Cryptocurrency Fees Explained: What They Are and How to Minimize Them

Every operation in blockchain consumes computing resources, for which a fee is charged. The size depends on the network load and other parameters. Let's figure out how fees work in crypto, why they are necessary and how to minimize transfer costs.

What is a fee in cryptocurrencies?

The initiator of the crypto transfer pays for processing transactions in the blockchain. The commissions perform three main functions.

- Incentivizes miners and validators. They receive rewards for maintaining the correct operation of the network.

- Protects against spam. Prevents overload with useless operations.

- Regulates priority. The higher the commission, the faster the transaction will go.

Understanding the fee structure helps traders navigate the world of digital assets. The main types of fees fall into several categories.

- Network fees (Miner/Validator Fees) – reward to miners or validators for processing and confirming transactions in blockchain. The size changes depending on the load on the network and current demand.

- Trading commissions – are charged by crypto exchanges for executing buy or sell orders. Usually calculated as a percentage of the transaction amount. May differ for makers (creating liquidity) and takers (taking liquidity).

- Withdrawal fees – are used when transferring cryptocurrency from exchanges to an external wallet. They can be fixed or floating.

- Deposit fees – are rare, but some platforms may charge them when crediting cryptocurrency to a user’s account.

Crypto without fees – myth or reality?

It is impossible to completely eliminate commissions in cryptocurrency: without them network will not be able to function correctly. However, there are ways to optimize costs - for example, blockchains that have low fees:

- Polygon – $0.002;

- Binance Smart Chain (BSC) – $0.01 - $0.03;

- Arbitrum (L2) – $0.01 - $0.05;

- Optimism – $0.007 - $0.001;

- Solana – $0.001 - $0.01.

Minimum fees for cryptocurrency transfers: comparison of popular networks

The size of the commissions in blockchains differs. It all depends on the network bandwidth, complexity of operations, current load. Let's compare several popular blockchains.

TRON (TRC-20)

Offers one of the most optimal commission structures. It uses internal network resources - energy and bandwidth. Freezing in staking tokens TRX, the user receives bandwidth and energy on the wallet balance, this reduces costs.

Current TRON fee for TRC-20: ~$4.40 - $9.49.

Ethereum (ERC-20)

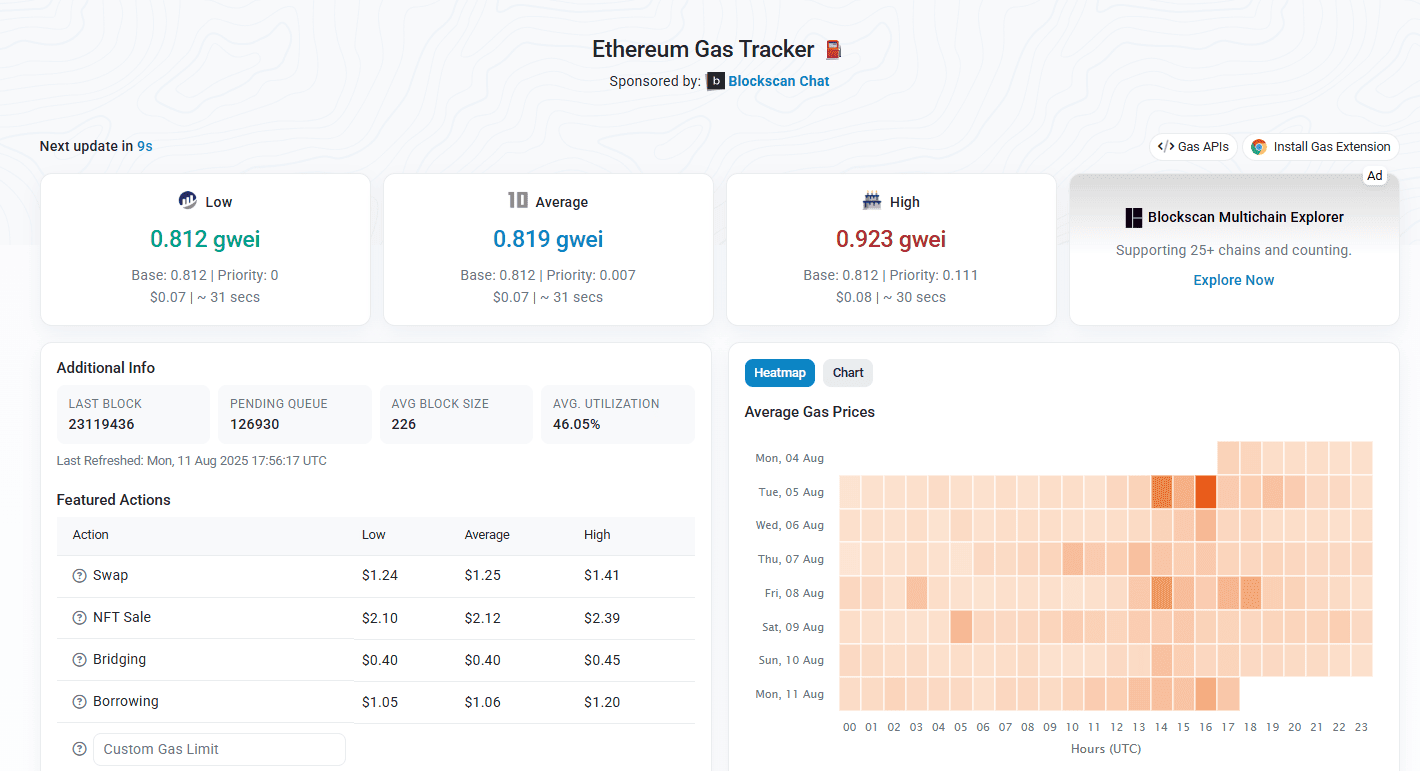

In the Ethereum ecosystem the commission known as gas and is measured in Gwei. Gas reflects the amount of computing resources required to process transactions or execute a smart contract. The total cost of the operation is formed from the amount gas and its current price. After the implementation of EIP-1559, part of the commission is automatically burned, which smooths out price fluctuations. With increased activity, the fees for transferring ERC-20 tokens in Ethereum can be significantly high.

Current Ethereum fee for ERC-20: ~$0.33 - $0.55.

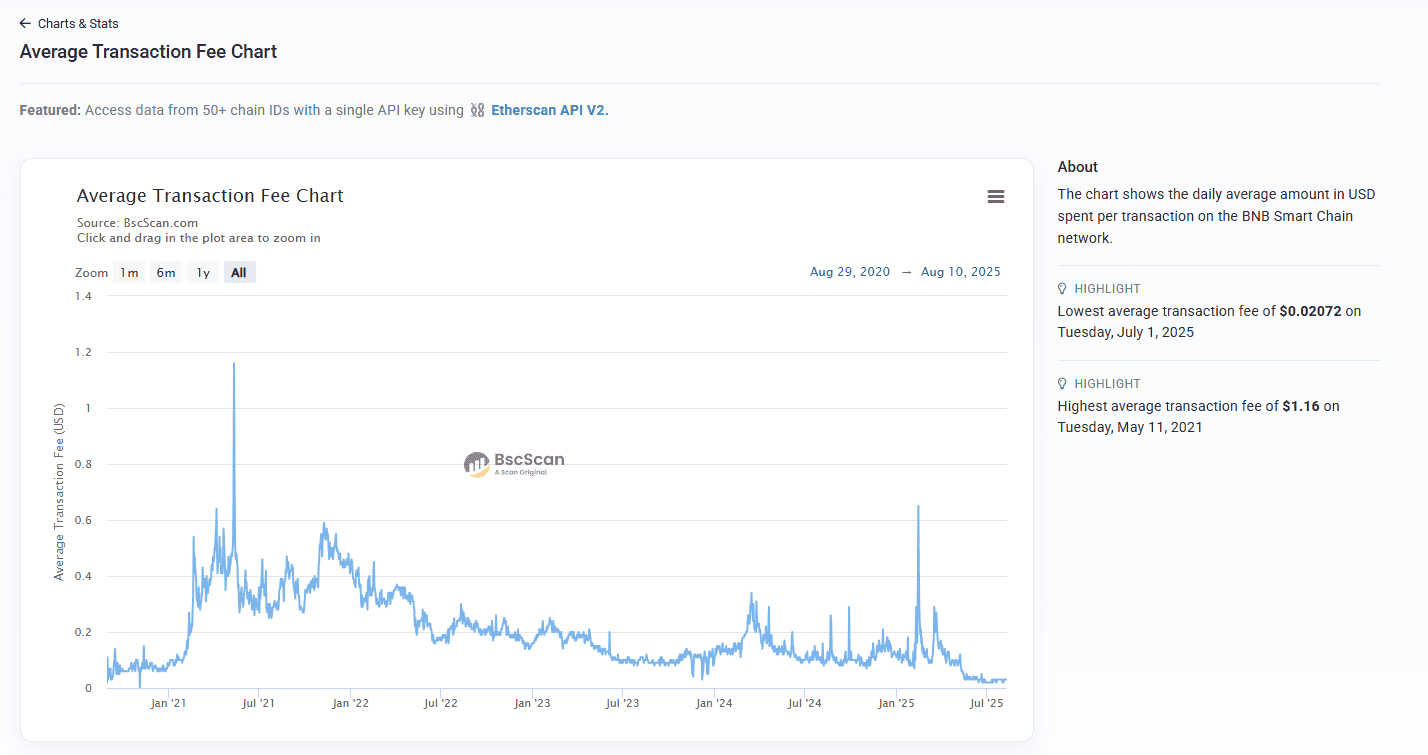

Binance Smart Chain (BEP-20)

Binance Smart Chain fees for BEP-20 tokens are generally lower than Ethereum (ERC-20) or Tron (TRC-20). The discount is achieved through an optimized network architecture and a more energy-efficient consensus mechanism. Users pay fees in native BNB tokens.

Current crypto fee in BSC for BEP-20: $0.02 – $0.03.

What does the fee for transferring cryptocurrency depend on?

The cost of conducting transactions in cryptocurrencies is a variable value. The size depends on the architecture of a particular blockchain.

Load on network is one of the key factors. When many users try to transfer cryptocurrencies at the same time, a queue for processing is formed. In such conditions, fees naturally increase – participants begin to compete for a place in the next block. In networks with proof of work (PoW), this increases the fee for accelerated confirmation, while in blockchains based on proof of stake (PoS), the base rate is adjusted.

The structure of the most transactions also plays an important role. In UTXO-type systems, which include Bitcoin, the processing cost is determined by the size of the transaction in bytes, not the nominal amount of the transfer. Transactions with many inputs and outputs take up more space, so they can be more expensive. In networks that support smart contracts, like Ethereum, the calculation is based on computational complexity - interactions with smart contracts require more resources than native token transfers.

Different blockchain platforms use different models for forming commissions. Bitcoin uses a market approach, where miners select the most profitable offers. Ethereum, after the EIP-1559 update, implemented a two-component system, including a basic burned commission and voluntary “tips” for acceleration. Such blockchains, like Solana or Avalanche, were originally designed with a focus on minimal fees. But they are also subject to fluctuations during peak loads.

Technical parameters of the blockchain – block size and throughput – directly affect the cost of transactions. The limited block size in Bitcoin and the relatively long period of its formation (about 10 minutes) create a deficit, which sometimes leads to a sharp increase in commissions. In Ethereum, a similar function is performed by limits on the number of computational operations in a block.

Layer 2 solutions offer alternative ways to reduce fees. The Lightning Network for Bitcoin and various L2 solutions for Ethereum (Arbitrum or Optimism) allow transactions to be carried out off-chain with results being recorded, which provides significant savings while maintaining the base level of security.

Thus, the cost of transactions is a complex mechanism that depends on the load, the type of operation, the architecture blockchain, available technologies scaling.

What is the optimal commission rate in crypto?

Balance between cost and speed confirmation forms the optimal commission for the transfer of cryptocurrency. The final amount depends on the purpose of the transaction.

- For urgent payments the priority is speed. In Bitcoin, it is worth choosing a commission higher than the average value, in Ethereum - set an increased gas price. This guarantees confirmation in seconds.

- For non-urgent transactions, you can try to set minimum fees, but be prepared to wait several hours or even days for confirmation.

The main principle: the lower the fee, the better for users. But too small a fee can lead to a long delay of the transaction in the mempool.

How to calculate transaction fees

Calculating transfer costs requires taking into account many dynamic factors, from market conditions and current network load to the type of transaction (simple translation of native tokens, interaction with dApps, transfers of stablecoins USDT). More accurate calculations are performed automatically. There are several popular services.

Bitcoin Fees Chart – official tracker for tracking commissions in blockchain Bitcoin.

Etherscan Gas Tracker – a service for monitoring fees in Ethereum and ERC-20 tokens.

BSC Scan – a tracker for monitoring fees in the Binance Smart Chain network.

In addition to commission trackers, you can use the functionality of cryptocurrency wallets. For example, Trust Wallet, TR.ENERGY Wallet, Exodus in automatic mode:

- analyze network load;

- offer to speed up the operation;

- show the estimated confirmation time.

Crypto without fees - alternative solutions

Although the concept of completely free cryptocurrency transfers contradicts the architecture of blockchains, modern solutions allow us to minimize costs.

Services to reduce fees

Among the most effective solutions for reducing fees is TR.ENERGY. The service allows you to save significantly on USDT transfers in the TRON network.

The platform offers to rent TRON network energy, which can be used to pay fees in TRX for transactions USDT TRC-20. If a standard stablecoin transfer costs 28 TRX, then thanks to TR.ENERGY the user will pay only 10 TRX.

Although the service does not make transfers absolutely free, it brings each user closer to the concept of "cryptocurrency without fees", reducing costs to the minimum possible in the existing blockchain-systems.

Conclusion

Cryptocurrency transaction fees are a complex mechanism that ensures stability and safety of the entire system. The size and operating principles vary across networks. It is impossible to completely avoid fees for token transfers. At the same time, there are services on the market that allow you to minimize costs.