptocurrency remains locked until the payment is confirmed.

How Does P2P Work on a Crypto Exchange?

To understand how P2P works, imagine a simple scenario. You want to buy Bitcoin but avoid losing money to large exchange fees. Instead, you visit the P2P section of a cryptocurrency exchange, find an offer from someone willing to sell Bitcoin, and purchase directly from them.

Here’s how the process works:

- Sellers post their ads with prices and conditions.

- Buyers select a suitable offer.

- The exchange locks the cryptocurrency in escrow. This is like a temporary safe that ensures the funds don’t disappear.

- The buyer sends the payment.

- Once the seller confirms payment, the cryptocurrency is transferred to the buyer's account.

Escrow protects both parties from fraud. The cryptocurrency remains locked until the payment is confirmed.

How Does P2P Work on a Crypto Exchange?

To understand how P2P works on a crypto exchange, let’s look at an example using a popular platform like Bybit:

- Registration and verification. First, you need to register and complete identity verification—a standard security measure.

- Selecting P2P trading. Choose the P2P trading section.

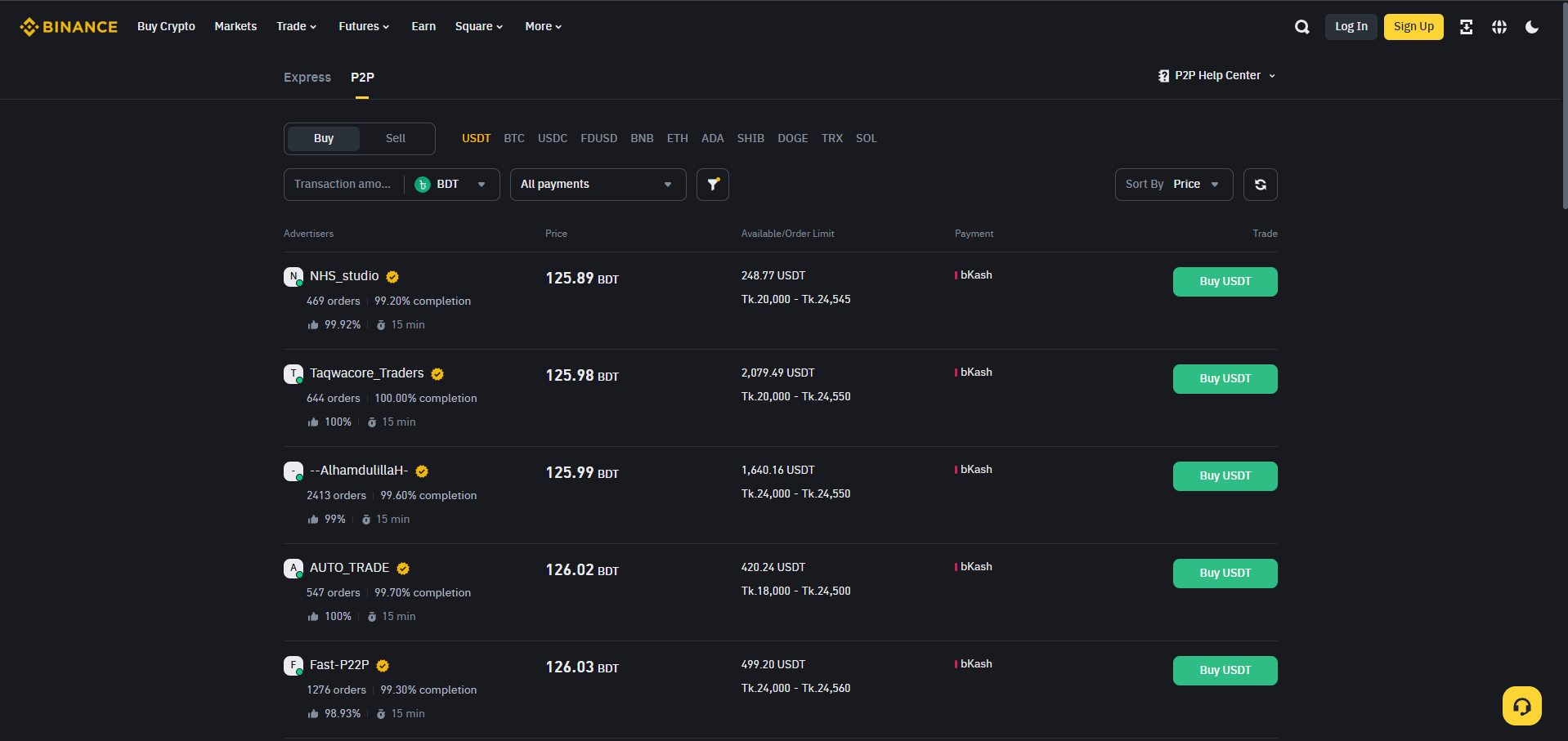

- Choosing an offer. In the P2P section, you’ll see a list of sellers and buyers, including their prices, available volumes, and deal conditions.

- Filter options. Choose the coin you want to buy or sell, the total amount, payment method, and other filters. For added security, check the "verified merchants" box. It’s recommended to trade with individuals who have a high number of transactions and a high completion rate.

- Making a trade. After selecting a trading partner and entering the required amount, you can click “sell” (or “buy”). You’ll then move to a private chat where the payment is made. Once the transaction is complete, the buyer receives the cryptocurrency.

Thanks to platforms like Bybit, Binance, or OKX, the entire process takes just a few minutes (or a maximum of half an hour).

Advantages of P2P

- Flexible conditions. You choose the price, payment method, and counterparty, much like haggling at a market.

- Minimal fees. Traditional exchanges can charge fees of several percent per transaction, but P2P often has minimal or no fees.

- Convenient payment options. Pay with a card or e-wallet—there are plenty of choices.

- Bypassing restrictions. In some countries, banks block crypto-related operations. P2P helps circumvent such limitations since it’s a direct exchange between individuals.

Disadvantages of P2P

- Delays. If a seller or buyer is slow, the transaction may take longer.

- Risks. Despite escrow protection, fraudsters still exist. For example, someone might send you a fake payment confirmation. Always verify that you’ve actually received the money (e.g., via your banking app).

Tips for Safe P2P Trading

- Choose trusted sellers and buyers by checking their ratings and reviews.

- Always operate within the platform. Never send money outside the escrow system.

- Read the deal terms carefully. Pay attention to limits, payment methods, and timeframes for transferring funds.

Why P2P Is Great

With P2P, you can not only buy and sell cryptocurrencies but also earn money:

- Trading price differences. Buy low, sell high, and profit—but don’t forget to consider fees.

- Creating your own ads. This lets you act as a “mini-exchange,” offering convenient conditions and earning on commissions.

Conclusion

This article has helped you understand how P2P trading works—it’s simpler than it seems. You’ve also learned its benefits and what to watch out for. It’s an excellent way for beginners and experienced traders to work with cryptocurrencies directly, without intermediaries.

The key is to stay vigilant, follow safety rules, and remember that P2P isn’t just about exchanging—it’s also an opportunity to feel part of the global crypto community.