Bybit Exchange Listings: A Guide for Investors and Traders

Bybit enters the top 5 cryptocurrency exchanges by trading volume. In 2024, the platform became the leader in listing growth among centralized platforms (+83%). Adding new coins or tokens this is an opportunity for traders to make money on sharp fluctuations in the price of an asset.

Let's figure out what listings on the Bybit exchange are, why you should monitor them, and what risks you need to consider when trading new cryptocurrencies.

What are Bybit listing?

The procedure of adding a fresh coin or token to the quotation list of the crypto exchange is called listing. After that, you can buy, sell, and exchange assets in pairs with USDT, BTC, ETH, and other coins.

Why is it important to monitor listings?

Tracking upcoming listings on Bybit offers a number of benefits to traders and investors.

- Access to promising assets at an early stage. Many altcoins have experienced a sharp rise after being listed on Bybit due to high demand and marketing support.

- Opportunity to make big profits. In the first hours after adding a coin, the rate fluctuates greatly - successful traders manage to sell the asset at a good price.

- Project reliability. Listing on Tier-1 exchanges, which includes Bybit, requires strict verification of the token before placement.

Information about listings helps to find new investment ideas and diversify your crypto portfolio.

What Coins and Tokens Appear on Bybit in 2025?

The crypto exchange is expanding the list of assets available for trading. In 2025, the platform added new assets:

- DeFi protocols (decentralized finance);

- AI-tokens (protocols and services from the artificial intelligence sector);

- Infrastructure tokens (Web3 solutions);

- RWA-tokens (real assets tokenization segment).

Bybit users were most interested in TUNA, TREE, FIS listings.

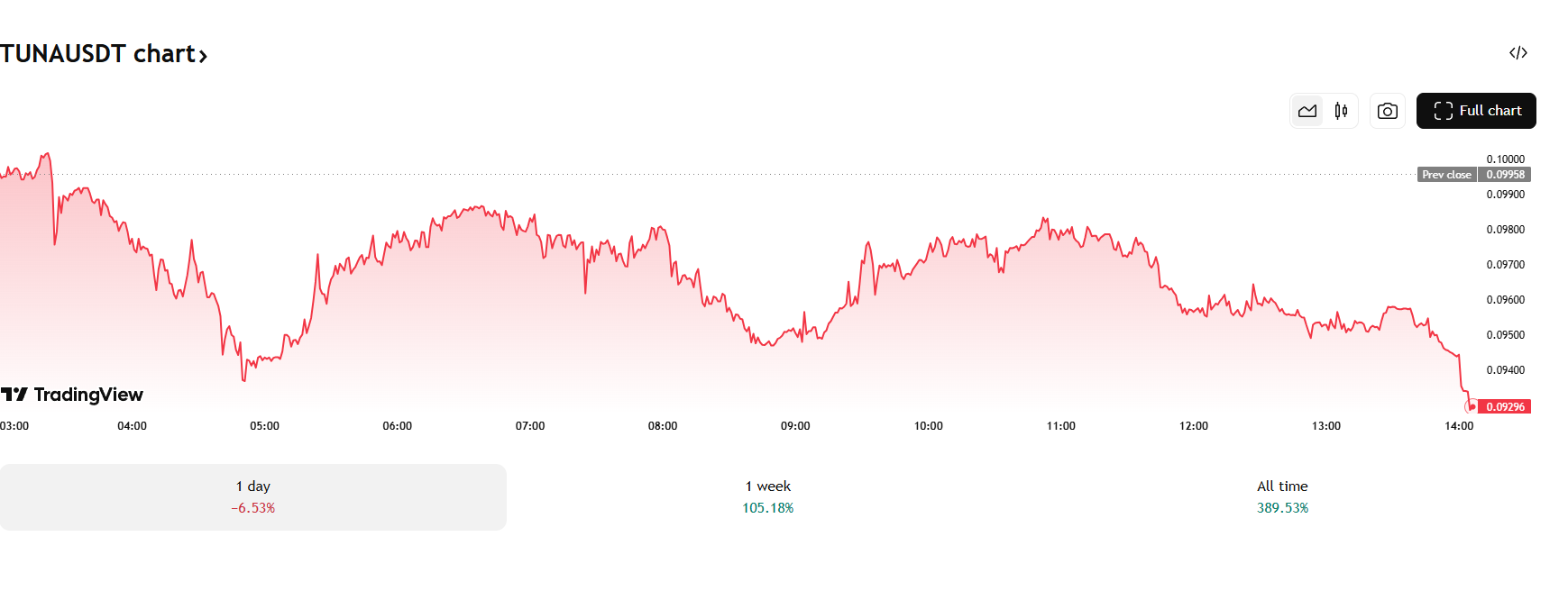

TUNA (DefiTuna)

Native token decentralized exchange DefiTuna platform added on July 29. Developed on the Solana blockchain, the coin started at $0.019, reached a maximum of $0.52, then the price corrected to $0.048.

The coin is available for trading via spot grid bots on Bybit.

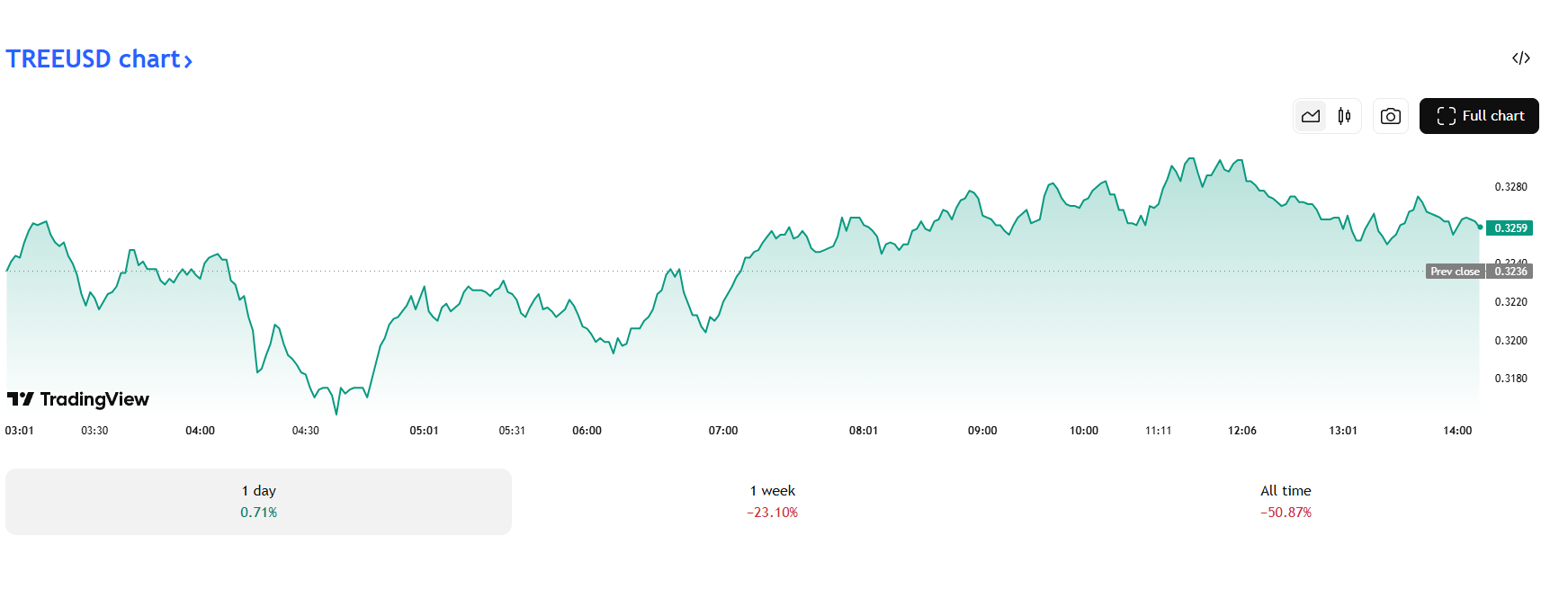

TREE (Treehouse)

The exchange placed token at the end of July. TREE is the cryptocurrency of the Treehouse decentralized application. The project allows you to increase your profit from Ethereum staking through the Treehouse Assets (tAssets) system.

Trading on Bybit started at $0.2; immediately after the listing, the price jumped to $1.4. By mid-August, the token was trading at $0.43.

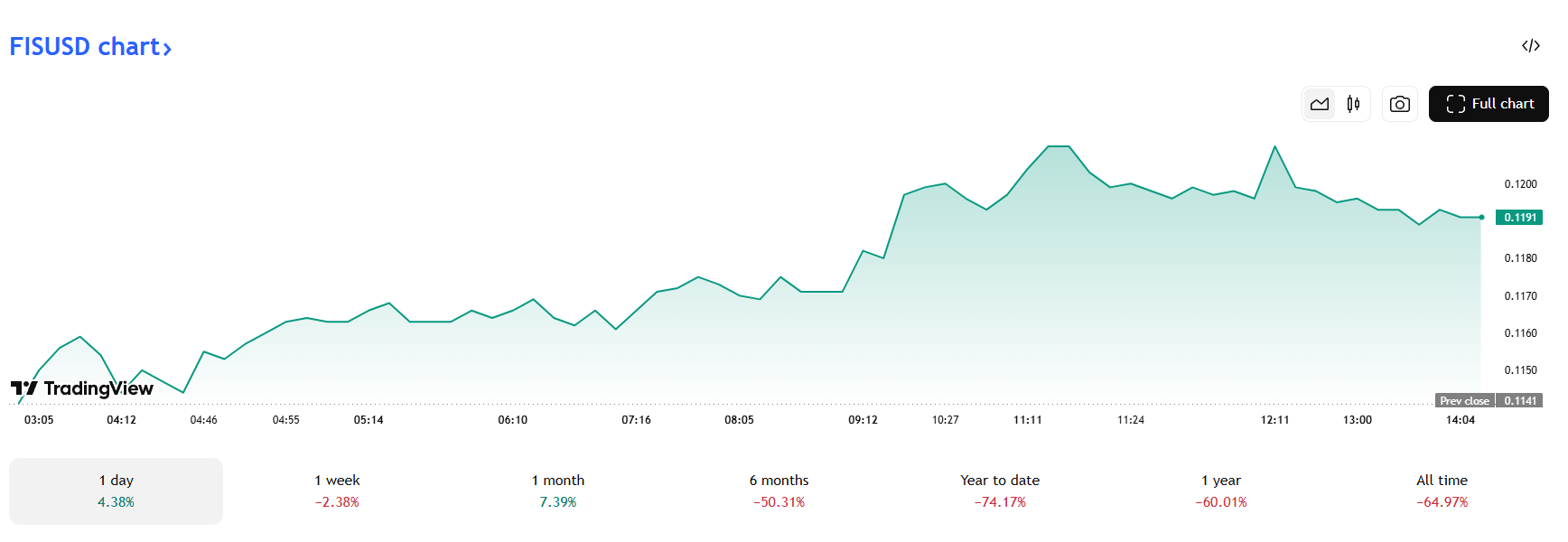

FIS (Stafi Protocol)

The token ensures the security of the Stafi Protocol network. The coin is also used to pay fees within the blockchain, participate in the management of the protocol through the DAO system.

Since July 28, the asset has been available in the perpetual contracts trading section.

How cryptocurrency listing works on Bybit?

Before entering the spot or derivatives market, a token goes through several stages. On Bybit, this is the application submission, verification, announcement, and the listing itself.

Steps to add a new token to Bybit

The first step is for the project team to make a request to the crypto exchange. At the next stage, Bybit specialists must check:

- Blockchain on the basis of which the project was launched;

- Smart contract security;

- Economy token (emission, inflation, utility);

- Project team;

- Legal compliance (KYC/AML).

If everything is OK, the crypto exchange will announce listing date. The final step is to place the token in the platform’s trading terminal, where the asset can be freely bought and sold.

Some listings are accompanied by giveaways. For example, for purchasing a TREE coin during the listing, you could get 30 TREE for free.

Impact of cryptocurrency listing on the market

Listing is a major milestone in the development of a crypto project. Placing a cryptocurrency on a major centralized exchange is recognition of its reliability and financial prospects. For investors, the entry of a new asset into the market is a reason to diversify their portfolio with tokens with high growth potential.

In the first hours after listing, the crypto exchange sees an increase in trading volumes: millions of users start buying up the new coin and locking in profits. This increases liquidity.

Successful listings can set new trends. The emerging trends influence investor behavior and capital redistribution. For example, if Bybit lists a token from one of the sectors (DeFi, AI, etc.), it could create hype around similar projects.

How to find new ones listings on Bybit?

Information about upcoming listings allows you to prepare for trading in advance and develop a strategy. You can find out the details of the placement in several ways.

- Bybit website and social networks. Dates and conditions of placement are published in the section "New listings" on the official page of the crypto exchange. The platform announces trading of new tokens in Telegram-channel and X (Twitter).

- Crypto aggregators and calendars. The information can be found on CoinMarketCap’s upcoming events page and in Coindar — a listing calendar.

- Analysis of decentralized exchanges and premarket. If token already traded on DEX (Uniswap, PancakeSwap etc.) but is preparing to be listed on Bybit premarket could be an early signal.

You can also set up Google Alerts for queries like “Bybit new coin listing announcement”, “Bybit new listing”, etc.

Coin Listings on Bybit: Benefits and Risks

The placement of a token on the Bybit exchange is a significant event for traders and investors. Before deciding to participate in cryptocurrency listings, you need to evaluate the advantages and potential risks.

Advantages:

- you can make money on strong price fluctuations in the first hours after listing;

- the possibility of additional profit by including the token in futures, margin trading or staking;

- prizes from the exchange for participation in the listing, Launchpool or Launchpad.

Risks:

- the likelihood of a sharp price drop immediately after listing;

- application of the “Pump & Dump” scheme by large holders;

- errors when processing a large number of orders.

Conclusion

Bybit coin listing can be a good investment opportunity. At the moment of token placement, a trader can hit a solid jackpot. However, there is also a possibility of a sharp price drop and, as a result, significant losses. Bybit crypto exchange announces the upcoming release of coins. Each token undergoes a thorough check by the platform's specialists before placement. From the moment the listing is announced until its start, the user has time to collect information about the coin, evaluate its potential and make an informed decision about participating in the auction.