Overview of Cryptocurrency Trading Bots

Round-the-clock cryptocurrency trading can be an exhausting process, and keeping up with rapid changes, trends, and coin rates in the market is often a challenging task for any trader.

According to some data, by 2026, the cryptocurrency trading bot market volume may reach $4.2 billion, with an annual growth rate increasing by 21.5%.

In this article, we will explore what cryptocurrency trading bots are, what types exist, and their main advantages.

What are Cryptocurrency Trading Bots

Trading bots or trading bots for cryptocurrencies are special software and services that allow traders to trade by executing pre-set algorithms automatically. Typically, bots can analyze market data, execute buy or sell orders, set stop-loss and take-profit orders, manage investment portfolios, and much more based on user instructions.

By automating the trading process, such solutions help traders and investors take advantage of price fluctuations without the need for constant manual monitoring of the crypto market.

Why Use Bots for Cryptocurrency Trading

The cryptocurrency market is extremely volatile, operating 24 hours a day, 7 days a week, making it often difficult for traders to keep track of all digital assets' behavior. Let's consider several main reasons why using automated bots can be beneficial in 2025:

1. Psychological Factors

Human emotions such as fear, greed, and anxiety often lead to impulsive decisions. Bots eliminate emotional trading and follow pre-set rules, ensuring that all trades are made based on a large amount of data and logic.

2. Time Savings

Trading automation systems work around the clock without breaks. This gives traders the opportunity to use market potential even while sleeping or away from the computer.

3. Efficiency

Trading bots analyze huge amounts of data and can make trades in seconds, faster than a human. This allows traders not to miss profitable opportunities.

4. Strategy Testing

Most bots offer backtesting features, allowing traders to test trading algorithms on historical data. This helps users refine their strategies before applying them in the real market.

Customizable Trading Strategies

In cryptocurrency trading, there is no one-size-fits-all approach; everything is highly individual. A well-developed bot allows customizing strategies depending on traders' preferences - acceptable risk, trading style, and choice of specific assets in the market. This flexibility makes such bots accessible to a wide range of traders.

Types of Trading Bots and Strategies

Various trading bots offer different approaches and strategies depending on the trader's goals:

- Scalping bots - designed for short-term trades, using small price changes within minimal time intervals.

- Long-term investment bots - examine fundamental indicators so that the trader can hold assets for an extended period (from several weeks to several years).

- Arbitrage trading bots - based on profiting from price differences of the same asset on different trading platforms.

- Indicator-based bots - make decisions by analyzing technical indicators such as moving averages (MA, SMA, EMA), as well as RSI, MACD, Volumes, etc.

- Trend bots - follow market movement (upward or downward trend).

The key potential of using bots in cryptocurrency trading lies in their ability to instantly react to any market changes, minimizing the influence of the human factor, but increasing the chances of successful trades.

Along with the advantages of using trading bots, there are risks: incorrect bot setup or choosing the wrong strategy for a particular cryptocurrency. This can lead to huge losses.

Popular Bots and Services for Crypto Trading

Among the many trading bots in 2025, several of the most effective can be highlighted:

Veles Finance

Veles Finance is a cloud platform for developing and launching trading bots, offering finely tunable tools for automatic trading of digital assets. The service offers users a complex of unique solutions, significantly differing from competitors in the market.

Advantages:

- Availability of ready-made strategies;

- Option to copy strategies and signals;

- Option to develop bots for both spot and futures trading;

- High performance and low latency in trading;

- Does not store client funds and deposits;

- No subscription fee;

- User-friendly interface.

Moreover, to minimize traders' risks, Veles Finance uses tools such as Stop-Loss to breakeven, Multi-Takes, and Trailing Take-Profit.

Disadvantages:

- No mobile application;

- Limited number of supported exchanges.

Features:

- Possibility to combine various indicators;

- No need to install programs or third-party tools to work with the service;

- Availability of backtests allowing professional testing of trading strategies;

- 20% commission fee from traders' profits;

- Flexible setup of trading by indicators, including CCI, MFI, RSI, Bollinger Bands, and signals from TradingView.

Available crypto exchanges:

Binance, Bybit, OKX, BingX, Gate.io, HTX.

KuCoin and Bitget will be connected to the project soon.

The translation continues with descriptions of other bots and services, advantages and risks of using trading bots, how to choose a reliable bot, key characteristics, setup and launch process, strategy selection, and future prospects of AI in crypto trading. The structure and headings are maintained throughout.

ArbitrageScanner

ArbitrageScanner is one of the most popular arbitrage scanners within the cryptocurrency marketplace.

Advantages:

- Availability of futures arbitrage, AI-pushed wallet evaluation and search, information scanner, and different various capabilities.

- Manual configuration of signals and monitoring of any cash.

- Arbitrage tutorials and personal supervisor services.

Disadvantages:

- Limitations at the wide variety of cash tracked.

- Short demo access duration with restrained functionality.

- Complex arbitrage setups are calculated manually.

Features:

- Unique API for its services.

- Ability to create custom analytical offerings and integrate statistics from CEX and DEX exchanges into your projects.

Available Crypto Exchanges:

Binance, Bybit, OKX, BingX, Gate.Io, Huobi, Xtcom, Mexc, Bitget, KuCoin, Phemex, Coinex, Coincatch, BTSE, Bitvenus, Poloniex, Lbank, Kraken, Coinbase, Sushiswap, Stonfi, Hyperliquid, Apex-omni, Bitmart, Bitmex, Probit, Bitrue, Whitebit, Uniswap, Deepcoin, Crypto.Com, Bitfinex.

RevenueBot

RevenueBot is a flexible net provider designed for producing passive profits from the operation of buying and selling bots.

Advantages:

- Maintaining and offering complete trading facts.

- The service does not store or receive consumer deposits.

- Has its very own marketplace for getting and selling the simplest bot configurations.

- No subscription rate.

- Ability to exchange multiple different pairs on distinctive exchanges.

- Futures buying and selling with leverage.

Disadvantages:

- No mobile utility.

- Limited number of supported exchanges.

Features:

- Availability of backtests for trying out trading techniques.

- Using a smart order grid for buying and selling.

- The carrier charges 20% of the investors' income from bots.

- Grouping bots by tags for convenient paintings with facts.

Available Crypto Exchanges:

Binance, ByBit, OKX, BingX, Bitfinex, Bitget, HTX, Gate.Io, Exmo, HitBTC, Kraken, KuCoin, Poloniex, MEXC.

Kryll

Kryll is a decentralized platform with advanced synthetic intelligence-primarily based tools that simplify the automation of virtual asset buying and selling and the exploration of Web three.

Advantages:

- Tracking and optimization of the complete portfolio the usage of superior synthetic intelligence.

- Fast tracking of trends in social networks, in addition to essential information.

- AI monitoring of "Smart Money" actions inside the marketplace.

- Availability of a mobile software.

Disadvantages:

- To absolutely launch a strategy, you want as a minimum $two hundred and 25 KRL tokens.

- Difficulty in putting in place for novices.

Features:

- Funding and partnership from Google.

- Project interaction with Google AI, Anthropic, and Google Cloud.

- Availability of its personal KRL token.

Available Crypto Exchanges:

Binance, Binance US, Coinbase Pro, KuCoin, Bittrex, Liquid, Kraken, HitBTC, FTX.

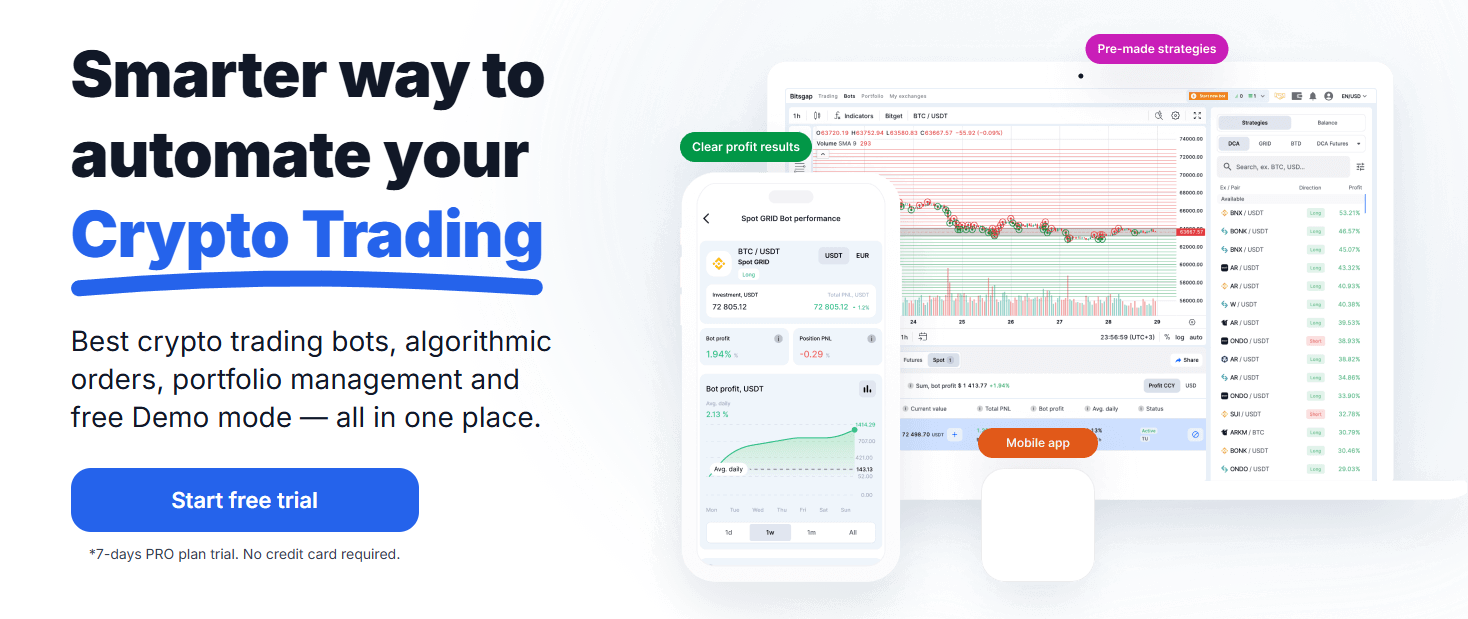

Bitsgap

Bitsgap is a browser-primarily based terminal designed for various sorts of automated trading.

Advantages:

- Testing techniques on real historic trading records.

- Maintaining and imparting complete buying and selling information.

- Ready-made configured techniques.

- High-give up encryption.

- AI-primarily based bot trading feature.

- Availability of demo buying and selling.

Disadvantages:

- Short trial duration.

- No leverage.

- Slow technical guide.

- No cellular software.

Features:

- More than six hundred cryptocurrency pairs.

- No commissions for trades and no extra expenses for deposits and withdrawals.

Available Crypto Exchanges:

Binance, Coinbase, HTX, OKX, Gate.Io, Bitget, Kraken, KuCoin, Crypto.Com, HitBTC, Bitfinex, Poloniex, Gemini, Whitebit, Bitmart.

Conclusion

The best cryptocurrency trading bots are radically changing the ways traders interact with the market. By automating trading strategies, trading bots provide efficiency, accuracy, and emotional neutrality that manual trading simply cannot match. However, while trading bots are highly effective, they are auxiliary tools. They have significant advantages but require a careful approach to selection, setup, and management. Whether you're a beginner or an experienced trader, a quality and well-developed bot can be a decisive factor on the path to big profits in trading.