Binance account verification – step-by-step guide for beginners

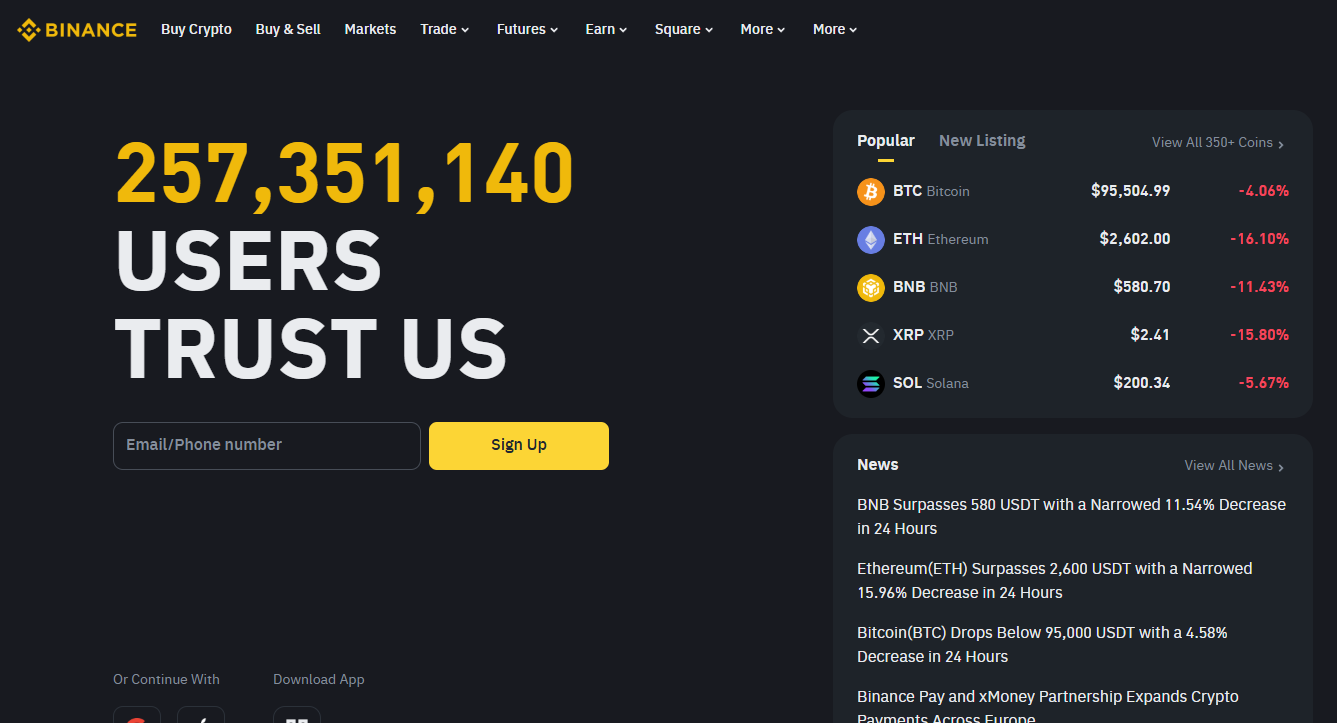

Binance is one of the world's largest cryptocurrency exchanges. The platform trades over 400 tokens and 344 pairs. The daily spot trading volume exceeds $22 billion, while futures trading turnover amounts to $74 billion. The exchange maintains low spot trading fees (0.1%) and withdrawal fees in USDT via TRC-20 (from 0.027% to 0.04%). Binance also offers P2P trading. The platform is visited by 75 million people every month.

Binance is one of the world's largest cryptocurrency exchanges. The platform trades over 400 tokens and 344 pairs. The daily spot trading volume exceeds $22 billion, while futures trading turnover amounts to $74 billion. The exchange maintains low spot trading fees (0.1%) and withdrawal fees in USDT via TRC-20 (from 0.027% to 0.04%). Binance also offers P2P trading. The platform is visited by 75 million people every month.

What is KYC verification?

KYC ("Know Your Customer") is an identification procedure that most cryptocurrency exchanges use to verify users' identities. On the Binance platform, verification is mandatory. Account confirmation minimizes the likelihood of fraudulent transactions and prevents money laundering.

Stages of verification on Binance:

- Account creation. First, you need to register on the platform: provide your phone number or email, confirm the process with a code from an SMS or email.

- Uploading documents. You need to submit a photo of your passport, driver's license, or another identity document. Sometimes, exchange staff may request a selfie.

- Address verification. To complete the verification, provide a document with your place of residence: a utility bill or a bank statement. The certificate must be issued within the last three months.

- Verification process. After submitting the documents, the system automatically checks their authenticity. The process takes one to two days. Once verification is completed, a notification with the results will be sent to your email.

Binance's responsibility regarding KYC verification

Binance adheres to international data protection and privacy standards. The documents provided during verification are encrypted and stored on secure servers. Only specialists responsible for data verification have access to the information.

Binance is required to provide user information to government authorities upon request if suspicious transactions are detected or if the law is violated. This helps reduce the number of unscrupulous traders and questionable transactions on the cryptocurrency exchange.

Verification options on Binance

Binance has introduced two levels of verification for investors:

Basic. Provides access to cryptocurrency trading and the use of the P2P platform. To verify identity, you need to upload a photo of your passport, driver's license, or ID card. Cryptocurrency withdrawal limits are up to $8,000,000 per day, and fiat deposit and withdrawal limits are up to $50,000 per day.

Advanced. Required for users with large trading volumes. It significantly increases fiat transaction limits — up to $2,000,000 per day. In addition to basic requirements, you must confirm your residential address by submitting a scanned bank statement or a utility bill.

Comparison of Binance verification levels

| Verification level | Features | Cryptocurrency withdrawal limit | Fiat deposit/withdrawal limit |

| Basic | Access to core exchange features, P2P trading | Up to $8,000,000 per day | Up to $50,000 per day |

| Advanced | Increased limits and premium features | Up to $8,000,000 per day | Up to $2,000,000 per day |

The basic verification level is suitable for those new to cryptocurrency trading, while the advanced level is ideal for active traders and institutional investors who require a full set of features for efficient large-asset trading.

How to verify your Binance account

To access all features, you need to verify your account. The process consists of several steps:

- Authorization on the platform. Log into your Binance account. If you haven’t created a personal account yet, go through the registration process: enter your phone number or email, agree to the platform's terms. After registration, confirm your data with a code from an SMS or email.

- Proceeding to verification. Go to your account and select the "Verification" section. The page will display your current verification status and a button to start the process.

- Filling in personal information. Enter your personal details: full name, date of birth, and residential address. Ensure the information is accurate.

- Providing documents. Upload a scan or photo of one of the identity documents: passport, driver's license, or ID card. A selfie with the document may also be required. For advanced verification, prepare a bank statement or utility bill to confirm your residential address.

- Waiting for verification. The system analyzes the information within a few minutes to two days. The processing speed depends on the number of submitted requests.

- Confirmation. A notification with the verification results will be sent to your phone or email. Once the account is successfully verified, the user can access all Binance features.

Tips for successful verification

To verify your Binance account smoothly:

- Use high-quality document photos. Make sure the images are clear and the text is easy to read. Blurry or overly dark images may be rejected by the system.

- Provide up-to-date information. The details you enter must match the information in your documents. Any discrepancies may result in verification failure, requiring a reattempt.

- Update documents. If verifying your address, ensure that the attached documents are no older than three months. Binance accepts bank statements, utility bills, and other official forms indicating your place of residence.

- Check notifications. After submitting documents, monitor your account and email. If the system requests additional data, provide it immediately. This will significantly speed up the process.

What to avoid during verification:

- Attempting to bypass rules. Using fake documents or false information is strictly prohibited. This may lead to account suspension and potential legal consequences.

- Mistakes when choosing documents. Ensure that your document meets Binance's requirements. Some types of ID may not be accepted in certain countries.

- Discrepancy between account region and documents. If your documents are issued in one country but your account is registered in another, it may raise suspicions and result in verification failure.

Risks and limitations for Binance users without verification

Users who do not complete verification on Binance face significant restrictions. The main risks include:

- Limited functionality. Without verification, users cannot perform most operations, such as depositing funds, withdrawing money, trading fiat currencies, or using the P2P platform.

- Low transaction limits. The volume of operations is significantly restricted.

- Risk of account suspension. Binance strictly enforces its rules, so users with unverified accounts may face temporary or permanent suspension.

- Restricted access to fiat transactions. Without identity verification, it is impossible to deposit or withdraw fiat funds, complicating exchange use.

Thus, using Binance without KYC verification is not feasible. The process is straightforward and takes minimal time.

Verification options for Russian citizens

Anti-Russian sanctions have significantly complicated the Binance verification process for Russian residents. However, Russians can still verify their profiles through several methods:

- Using documents from another jurisdiction. If a user has a residence permit or citizenship in another country, they can use these documents for identity verification. This is the most reliable way to bypass restrictions. It is essential to register with the country whose documents will be used.

- Contacting Binance support. If you experience difficulties verifying your identity, contact Binance's 24/7 support team. They may suggest alternative solutions or clarify requirements.

It is important to note that any attempts to bypass the system using false information may lead to account suspension. It is recommended to act within the established rules.

Conclusion

Verification on Binance is a mandatory step for fully utilizing the platform. KYC protects user accounts and prevents fraudulent transactions on the exchange. The process takes one to two days and includes identity and address confirmation. After completing verification, users can trade, deposit, and withdraw funds without restrictions.